ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

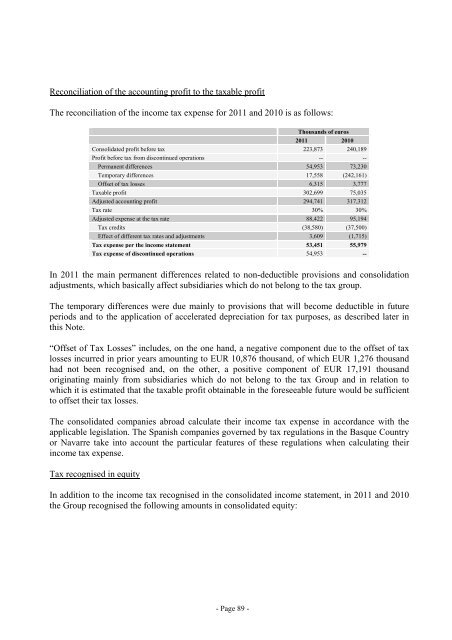

Reconciliation of the accounting profit to the taxable profit<br />

The reconciliation of the income tax expense for 2011 and 2010 is as follows:<br />

Thousands of euros<br />

2011 2010<br />

<strong>Consolidated</strong> profit before tax 223,873 240,189<br />

Profit before tax from discontinued operations -- --<br />

Permanent differences 54,953 73,230<br />

Temporary differences 17,558 (242,161)<br />

Offset of tax losses 6,315 3,777<br />

Taxable profit 302,699 75,035<br />

Adjusted accounting profit 294,741 317,312<br />

Tax rate 30% 30%<br />

Adjusted expense at the tax rate 88,422 95,194<br />

Tax credits (38,580) (37,500)<br />

Effect of different tax rates and adjustments 3,609 (1,715)<br />

Tax expense per the income statement 53,451 55,979<br />

Tax expense of discontinued operations 54,953 --<br />

In 2011 the main permanent differences related to non-deductible provisions and consolidation<br />

adjustments, which basically affect subsidiaries which do not belong to the tax group.<br />

The temporary differences were due mainly to provisions that will become deductible in future<br />

periods and to the application of accelerated depreciation for tax purposes, as described later in<br />

this Note.<br />

“Offset of Tax Losses” includes, on the one hand, a negative component due to the offset of tax<br />

losses incurred in prior years amounting to EUR 10,876 thousand, of which EUR 1,276 thousand<br />

had not been recognised and, on the other, a positive component of EUR 17,191 thousand<br />

originating mainly from subsidiaries which do not belong to the tax <strong>Group</strong> and in relation to<br />

which it is estimated that the taxable profit obtainable in the foreseeable future would be sufficient<br />

to offset their tax losses.<br />

The consolidated companies abroad calculate their income tax expense in accordance with the<br />

applicable legislation. The Spanish companies governed by tax regulations in the Basque Country<br />

or Navarre take into account the particular features of these regulations when calculating their<br />

income tax expense.<br />

Tax recognised in equity<br />

In addition to the income tax recognised in the consolidated income statement, in 2011 and 2010<br />

the <strong>Group</strong> recognised the following amounts in consolidated equity:<br />

- Page 89 -