ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

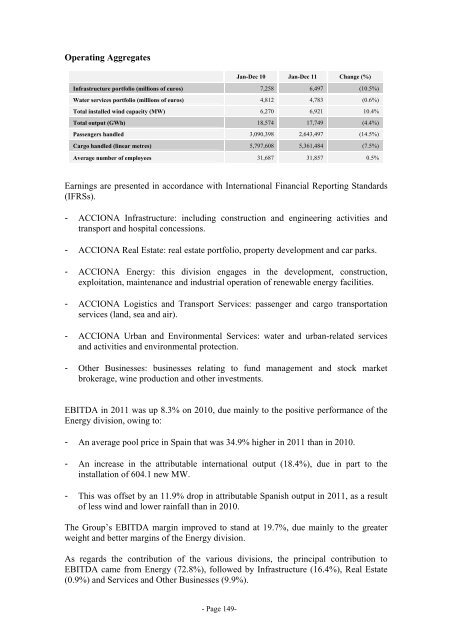

Operating Aggregates<br />

- Page 149-<br />

Jan-Dec 10 Jan-Dec 11 Change (%)<br />

Infrastructure portfolio (millions of euros) 7,258 6,497 (10.5%)<br />

Water services portfolio (millions of euros) 4,812 4,783 (0.6%)<br />

Total installed wind capacity (MW) 6,270 6,921 10.4%<br />

Total output (GWh) 18,574 17,749 (4.4%)<br />

Passengers handled 3,090,398 2,643,497 (14.5%)<br />

Cargo handled (linear metres) 5,797,608 5,361,484 (7.5%)<br />

Average number of employees 31,687 31,857 0.5%<br />

Earnings are presented in accordance with International Financial Reporting Standards<br />

(IFRSs).<br />

- <strong>ACCIONA</strong> Infrastructure: including construction and engineering activities and<br />

transport and hospital concessions.<br />

- <strong>ACCIONA</strong> Real Estate: real estate portfolio, property development and car parks.<br />

- <strong>ACCIONA</strong> Energy: this division engages in the development, construction,<br />

exploitation, maintenance and industrial operation of renewable energy facilities.<br />

- <strong>ACCIONA</strong> Logistics and Transport Services: passenger and cargo transportation<br />

services (land, sea and air).<br />

- <strong>ACCIONA</strong> Urban and Environmental Services: water and urban-related services<br />

and activities and environmental protection.<br />

- Other Businesses: businesses relating to fund management and stock market<br />

brokerage, wine production and other investments.<br />

EBITDA in 2011 was up 8.3% on 2010, due mainly to the positive performance of the<br />

Energy division, owing to:<br />

- An average pool price in Spain that was 34.9% higher in 2011 than in 2010.<br />

- An increase in the attributable international output (18.4%), due in part to the<br />

installation of 604.1 new MW.<br />

- This was offset by an 11.9% drop in attributable Spanish output in 2011, as a result<br />

of less wind and lower rainfall than in 2010.<br />

The <strong>Group</strong>’s EBITDA margin improved to stand at 19.7%, due mainly to the greater<br />

weight and better margins of the Energy division.<br />

As regards the contribution of the various divisions, the principal contribution to<br />

EBITDA came from Energy (72.8%), followed by Infrastructure (16.4%), Real Estate<br />

(0.9%) and Services and Other Businesses (9.9%).