We - KappAhl

We - KappAhl

We - KappAhl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

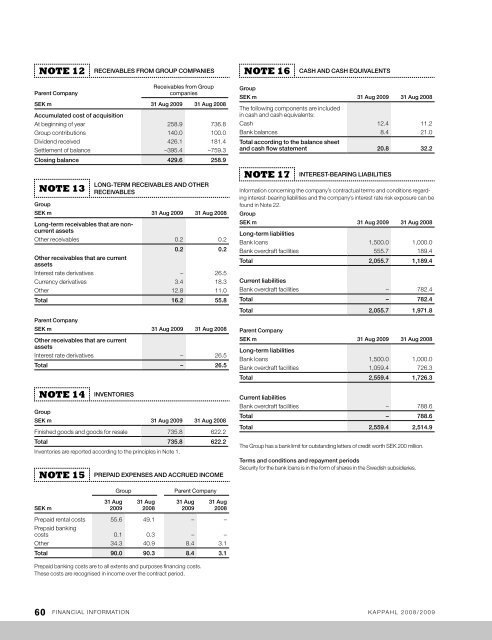

Note 12 RECEIVABLES FROM GROUP COMPANIES<br />

Parent Company<br />

Receivables from Group<br />

companies<br />

SEK m 31 Aug 2009 31 Aug 2008<br />

Accumulated cost of acquisition<br />

at beginning of year 258.9 736.8<br />

Group contributions 140.0 100.0<br />

Dividend received 426.1 181.4<br />

Settlement of balance –395.4 –759.3<br />

Closing balance 429.6 258.9<br />

Note 13<br />

Group<br />

LONG-TERM RECEIVABLES AND OTHER<br />

RECEIVABLES<br />

SEK m 31 Aug 2009 31 Aug 2008<br />

Long-term receivables that are noncurrent<br />

assets<br />

other receivables 0.2 0.2<br />

0.2 0.2<br />

Other receivables that are current<br />

assets<br />

interest rate derivatives – 26.5<br />

currency derivatives 3.4 18.3<br />

other 12.8 11.0<br />

Total 16.2 55.8<br />

Parent Company<br />

SEK m 31 Aug 2009 31 Aug 2008<br />

Other receivables that are current<br />

assets<br />

interest rate derivatives – 26.5<br />

Total – 26.5<br />

Note 14 INVENTORIES<br />

Group<br />

SEK m 31 Aug 2009 31 Aug 2008<br />

finished goods and goods for resale 735.8 622.2<br />

Total 735.8 622.2<br />

inventories are reported according to the principles in note 1.<br />

Note 15 PREPAID EXPENSES AND ACCRUED INCOME<br />

SEK m<br />

31 Aug<br />

2009<br />

Group Parent Company<br />

31 Aug<br />

2008<br />

31 Aug<br />

2009<br />

31 Aug<br />

2008<br />

prepaid rental costs 55.6 49.1 – –<br />

prepaid banking<br />

costs 0.1 0.3 – –<br />

other 34.3 40.9 8.4 3.1<br />

Total 90.0 90.3 8.4 3.1<br />

prepaid banking costs are to all extents and purposes financing costs.<br />

these costs are recognised in income over the contract period.<br />

Note 16 CASH AND CASH EQUIVALENTS<br />

60 financial information Kappahl 2008/2009<br />

Group<br />

SEK m 31 Aug 2009 31 Aug 2008<br />

the following components are included<br />

in cash and cash equivalents:<br />

cash 12.4 11.2<br />

Bank balances 8.4 21.0<br />

Total according to the balance sheet<br />

and cash flow statement 20.8 32.2<br />

Note 17 INTEREST-BEARING LIABILITIES<br />

information concerning the company’s contractual terms and conditions regarding<br />

interest-bearing liabilities and the company’s interest rate risk exposure can be<br />

found in note 22.<br />

Group<br />

SEK m 31 Aug 2009 31 Aug 2008<br />

Long-term liabilities<br />

Bank loans 1,500.0 1,000.0<br />

Bank overdraft facilities 555.7 189.4<br />

Total 2,055.7 1,189.4<br />

Current liabilities<br />

Bank overdraft facilities – 782.4<br />

Total – 782.4<br />

Total 2,055.7 1,971.8<br />

Parent Company<br />

SEK m 31 Aug 2009 31 Aug 2008<br />

Long-term liabilities<br />

Bank loans 1,500.0 1,000.0<br />

Bank overdraft facilities 1,059.4 726.3<br />

Total 2,559.4 1,726.3<br />

Current liabilities<br />

Bank overdraft facilities – 788.6<br />

Total – 788.6<br />

Total 2,559.4 2,514.9<br />

the Group has a bank limit for outstanding letters of credit worth SEK 200 million.<br />

Terms and conditions and repayment periods<br />

Security for the bank loans is in the form of shares in the Swedish subsidiaries.