ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

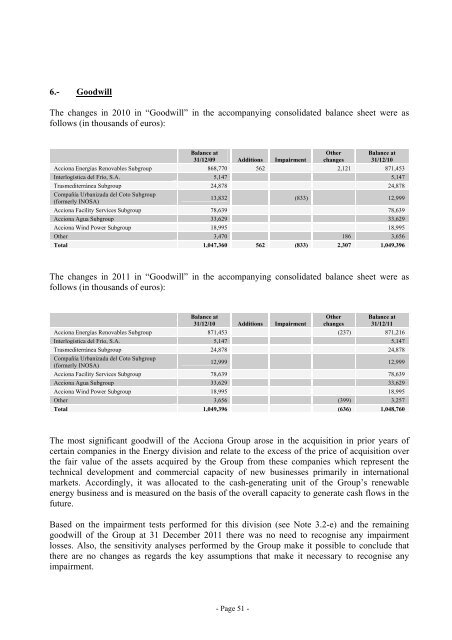

6.- Goodwill<br />

The changes in 2010 in “Goodwill” in the accompanying consolidated balance sheet were as<br />

follows (in thousands of euros):<br />

Balance at<br />

31/12/09 Additions Impairment<br />

- Page 51 -<br />

Other<br />

changes<br />

Balance at<br />

31/12/10<br />

Acciona Energías Renovables Subgroup 868,770 562 2,121 871,453<br />

Interlogística del Frío, S.A. 5,147 5,147<br />

Trasmediterránea Subgroup 24,878 24,878<br />

Compañía Urbanizada del Coto Subgroup<br />

(formerly INOSA)<br />

13,832 (833) 12,999<br />

Acciona Facility Services Subgroup 78,639 78,639<br />

Acciona Agua Subgroup 33,629 33,629<br />

Acciona Wind Power Subgroup 18,995 18,995<br />

Other 3,470 186 3,656<br />

Total 1,047,360 562 (833) 2,307 1,049,396<br />

The changes in 2011 in “Goodwill” in the accompanying consolidated balance sheet were as<br />

follows (in thousands of euros):<br />

Balance at<br />

31/12/10 Additions Impairment<br />

Other<br />

changes<br />

Balance at<br />

31/12/11<br />

Acciona Energías Renovables Subgroup 871,453 (237) 871,216<br />

Interlogística del Frío, S.A. 5,147 5,147<br />

Trasmediterránea Subgroup 24,878 24,878<br />

Compañía Urbanizada del Coto Subgroup<br />

(formerly INOSA)<br />

12,999 12,999<br />

Acciona Facility Services Subgroup 78,639 78,639<br />

Acciona Agua Subgroup 33,629 33,629<br />

Acciona Wind Power Subgroup 18,995 18,995<br />

Other 3,656 (399) 3,257<br />

Total 1,049,396 (636) 1,048,760<br />

The most significant goodwill of the Acciona <strong>Group</strong> arose in the acquisition in prior years of<br />

certain companies in the Energy division and relate to the excess of the price of acquisition over<br />

the fair value of the assets acquired by the <strong>Group</strong> from these companies which represent the<br />

technical development and commercial capacity of new businesses primarily in international<br />

markets. Accordingly, it was allocated to the cash-generating unit of the <strong>Group</strong>’s renewable<br />

energy business and is measured on the basis of the overall capacity to generate cash flows in the<br />

future.<br />

Based on the impairment tests performed for this division (see Note 3.2-e) and the remaining<br />

goodwill of the <strong>Group</strong> at 31 December 2011 there was no need to recognise any impairment<br />

losses. Also, the sensitivity analyses performed by the <strong>Group</strong> make it possible to conclude that<br />

there are no changes as regards the key assumptions that make it necessary to recognise any<br />

impairment.