ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

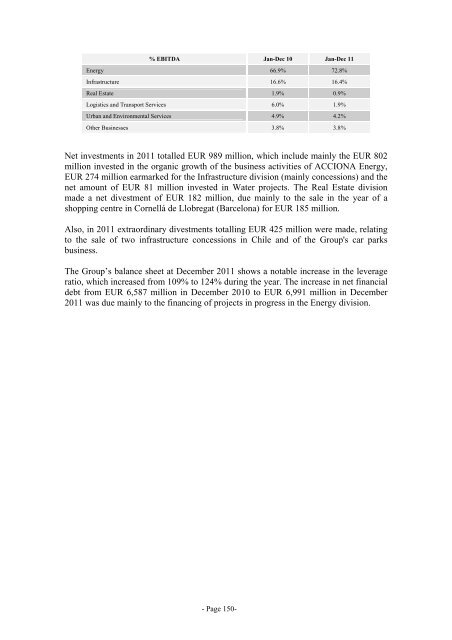

% EBITDA Jan-Dec 10 Jan-Dec 11<br />

Energy 66.9% 72.8%<br />

Infrastructure 16.6% 16.4%<br />

Real Estate 1.9% 0.9%<br />

Logistics and Transport Services 6.0% 1.9%<br />

Urban and Environmental Services 4.9% 4.2%<br />

Other Businesses 3.8% 3.8%<br />

Net investments in 2011 totalled EUR 989 million, which include mainly the EUR 802<br />

million invested in the organic growth of the business activities of <strong>ACCIONA</strong> Energy,<br />

EUR 274 million earmarked for the Infrastructure division (mainly concessions) and the<br />

net amount of EUR 81 million invested in Water projects. The Real Estate division<br />

made a net divestment of EUR 182 million, due mainly to the sale in the year of a<br />

shopping centre in Cornellá de Llobregat (Barcelona) for EUR 185 million.<br />

Also, in 2011 extraordinary divestments totalling EUR 425 million were made, relating<br />

to the sale of two infrastructure concessions in Chile and of the <strong>Group</strong>'s car parks<br />

business.<br />

The <strong>Group</strong>’s balance sheet at December 2011 shows a notable increase in the leverage<br />

ratio, which increased from 109% to 124% during the year. The increase in net financial<br />

debt from EUR 6,587 million in December 2010 to EUR 6,991 million in December<br />

2011 was due mainly to the financing of projects in progress in the Energy division.<br />

- Page 150-