ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

- The results for tax purposes of the various <strong>Group</strong> companies that will be reported to the<br />

tax authorities in the future that served as the basis for recognising the various income taxrelated<br />

balances in the accompanying consolidated financial statements.<br />

These estimates were made on the basis of the best information available at 31 December 2011<br />

and 2010 on the events analysed. However, events that take place in the future might make it<br />

necessary to change these estimates. Any such changes would be made in accordance with the<br />

requirements of IAS 8.<br />

3.4 Changes in accounting estimates and policies and correction of fundamental errors<br />

- Changes in accounting estimates: the effect of any change in accounting estimates is<br />

recognised under the same income statement heading as that under which the expense or<br />

income measured using the previous estimate was recognised.<br />

- Changes in accounting policies and correction of fundamental errors. The effects of changes<br />

and corrections of this kind are recognised as follows: if material, the cumulative effect at the<br />

beginning of the year is adjusted under “Reserves” and the effect for the current year is<br />

recognised in the income statement. In these cases, the financial data for the comparative year<br />

presented together with those for the current year are restated.<br />

At 31 December 2011 and 2010, there were no significant changes in accounting estimates or<br />

accounting policies or corrections of errors.<br />

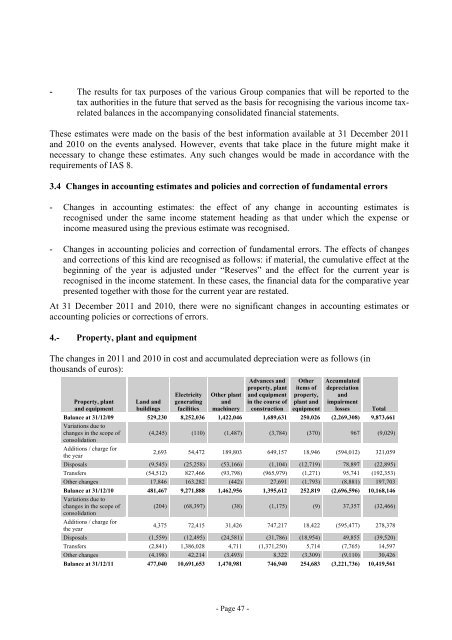

4.- Property, plant and equipment<br />

The changes in 2011 and 2010 in cost and accumulated depreciation were as follows (in<br />

thousands of euros):<br />

Property, plant<br />

and equipment<br />

Land and<br />

buildings<br />

Electricity<br />

generating<br />

facilities<br />

Other plant<br />

and<br />

machinery<br />

- Page 47 -<br />

Advances and<br />

property, plant<br />

and equipment<br />

in the course of<br />

construction<br />

Other<br />

items of<br />

property,<br />

plant and<br />

equipment<br />

Accumulated<br />

depreciation<br />

and<br />

impairment<br />

losses Total<br />

Balance at 31/12/09<br />

Variations due to<br />

529,230 8,252,036 1,422,046 1,689,631 250,026 (2,269,308) 9,873,661<br />

changes in the scope of<br />

consolidation<br />

(4,245) (110) (1,487) (3,784) (370) 967 (9,029)<br />

Additions / charge for<br />

the year<br />

2,693 54,472 189,803 649,157 18,946 (594,012) 321,059<br />

Disposals (9,545) (25,258) (53,166) (1,104) (12,719) 78,897 (22,895)<br />

Transfers (54,512) 827,466 (93,798) (965,979) (1,271) 95,741 (192,353)<br />

Other changes 17,846 163,282 (442) 27,691 (1,793) (8,881) 197,703<br />

Balance at 31/12/10<br />

Variations due to<br />

481,467 9,271,888 1,462,956 1,395,612 252,819 (2,696,596) 10,168,146<br />

changes in the scope of<br />

consolidation<br />

(204) (68,397) (38) (1,175) (9) 37,357 (32,466)<br />

Additions / charge for<br />

the year<br />

4,375 72,415 31,426 747,217 18,422 (595,477) 278,378<br />

Disposals (1,559) (12,495) (24,581) (31,786) (18,954) 49,855 (39,520)<br />

Transfers (2,841) 1,386,028 4,711 (1,371,250) 5,714 (7,765) 14,597<br />

Other changes (4,198) 42,214 (3,493) 8,322 (3,309) (9,110) 30,426<br />

Balance at 31/12/11 477,040 10,691,653 1,470,981 746,940 254,683 (3,221,736) 10,419,561