REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

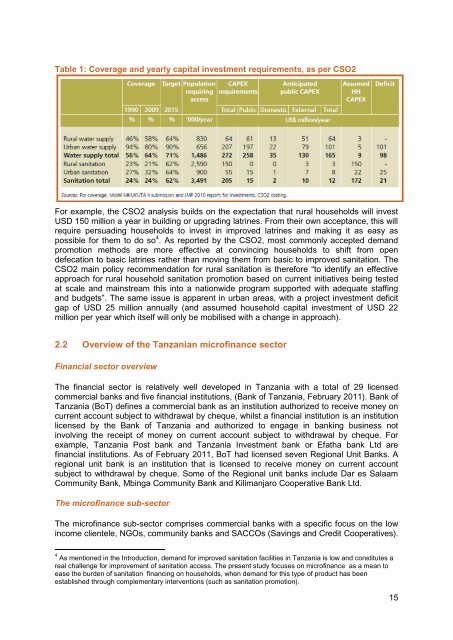

Table 1: Coverage and yearly capital <strong>in</strong>vestment requirements, as per CSO2<br />

For example, <strong>the</strong> CSO2 analysis builds on <strong>the</strong> expectation that rural households will <strong>in</strong>vest<br />

USD 150 million a year <strong>in</strong> build<strong>in</strong>g or upgrad<strong>in</strong>g latr<strong>in</strong>es. From <strong>the</strong>ir own acceptance, this will<br />

require persuad<strong>in</strong>g households to <strong>in</strong>vest <strong>in</strong> improved latr<strong>in</strong>es and mak<strong>in</strong>g it as easy as<br />

possible <strong>for</strong> <strong>the</strong>m to do so 4 . As reported by <strong>the</strong> CSO2, most commonly accepted demand<br />

promotion methods are more effective at conv<strong>in</strong>c<strong>in</strong>g households to shift from open<br />

defecation to basic latr<strong>in</strong>es ra<strong>the</strong>r than mov<strong>in</strong>g <strong>the</strong>m from basic to improved <strong>sanitation</strong>. The<br />

CSO2 ma<strong>in</strong> policy recommendation <strong>for</strong> rural <strong>sanitation</strong> is <strong>the</strong>re<strong>for</strong>e “to identify an effective<br />

approach <strong>for</strong> rural household <strong>sanitation</strong> promotion based on current <strong>in</strong>itiatives be<strong>in</strong>g tested<br />

at scale and ma<strong>in</strong>stream this <strong>in</strong>to a nationwide program supported with adequate staff<strong>in</strong>g<br />

and budgets”. The same issue is apparent <strong>in</strong> urban areas, with a project <strong>in</strong>vestment deficit<br />

gap <strong>of</strong> USD 25 million annually (and assumed household capital <strong>in</strong>vestment <strong>of</strong> USD 22<br />

million per year which itself will only be mobilised with a change <strong>in</strong> approach).<br />

2.2 Overview <strong>of</strong> <strong>the</strong> <strong>Tanzania</strong>n micr<strong>of</strong><strong>in</strong>ance sector<br />

F<strong>in</strong>ancial sector overview<br />

The f<strong>in</strong>ancial sector is relatively well developed <strong>in</strong> <strong>Tanzania</strong> with a total <strong>of</strong> 29 licensed<br />

commercial banks and five f<strong>in</strong>ancial <strong>in</strong>stitutions, (Bank <strong>of</strong> <strong>Tanzania</strong>, February 2011). Bank <strong>of</strong><br />

<strong>Tanzania</strong> (BoT) def<strong>in</strong>es a commercial bank as an <strong>in</strong>stitution authorized to receive money on<br />

current account subject to withdrawal by cheque, whilst a f<strong>in</strong>ancial <strong>in</strong>stitution is an <strong>in</strong>stitution<br />

licensed by <strong>the</strong> Bank <strong>of</strong> <strong>Tanzania</strong> and authorized to engage <strong>in</strong> bank<strong>in</strong>g bus<strong>in</strong>ess not<br />

<strong>in</strong>volv<strong>in</strong>g <strong>the</strong> receipt <strong>of</strong> money on current account subject to withdrawal by cheque. For<br />

example, <strong>Tanzania</strong> Post bank and <strong>Tanzania</strong> Investment bank or Efatha bank Ltd are<br />

f<strong>in</strong>ancial <strong>in</strong>stitutions. As <strong>of</strong> February 2011, BoT had licensed seven Regional Unit Banks. A<br />

regional unit bank is an <strong>in</strong>stitution that is licensed to receive money on current account<br />

subject to withdrawal by cheque. Some <strong>of</strong> <strong>the</strong> Regional unit banks <strong>in</strong>clude Dar es Salaam<br />

Community Bank, Mb<strong>in</strong>ga Community Bank and Kilimanjaro Cooperative Bank Ltd.<br />

The micr<strong>of</strong><strong>in</strong>ance sub-sector<br />

The micr<strong>of</strong><strong>in</strong>ance sub-sector comprises commercial banks with a specific focus on <strong>the</strong> low<br />

<strong>in</strong>come clientele, NGOs, community banks and SACCOs (Sav<strong>in</strong>gs and Credit Cooperatives).<br />

4 As mentioned <strong>in</strong> <strong>the</strong> Introduction, demand <strong>for</strong> improved <strong>sanitation</strong> facilities <strong>in</strong> <strong>Tanzania</strong> is low and constitutes a<br />

real challenge <strong>for</strong> improvement <strong>of</strong> <strong>sanitation</strong> access. The present study focuses on micr<strong>of</strong><strong>in</strong>ance as a mean to<br />

ease <strong>the</strong> burden <strong>of</strong> <strong>sanitation</strong> f<strong>in</strong>anc<strong>in</strong>g on households, when demand <strong>for</strong> this type <strong>of</strong> product has been<br />

established through complementary <strong>in</strong>terventions (such as <strong>sanitation</strong> promotion).<br />

15