ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

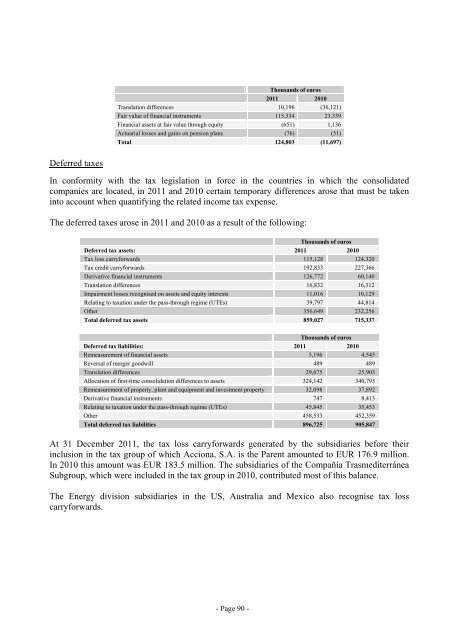

Deferred taxes<br />

Thousands of euros<br />

2011 2010<br />

Translation differences 10,196 (36,121)<br />

Fair value of financial instruments 115,334 23,339<br />

Financial assets at fair value through equity (651) 1,136<br />

Actuarial losses and gains on pension plans (76) (51)<br />

Total 124,803 (11,697)<br />

In conformity with the tax legislation in force in the countries in which the consolidated<br />

companies are located, in 2011 and 2010 certain temporary differences arose that must be taken<br />

into account when quantifying the related income tax expense.<br />

The deferred taxes arose in 2011 and 2010 as a result of the following:<br />

Thousands of euros<br />

Deferred tax assets: 2011 2010<br />

Tax loss carryforwards 115,128 124,320<br />

Tax credit carryforwards 192,833 227,366<br />

Derivative financial instruments 126,772 60,140<br />

Translation differences 16,832 16,312<br />

Impairment losses recognised on assets and equity interests 11,016 10,129<br />

Relating to taxation under the pass-through regime (UTEs) 39,797 44,814<br />

Other 356,649 232,256<br />

Total deferred tax assets 859,027 715,337<br />

Thousands of euros<br />

Deferred tax liabilities: 2011 2010<br />

Remeasurement of financial assets 5,196 4,545<br />

Reversal of merger goodwill 489 489<br />

Translation differences 29,675 25,903<br />

Allocation of first-time consolidation differences to assets 324,142 340,793<br />

Remeasurement of property, plant and equipment and investment property 32,098 37,892<br />

Derivative financial instruments 747 8,413<br />

Relating to taxation under the pass-through regime (UTEs) 45,845 35,453<br />

Other 458,533 452,359<br />

Total deferred tax liabilities 896,725 905,847<br />

At 31 December 2011, the tax loss carryforwards generated by the subsidiaries before their<br />

inclusion in the tax group of which Acciona, S.A. is the Parent amounted to EUR 176.9 million.<br />

In 2010 this amount was EUR 183.5 million. The subsidiaries of the Compañía Trasmediterránea<br />

Subgroup, which were included in the tax group in 2010, contributed most of this balance.<br />

The Energy division subsidiaries in the US, Australia and Mexico also recognise tax loss<br />

carryforwards.<br />

- Page 90 -