We - KappAhl

We - KappAhl

We - KappAhl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

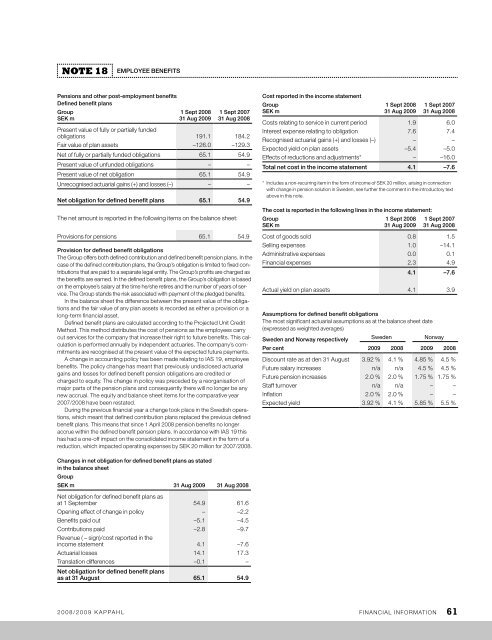

Note 18 EMPLOYEE BENEFITS<br />

Pensions and other post-employment benefits<br />

Defined benefit plans<br />

Group<br />

SEK m<br />

1 Sept 2008<br />

31 Aug 2009<br />

1 Sept 2007<br />

31 Aug 2008<br />

present value of fully or partially funded<br />

obligations 191.1 184.2<br />

fair value of plan assets –126.0 –129.3<br />

net of fully or partially funded obligations 65.1 54.9<br />

present value of unfunded obligations – –<br />

present value of net obligation 65.1 54.9<br />

Unrecognised actuarial gains (+) and losses (–) – –<br />

Net obligation for defined benefit plans 65.1 54.9<br />

the net amount is reported in the following items on the balance sheet:<br />

provisions for pensions 65.1 54.9<br />

Provision for defined benefit obligations<br />

the Group offers both defined contribution and defined benefit pension plans. in the<br />

case of the defined contribution plans, the Group’s obligation is limited to fixed contributions<br />

that are paid to a separate legal entity. the Group’s profits are charged as<br />

the benefits are earned. in the defined benefit plans, the Group’s obligation is based<br />

on the employee’s salary at the time he/she retires and the number of years of service.<br />

the Group stands the risk associated with payment of the pledged benefits.<br />

in the balance sheet the difference between the present value of the obligations<br />

and the fair value of any plan assets is recorded as either a provision or a<br />

long-term financial asset.<br />

Defined benefit plans are calculated according to the projected Unit credit<br />

method. this method distributes the cost of pensions as the employees carry<br />

out services for the company that increase their right to future benefits. this calculation<br />

is performed annually by independent actuaries. the company’s commitments<br />

are recognised at the present value of the expected future payments.<br />

a change in accounting policy has been made relating to iaS 19, employee<br />

benefits. the policy change has meant that previously undisclosed actuarial<br />

gains and losses for defined benefit pension obligations are credited or<br />

charged to equity. the change in policy was preceded by a reorganisation of<br />

major parts of the pension plans and consequently there will no longer be any<br />

new accrual. the equity and balance sheet items for the comparative year<br />

2007/2008 have been restated.<br />

During the previous financial year a change took place in the Swedish operations,<br />

which meant that defined contribution plans replaced the previous defined<br />

benefit plans. this means that since 1 april 2008 pension benefits no longer<br />

accrue within the defined benefit pension plans. in accordance with iaS 19 this<br />

has had a one-off impact on the consolidated income statement in the form of a<br />

reduction, which impacted operating expenses by SEK 20 million for 2007/2008.<br />

Changes in net obligation for defined benefit plans as stated<br />

in the balance sheet<br />

Group<br />

SEK m 31 Aug 2009 31 Aug 2008<br />

net obligation for defined benefit plans as<br />

at 1 September 54.9 61.6<br />

opening effect of change in policy – –2.2<br />

Benefits paid out –5.1 –4.5<br />

contributions paid –2.8 –9.7<br />

revenue ( – sign)/cost reported in the<br />

income statement 4.1 –7.6<br />

actuarial losses 14.1 17.3<br />

translation differences –0.1 –<br />

Net obligation for defined benefit plans<br />

as at 31 August 65.1 54.9<br />

Cost reported in the income statement<br />

Group<br />

SEK m<br />

1 Sept 2008<br />

31 Aug 2009<br />

1 Sept 2007<br />

31 Aug 2008<br />

costs relating to service in current period 1.9 6.0<br />

interest expense relating to obligation 7.6 7.4<br />

recognised actuarial gains (+) and losses (–) – –<br />

Expected yield on plan assets –5.4 –5.0<br />

Effects of reductions and adjustments* – –16.0<br />

Total net cost in the income statement 4.1 –7.6<br />

* includes a non-recurring item in the form of income of SEK 20 million, arising in connection<br />

with change in pension solution in Sweden, see further the comment in the introductory text<br />

above in this note.<br />

The cost is reported in the following lines in the income statement:<br />

Group<br />

SEK m<br />

1 Sept 2008<br />

31 Aug 2009<br />

1 Sept 2007<br />

31 Aug 2008<br />

cost of goods sold 0.8 1.5<br />

Selling expenses 1.0 –14.1<br />

administrative expenses 0.0 0.1<br />

financial expenses 2.3 4.9<br />

4.1 –7.6<br />

actual yield on plan assets 4.1 3.9<br />

Assumptions for defined benefit obligations<br />

the most significant actuarial assumptions as at the balance sheet date<br />

(expressed as weighted averages)<br />

Sweden and Norway respectively<br />

Sweden Norway<br />

Per cent 2009 2008 2009 2008<br />

Discount rate as at den 31 august 3.92 % 4.1 % 4.85 % 4.5 %<br />

future salary increases n/a n/a 4.5 % 4.5 %<br />

future pension increases 2.0 % 2.0 % 1.75 % 1.75 %<br />

Staff turnover n/a n/a – –<br />

inflation 2.0 % 2.0 % – –<br />

Expected yield 3.92 % 4.1 % 5.85 % 5.5 %<br />

2008/2009 Kappahl financial information 61