We - KappAhl

We - KappAhl

We - KappAhl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

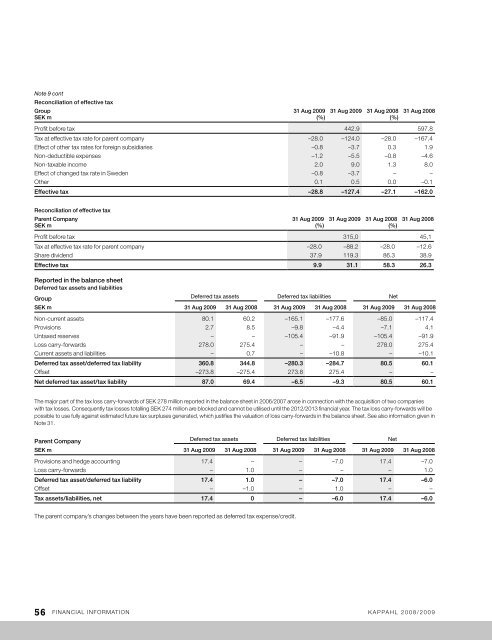

Note 9 cont<br />

Reconciliation of effective tax<br />

Group<br />

SEK m<br />

31 Aug 2009<br />

(%)<br />

31 Aug 2009 31 Aug 2008<br />

(%)<br />

31 Aug 2008<br />

profit before tax 442.9 597.8<br />

tax at effective tax rate for parent company –28.0 –124.0 –28.0 –167.4<br />

Effect of other tax rates for foreign subsidiaries –0.8 –3.7 0.3 1.9<br />

non-deductible expenses –1.2 –5.5 –0.8 –4.6<br />

non-taxable income 2.0 9.0 1.3 8.0<br />

Effect of changed tax rate in Sweden –0.8 –3.7 – –<br />

other 0.1 0.5 0.0 –0.1<br />

Effective tax –28.8 –127.4 –27.1 –162.0<br />

Reconciliation of effective tax<br />

Parent Company<br />

SEK m<br />

31 Aug 2009<br />

(%)<br />

31 Aug 2009 31 Aug 2008<br />

(%)<br />

31 Aug 2008<br />

profit before tax 315,0 45,1<br />

tax at effective tax rate for parent company –28.0 –88.2 –28.0 –12.6<br />

Share dividend 37.9 119.3 86.3 38.9<br />

Effective tax 9.9 31.1 58.3 26.3<br />

Reported in the balance sheet<br />

Deferred tax assets and liabilities<br />

Group Deferred tax assets Deferred tax liabilities Net<br />

SEK m 31 Aug 2009 31 Aug 2008 31 Aug 2009 31 Aug 2008 31 Aug 2009 31 Aug 2008<br />

non-current assets 80.1 60.2 –165.1 –177.6 –85.0 –117.4<br />

provisions 2.7 8.5 –9.8 –4.4 –7.1 4.1<br />

Untaxed reserves – – –105.4 –91.9 –105.4 –91.9<br />

loss carry-forwards 278.0 275.4 – – 278.0 275.4<br />

current assets and liabilities – 0.7 – –10.8 – –10.1<br />

Deferred tax asset/deferred tax liability 360.8 344.8 –280.3 –284.7 80.5 60.1<br />

offset –273.8 –275.4 273.8 275.4 – –<br />

Net deferred tax asset/tax liability 87.0 69.4 –6.5 –9.3 80.5 60.1<br />

the major part of the tax loss carry-forwards of SEK 278 million reported in the balance sheet in 2006/2007 arose in connection with the acquisition of two companies<br />

with tax losses. consequently tax losses totalling SEK 274 million are blocked and cannot be utilised until the 2012/2013 financial year. the tax loss carry-forwards will be<br />

possible to use fully against estimated future tax surpluses generated, which justifies the valuation of loss carry-forwards in the balance sheet. See also information given in<br />

note 31.<br />

Parent Company Deferred tax assets Deferred tax liabilities Net<br />

SEK m 31 Aug 2009 31 Aug 2008 31 Aug 2009 31 Aug 2008 31 Aug 2009 31 Aug 2008<br />

provisions and hedge accounting 17.4 – – –7.0 17.4 –7.0<br />

loss carry-forwards – 1.0 – – – 1.0<br />

Deferred tax asset/deferred tax liability 17.4 1.0 – –7.0 17.4 –6.0<br />

offset – –1.0 – 1.0 – –<br />

Tax assets/liabilities, net 17.4 0 – –6.0 17.4 –6.0<br />

the parent company’s changes between the years have been reported as deferred tax expense/credit.<br />

56 financial information Kappahl 2008/2009