ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

isks and uncertainties which, inevitably, surround most of the events and circumstances related<br />

thereto. In this respect, the negative performance of the general market situation in the last few<br />

years, as well as the economic and financial conditions of many of the countries in which the<br />

<strong>Group</strong> operates, has given rise to great instability in general with a widespread impact and severe<br />

uncertainty, which has not only continued but in fact worsened in the last year. In light of this<br />

situation, the measurement of uncertainty was carried out with prudence and a certain degree of<br />

precaution was taken in the making of necessary judgements, while preserving the fair<br />

presentation of the consolidated financial statements.<br />

<strong>Group</strong> management considers that no additional liabilities not provided for in the consolidated<br />

financial statements at 31 December 2011 and 2010 will arise.<br />

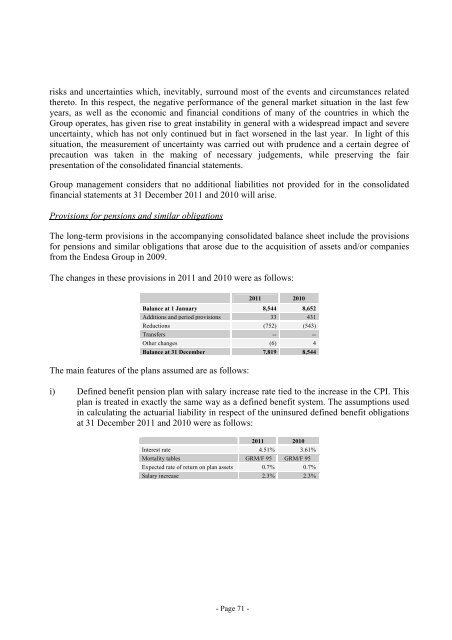

Provisions for pensions and similar obligations<br />

The long-term provisions in the accompanying consolidated balance sheet include the provisions<br />

for pensions and similar obligations that arose due to the acquisition of assets and/or companies<br />

from the Endesa <strong>Group</strong> in 2009.<br />

The changes in these provisions in 2011 and 2010 were as follows:<br />

2011 2010<br />

Balance at 1 January 8,544 8,652<br />

Additions and period provisions 33 431<br />

Reductions (752) (543)<br />

Transfers -- --<br />

Other changes (6) 4<br />

Balance at 31 December 7,819 8,544<br />

The main features of the plans assumed are as follows:<br />

i) Defined benefit pension plan with salary increase rate tied to the increase in the CPI. This<br />

plan is treated in exactly the same way as a defined benefit system. The assumptions used<br />

in calculating the actuarial liability in respect of the uninsured defined benefit obligations<br />

at 31 December 2011 and 2010 were as follows:<br />

2011 2010<br />

Interest rate 4.51% 3.61%<br />

Mortality tables GRM/F 95 GRM/F 95<br />

Expected rate of return on plan assets 0.7% 0.7%<br />

Salary increase 2.3% 2.3%<br />

- Page 71 -