We - KappAhl

We - KappAhl

We - KappAhl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Store network and expansion<br />

During the financial year, 32 new stores were opened: ten in<br />

Poland, nine in Sweden, seven in Finland and six in Norway.<br />

Three stores in Sweden and one in Norway were closed in the<br />

same period. At the end of the financial year the total number of<br />

stores was 319 (291); 144 in Sweden, 92 in Norway, 53 in Finland<br />

and 30 in Poland.<br />

The work of finding new store sites is proceeding according<br />

to plan. Apart from the 319 (291) stores in operation on 31<br />

August this year, there are at present contracts for 52 new stores,<br />

of which 20 in Poland. Of the new contracts, 18 stores will open<br />

in the first quarter and about 30 during the full year 2009/2010.<br />

Two to four stores will be closed during the year. The long-term<br />

goal to increase the number of stores by 20 to 25 per year remains.<br />

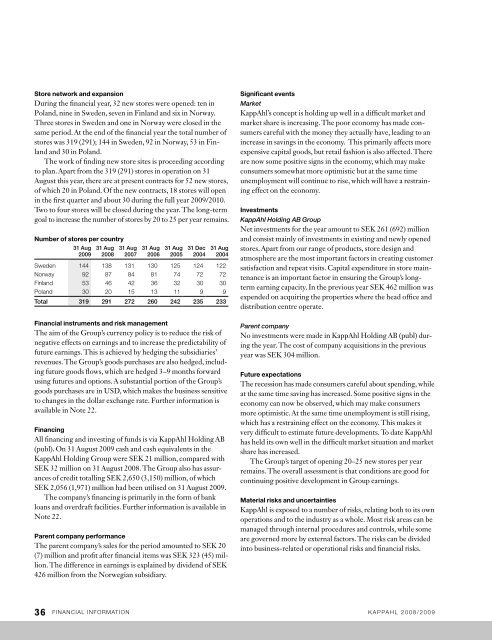

Number of stores per country<br />

31 Aug<br />

2009<br />

31 Aug<br />

2008<br />

31 Aug<br />

2007<br />

31 Aug<br />

2006<br />

31 Aug<br />

2005<br />

31 Dec<br />

2004<br />

31 Aug<br />

2004<br />

Sweden 144 138 131 130 125 124 122<br />

norway 92 87 84 81 74 72 72<br />

finland 53 46 42 36 32 30 30<br />

poland 30 20 15 13 11 9 9<br />

Total 319 291 272 260 242 235 233<br />

Financial instruments and risk management<br />

The aim of the Group’s currency policy is to reduce the risk of<br />

negative effects on earnings and to increase the predictability of<br />

future earnings. This is achieved by hedging the subsidiaries’<br />

revenues. The Group’s goods purchases are also hedged, including<br />

future goods flows, which are hedged 3–9 months forward<br />

using futures and options. A substantial portion of the Group’s<br />

goods purchases are in USD, which makes the business sensitive<br />

to changes in the dollar exchange rate. Further information is<br />

available in Note 22.<br />

Financing<br />

All financing and investing of funds is via <strong>KappAhl</strong> Holding AB<br />

(publ). On 31 August 2009 cash and cash equivalents in the<br />

<strong>KappAhl</strong> Holding Group were SEK 21 million, compared with<br />

SEK 32 million on 31 August 2008. The Group also has assurances<br />

of credit totalling SEK 2,650 (3,150) million, of which<br />

SEK 2,056 (1,971) million had been utilised on 31 August 2009.<br />

The company’s financing is primarily in the form of bank<br />

loans and overdraft facilities. Further information is available in<br />

Note 22.<br />

Parent company performance<br />

The parent company’s sales for the period amounted to SEK 20<br />

(7) million and profit after financial items was SEK 323 (45) million.<br />

The difference in earnings is explained by dividend of SEK<br />

426 million from the Norwegian subsidiary.<br />

Significant events<br />

Market<br />

<strong>KappAhl</strong>’s concept is holding up well in a difficult market and<br />

market share is increasing. The poor economy has made consumers<br />

careful with the money they actually have, leading to an<br />

increase in savings in the economy. This primarily affects more<br />

expensive capital goods, but retail fashion is also affected. There<br />

are now some positive signs in the economy, which may make<br />

consumers somewhat more optimistic but at the same time<br />

unemployment will continue to rise, which will have a restraining<br />

effect on the economy.<br />

Investments<br />

<strong>KappAhl</strong> Holding AB Group<br />

Net investments for the year amount to SEK 261 (692) million<br />

and consist mainly of investments in existing and newly opened<br />

stores. Apart from our range of products, store design and<br />

atmosphere are the most important factors in creating customer<br />

satisfaction and repeat visits. Capital expenditure in store maintenance<br />

is an important factor in ensuring the Group’s longterm<br />

earning capacity. In the previous year SEK 462 million was<br />

expended on acquiring the properties where the head office and<br />

distribution centre operate.<br />

Parent company<br />

No investments were made in <strong>KappAhl</strong> Holding AB (publ) during<br />

the year. The cost of company acquisitions in the previous<br />

year was SEK 304 million.<br />

Future expectations<br />

The recession has made consumers careful about spending, while<br />

at the same time saving has increased. Some positive signs in the<br />

economy can now be observed, which may make consumers<br />

more optimistic. At the same time unemployment is still rising,<br />

which has a restraining effect on the economy. This makes it<br />

very difficult to estimate future developments. To date <strong>KappAhl</strong><br />

has held its own well in the difficult market situation and market<br />

share has increased.<br />

The Group’s target of opening 20–25 new stores per year<br />

remains. The overall assessment is that conditions are good for<br />

continuing positive development in Group earnings.<br />

Material risks and uncertainties<br />

<strong>KappAhl</strong> is exposed to a number of risks, relating both to its own<br />

operations and to the industry as a whole. Most risk areas can be<br />

managed through internal procedures and controls, while some<br />

are governed more by external factors. The risks can be divided<br />

into business-related or operational risks and financial risks.<br />

36 financial information Kappahl 2008/2009