We - KappAhl

We - KappAhl

We - KappAhl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

➻<br />

GROWTH IN NEW AND EXISTING STORES In recent years<br />

<strong>KappAhl</strong> has focused on increasing profitability by strengthening<br />

the gross margin. This strategy has been successful. The gross<br />

margin is among the highest in the industry and stronger profitability<br />

has provided a stable basis for continued growth. Another<br />

goal has been to improve profitability by more effective use of<br />

<strong>KappAhl</strong>’s purchasing and logistics resources. This too has gone<br />

well.<br />

STRONG CASH FLOW MEANS SECURE GROWTH <strong>KappAhl</strong>’s<br />

operations generate a strong cash flow. This is partly due to a<br />

very low capital requirement in the business. One of the main<br />

advantages of this is that expansion via investment in new stores<br />

can take place without tying up large amounts of capital. Consequently,<br />

<strong>KappAhl</strong> can continue to invest in growth at the desired<br />

rate while distributing dividends to shareholders.<br />

EXPANSION OF STORE NETWORK Our focus on growth has<br />

also been clear in the 2008/2009 financial year. The growth<br />

strategy is based on two principles: increased sales via existing<br />

stores and establishment of new stores.<br />

<strong>KappAhl</strong> will continue to gain market share. The store network<br />

will continue to grow, increasing the company’s market<br />

share. The expansion of new stores will be mainly in shopping<br />

malls and central store sites, because historically <strong>KappAhl</strong> has<br />

been most profitable in these locations. <strong>We</strong> aim to increase the<br />

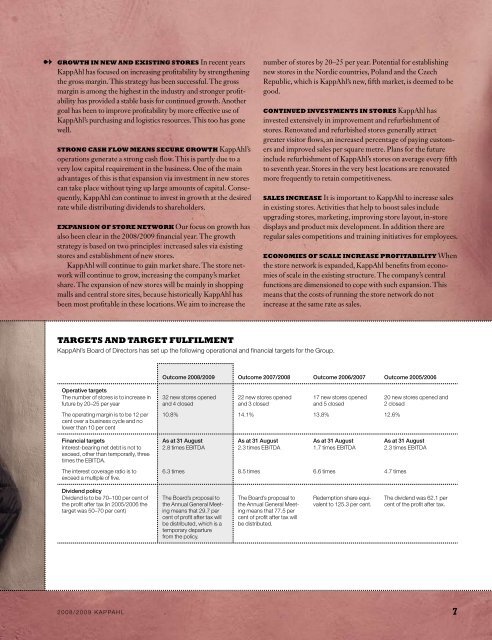

TARGETS AND TARGET FULFILMENT<br />

Kappahl’s Board of Directors has set up the following operational and financial targets for the Group.<br />

Operative targets<br />

The number of stores is to increase in<br />

future by 20–25 per year<br />

The operating margin is to be 12 per<br />

cent over a business cycle and no<br />

lower than 10 per cent<br />

2008/2009 Kappahl<br />

Outcome 2008/2009 Outcome 2007/2008 Outcome 2006/2007 Outcome 2005/2006<br />

32 new stores opened<br />

and 4 closed<br />

22 new stores opened<br />

and 3 closed<br />

17 new stores opened<br />

and 5 closed<br />

10.8% 14.1% 13.8% 12.6%<br />

20 new stores opened and<br />

2 closed<br />

Financial targets As at 31 August As at 31 August As at 31 August As at 31 August<br />

Interest-bearing net debt is not to<br />

exceed, other than temporarily, three<br />

times the EBITDa.<br />

2.8 times EBITDa 2.3 times EBITDa 1.7 times EBITDa 2.3 times EBITDa<br />

The interest coverage ratio is to<br />

exceed a multiple of five.<br />

Dividend policy<br />

Dividend is to be 70–100 per cent of<br />

the profit after tax (in 2005/2006 the<br />

target was 50–70 per cent)<br />

6.3 times 8.5 times 6.6 times 4.7 times<br />

The Board’s proposal to<br />

the annual General Meeting<br />

means that 29.7 per<br />

cent of profit after tax will<br />

be distributed, which is a<br />

temporary departure<br />

from the policy.<br />

number of stores by 20–25 per year. Potential for establishing<br />

new stores in the Nordic countries, Poland and the Czech<br />

Republic, which is <strong>KappAhl</strong>’s new, fifth market, is deemed to be<br />

good.<br />

CONTINUED INVESTMENTS IN STORES <strong>KappAhl</strong> has<br />

invested extensively in improvement and refurbishment of<br />

stores. Renovated and refurbished stores generally attract<br />

greater visitor flows, an increased percentage of paying customers<br />

and improved sales per square metre. Plans for the future<br />

include refurbishment of <strong>KappAhl</strong>’s stores on average every fifth<br />

to seventh year. Stores in the very best locations are renovated<br />

more frequently to retain competitiveness.<br />

SALES INCREASE It is important to <strong>KappAhl</strong> to increase sales<br />

in existing stores. Activities that help to boost sales include<br />

upgrading stores, marketing, improving store layout, in-store<br />

displays and product mix development. In addition there are<br />

regular sales competitions and training initiatives for employees.<br />

ECONOMIES OF SCALE INCREASE PROFITABILITY When<br />

the store network is expanded, <strong>KappAhl</strong> benefits from economies<br />

of scale in the existing structure. The company’s central<br />

functions are dimensioned to cope with such expansion. This<br />

means that the costs of running the store network do not<br />

increase at the same rate as sales.<br />

The Board’s proposal to<br />

the annual General Meeting<br />

means that 77.5 per<br />

cent of profit after tax will<br />

be distributed.<br />

Redemption share equivalent<br />

to 125.3 per cent.<br />

The dividend was 62.1 per<br />

cent of the profit after tax.<br />

7