We - KappAhl

We - KappAhl

We - KappAhl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

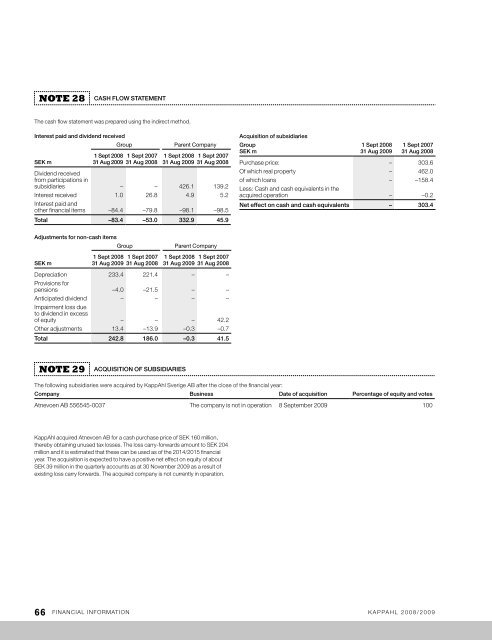

Note 28 CASH FLOW STATEMENT<br />

the cash flow statement was prepared using the indirect method.<br />

Interest paid and dividend received<br />

SEK m<br />

1 Sept 2008<br />

31 Aug 2009<br />

Group Parent Company<br />

1 Sept 2007<br />

31 Aug 2008<br />

1 Sept 2008<br />

31 Aug 2009<br />

Note 29 ACQUISITION OF SUBSIDIARIES<br />

1 Sept 2007<br />

31 Aug 2008<br />

Dividend received<br />

from participations in<br />

subsidiaries – – 426.1 139.2<br />

interest received 1.0 26.8 4.9 5.2<br />

interest paid and<br />

other financial items –84.4 –79.8 –98.1 –98.5<br />

Total –83.4 –53.0 332.9 45.9<br />

Adjustments for non-cash items<br />

SEK m<br />

1 Sept 2008<br />

31 Aug 2009<br />

Group Parent Company<br />

1 Sept 2007<br />

31 Aug 2008<br />

1 Sept 2008<br />

31 Aug 2009<br />

1 Sept 2007<br />

31 Aug 2008<br />

Depreciation 233.4 221.4 – –<br />

provisions for<br />

pensions –4.0 –21.5 – –<br />

anticipated dividend – – – –<br />

impairment loss due<br />

to dividend in excess<br />

of equity – – – 42.2<br />

other adjustments 13.4 –13.9 –0.3 –0.7<br />

Total 242.8 186.0 –0.3 41.5<br />

the following subsidiaries were acquired by Kappahl Sverige aB after the close of the financial year:<br />

Company Business Date of acquisition Percentage of equity and votes<br />

atnevoen aB 556545-0037 the company is not in operation 8 September 2009 100<br />

Kappahl acquired atnevoen aB for a cash purchase price of SEK 160 million,<br />

thereby obtaining unused tax losses. the loss carry-forwards amount to SEK 204<br />

million and it is estimated that these can be used as of the 2014/2015 financial<br />

year. the acquisition is expected to have a positive net effect on equity of about<br />

SEK 39 million in the quarterly accounts as at 30 november 2009 as a result of<br />

existing loss carry forwards. the acquired company is not currently in operation.<br />

Acquisition of subsidiaries<br />

Group<br />

SEK m<br />

1 Sept 2008<br />

31 Aug 2009<br />

1 Sept 2007<br />

31 Aug 2008<br />

purchase price: – 303.6<br />

of which real property – 462.0<br />

of which loans – –158.4<br />

less: cash and cash equivalents in the<br />

acquired operation – –0.2<br />

Net effect on cash and cash equivalents – 303.4<br />

66 financial information Kappahl 2008/2009