ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

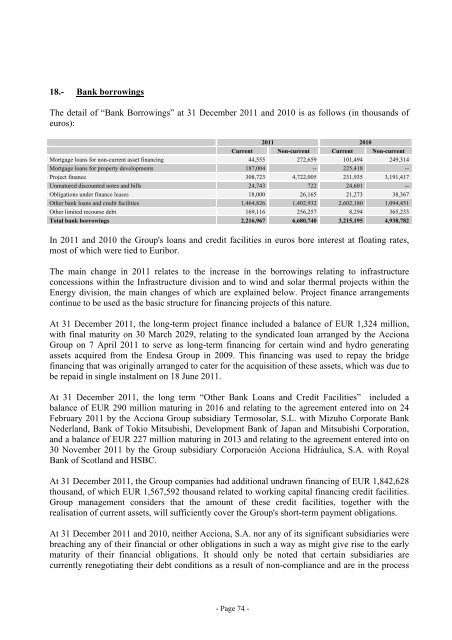

18.- Bank borrowings<br />

The detail of “Bank Borrowings” at 31 December 2011 and 2010 is as follows (in thousands of<br />

euros):<br />

2011 2010<br />

Current Non-current Current Non-current<br />

Mortgage loans for non-current asset financing 44,555 272,659 101,494 249,314<br />

Mortgage loans for property developments 187,004 -- 225,418 --<br />

Project finance 308,723 4,722,005 231,935 3,191,417<br />

Unmatured discounted notes and bills 24,743 722 24,601 --<br />

Obligations under finance leases 18,000 26,165 21,273 38,367<br />

Other bank loans and credit facilities 1,464,826 1,402,932 2,602,180 1,094,451<br />

Other limited recourse debt 169,116 256,257 8,294 365,233<br />

Total bank borrowings 2,216,967 6,680,740 3,215,195 4,938,782<br />

In 2011 and 2010 the <strong>Group</strong>'s loans and credit facilities in euros bore interest at floating rates,<br />

most of which were tied to Euribor.<br />

The main change in 2011 relates to the increase in the borrowings relating to infrastructure<br />

concessions within the Infrastructure division and to wind and solar thermal projects within the<br />

Energy division, the main changes of which are explained below. Project finance arrangements<br />

continue to be used as the basic structure for financing projects of this nature.<br />

At 31 December 2011, the long-term project finance included a balance of EUR 1,324 million,<br />

with final maturity on 30 March 2029, relating to the syndicated loan arranged by the Acciona<br />

<strong>Group</strong> on 7 April 2011 to serve as long-term financing for certain wind and hydro generating<br />

assets acquired from the Endesa <strong>Group</strong> in 2009. This financing was used to repay the bridge<br />

financing that was originally arranged to cater for the acquisition of these assets, which was due to<br />

be repaid in single instalment on 18 June 2011.<br />

At 31 December 2011, the long term “Other Bank Loans and Credit Facilities” included a<br />

balance of EUR 290 million maturing in 2016 and relating to the agreement entered into on 24<br />

February 2011 by the Acciona <strong>Group</strong> subsidiary Termosolar, S.L. with Mizuho Corporate Bank<br />

Nederland, Bank of Tokio Mitsubishi, Development Bank of Japan and Mitsubishi Corporation,<br />

and a balance of EUR 227 million maturing in 2013 and relating to the agreement entered into on<br />

30 November 2011 by the <strong>Group</strong> subsidiary Corporación Acciona Hidráulica, S.A. with Royal<br />

Bank of Scotland and HSBC.<br />

At 31 December 2011, the <strong>Group</strong> companies had additional undrawn financing of EUR 1,842,628<br />

thousand, of which EUR 1,567,592 thousand related to working capital financing credit facilities.<br />

<strong>Group</strong> management considers that the amount of these credit facilities, together with the<br />

realisation of current assets, will sufficiently cover the <strong>Group</strong>'s short-term payment obligations.<br />

At 31 December 2011 and 2010, neither Acciona, S.A. nor any of its significant subsidiaries were<br />

breaching any of their financial or other obligations in such a way as might give rise to the early<br />

maturity of their financial obligations. It should only be noted that certain subsidiaries are<br />

currently renegotiating their debt conditions as a result of non-compliance and are in the process<br />

- Page 74 -