We - KappAhl

We - KappAhl

We - KappAhl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

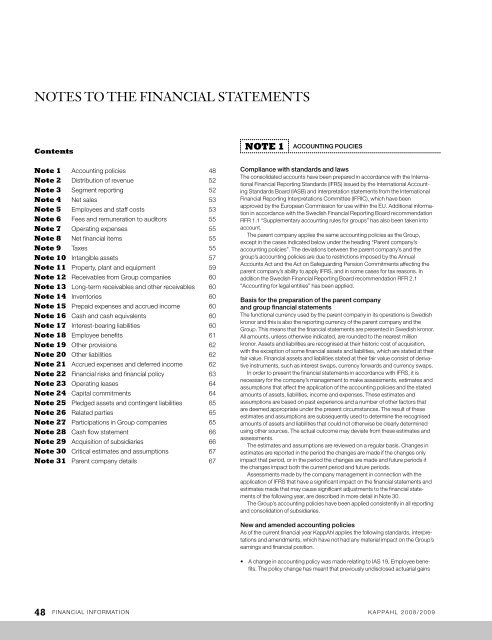

NOTES TO THE FINANCIAL STATEMENTS<br />

Contents<br />

Note 1 accounting policies 48<br />

Note 2 Distribution of revenue 52<br />

Note 3 Segment reporting 52<br />

Note 4 net sales 53<br />

Note 5 Employees and staff costs 53<br />

Note 6 fees and remuneration to auditors 55<br />

Note 7 operating expenses 55<br />

Note 8 net financial items 55<br />

Note 9 taxes 55<br />

Note 10 intangible assets 57<br />

Note 11 property, plant and equipment 59<br />

Note 12 receivables from Group companies 60<br />

Note 13 long-term receivables and other receivables 60<br />

Note 14 inventories 60<br />

Note 15 prepaid expenses and accrued income 60<br />

Note 16 cash and cash equivalents 60<br />

Note 17 interest-bearing liabilities 60<br />

Note 18 Employee benefits 61<br />

Note 19 other provisions 62<br />

Note 20 other liabilities 62<br />

Note 21 accrued expenses and deferred income 62<br />

Note 22 financial risks and financial policy 63<br />

Note 23 operating leases 64<br />

Note 24 capital commitments 64<br />

Note 25 pledged assets and contingent liabilities 65<br />

Note 26 related parties 65<br />

Note 27 participations in Group companies 65<br />

Note 28 cash flow statement 66<br />

Note 29 acquisition of subsidiaries 66<br />

Note 30 critical estimates and assumptions 67<br />

Note 31 parent company details 67<br />

Note 1 ACCOUNTING POLICIES<br />

Compliance with standards and laws<br />

the consolidated accounts have been prepared in accordance with the international<br />

financial reporting Standards (ifrS) issued by the international accounting<br />

Standards Board (iaSB) and interpretation statements from the international<br />

financial reporting interpretations committee (ifric), which have been<br />

approved by the European commission for use within the EU. additional information<br />

in accordance with the Swedish financial reporting Board recommendation<br />

rfr 1.1 “Supplementary accounting rules for groups” has also been taken into<br />

account.<br />

the parent company applies the same accounting policies as the Group,<br />

except in the cases indicated below under the heading “parent company’s<br />

accounting policies”. the deviations between the parent company’s and the<br />

group’s accounting policies are due to restrictions imposed by the annual<br />

accounts act and the act on Safeguarding pension commitments affecting the<br />

parent company’s ability to apply ifrS, and in some cases for tax reasons. in<br />

addition the Swedish financial reporting Board recommendation rfr 2.1<br />

“accounting for legal entities” has been applied.<br />

Basis for the preparation of the parent company<br />

and group financial statements<br />

the functional currency used by the parent company in its operations is Swedish<br />

kronor and this is also the reporting currency of the parent company and the<br />

Group. this means that the financial statements are presented in Swedish kronor.<br />

all amounts, unless otherwise indicated, are rounded to the nearest million<br />

kronor. assets and liabilities are recognised at their historic cost of acquisition,<br />

with the exception of some financial assets and liabilities, which are stated at their<br />

fair value. financial assets and liabilities stated at their fair value consist of derivative<br />

instruments, such as interest swaps, currency forwards and currency swaps.<br />

in order to present the financial statements in accordance with ifrS, it is<br />

necessary for the company’s management to make assessments, estimates and<br />

assumptions that affect the application of the accounting policies and the stated<br />

amounts of assets, liabilities, income and expenses. these estimates and<br />

assumptions are based on past experience and a number of other factors that<br />

are deemed appropriate under the present circumstances. the result of these<br />

estimates and assumptions are subsequently used to determine the recognised<br />

amounts of assets and liabilities that could not otherwise be clearly determined<br />

using other sources. the actual outcome may deviate from these estimates and<br />

assessments.<br />

the estimates and assumptions are reviewed on a regular basis. changes in<br />

estimates are reported in the period the changes are made if the changes only<br />

impact that period, or in the period the changes are made and future periods if<br />

the changes impact both the current period and future periods.<br />

assessments made by the company management in connection with the<br />

application of ifrS that have a significant impact on the financial statements and<br />

estimates made that may cause significant adjustments to the financial statements<br />

of the following year, are described in more detail in note 30.<br />

the Group’s accounting policies have been applied consistently in all reporting<br />

and consolidation of subsidiaries.<br />

New and amended accounting policies<br />

as of the current financial year Kappahl applies the following standards, interpretations<br />

and amendments, which have not had any material impact on the Group’s<br />

earnings and financial position.<br />

• A change in accounting policy was made relating to IAS 19, Employee benefits.<br />

the policy change has meant that previously undisclosed actuarial gains<br />

48 financial information Kappahl 2008/2009