ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

ACCIONA, S.A. AND SUBSIDIARIES (Consolidated Group ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

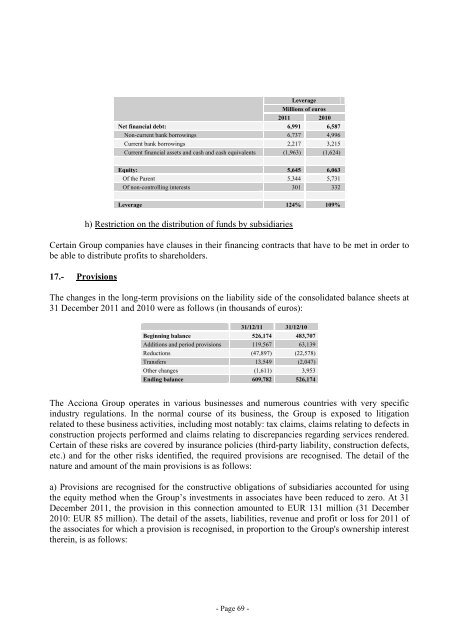

Leverage<br />

Millions of euros<br />

2011 2010<br />

Net financial debt: 6,991 6,587<br />

Non-current bank borrowings 6,737 4,996<br />

Current bank borrowings 2,217 3,215<br />

Current financial assets and cash and cash equivalents (1,963) (1,624)<br />

Equity: 5,645 6,063<br />

Of the Parent 5,344 5,731<br />

Of non-controlling interests 301 332<br />

Leverage 124% 109%<br />

h) Restriction on the distribution of funds by subsidiaries<br />

Certain <strong>Group</strong> companies have clauses in their financing contracts that have to be met in order to<br />

be able to distribute profits to shareholders.<br />

17.- Provisions<br />

The changes in the long-term provisions on the liability side of the consolidated balance sheets at<br />

31 December 2011 and 2010 were as follows (in thousands of euros):<br />

31/12/11 31/12/10<br />

Beginning balance 526,174 483,707<br />

Additions and period provisions 119,567 63,139<br />

Reductions (47,897) (22,578)<br />

Transfers 13,549 (2,047)<br />

Other changes (1,611) 3,953<br />

Ending balance 609,782 526,174<br />

The Acciona <strong>Group</strong> operates in various businesses and numerous countries with very specific<br />

industry regulations. In the normal course of its business, the <strong>Group</strong> is exposed to litigation<br />

related to these business activities, including most notably: tax claims, claims relating to defects in<br />

construction projects performed and claims relating to discrepancies regarding services rendered.<br />

Certain of these risks are covered by insurance policies (third-party liability, construction defects,<br />

etc.) and for the other risks identified, the required provisions are recognised. The detail of the<br />

nature and amount of the main provisions is as follows:<br />

a) Provisions are recognised for the constructive obligations of subsidiaries accounted for using<br />

the equity method when the <strong>Group</strong>’s investments in associates have been reduced to zero. At 31<br />

December 2011, the provision in this connection amounted to EUR 131 million (31 December<br />

2010: EUR 85 million). The detail of the assets, liabilities, revenue and profit or loss for 2011 of<br />

the associates for which a provision is recognised, in proportion to the <strong>Group</strong>'s ownership interest<br />

therein, is as follows:<br />

- Page 69 -