REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Few commercial banks extend f<strong>in</strong>ancial services to <strong>the</strong> low end market (i.e. unsalaried selfemployed<br />

market segment) ei<strong>the</strong>r <strong>in</strong> urban or rural areas. The lead<strong>in</strong>g commercial banks<br />

active <strong>in</strong> <strong>the</strong> low end market segment <strong>in</strong>clude National Micr<strong>of</strong><strong>in</strong>ance Bank (NMB) and Akiba<br />

Commercial Bank.<br />

The most commonly mentioned MFIs <strong>in</strong> <strong>Tanzania</strong> <strong>in</strong>clude BRAC <strong>Tanzania</strong> (NGO/MFI),<br />

PRIDE <strong>Tanzania</strong> (NGO/MFI), FINCA <strong>Tanzania</strong> (NGO/MFI), SELFINA and Tujijenge<br />

<strong>Tanzania</strong> (Company Limited by shares).<br />

The <strong>Tanzania</strong> Association <strong>of</strong> Micr<strong>of</strong><strong>in</strong>ance Institutions (TAMFI) is <strong>the</strong> network organisation<br />

<strong>for</strong> micr<strong>of</strong><strong>in</strong>ance organisations. TAMFI reportedly comprises <strong>of</strong> 42 micr<strong>of</strong><strong>in</strong>ance<br />

organisations, most <strong>of</strong> which are relatively new and small. Data presented to Mix Market 5<br />

show that <strong>in</strong> 2010, report<strong>in</strong>g f<strong>in</strong>ancial <strong>in</strong>stitutions had a gross loan portfolio <strong>of</strong> USD 591<br />

million. O<strong>the</strong>r sector per<strong>for</strong>mance <strong>in</strong>dicators are presented <strong>in</strong> Table 2 below.<br />

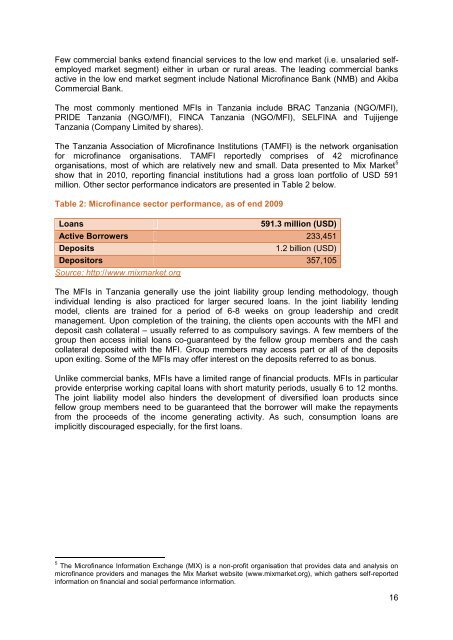

Table 2: Micr<strong>of</strong><strong>in</strong>ance sector per<strong>for</strong>mance, as <strong>of</strong> end 2009<br />

Loans 591.3 million (USD)<br />

Active Borrowers 233,451<br />

Deposits 1.2 billion (USD)<br />

Depositors 357,105<br />

Source: http://www.mixmarket.org<br />

The MFIs <strong>in</strong> <strong>Tanzania</strong> generally use <strong>the</strong> jo<strong>in</strong>t liability group lend<strong>in</strong>g methodology, though<br />

<strong>in</strong>dividual lend<strong>in</strong>g is also practiced <strong>for</strong> larger secured loans. In <strong>the</strong> jo<strong>in</strong>t liability lend<strong>in</strong>g<br />

model, clients are tra<strong>in</strong>ed <strong>for</strong> a period <strong>of</strong> 6-8 weeks on group leadership and credit<br />

management. Upon completion <strong>of</strong> <strong>the</strong> tra<strong>in</strong><strong>in</strong>g, <strong>the</strong> clients open accounts with <strong>the</strong> MFI and<br />

deposit cash collateral – usually referred to as compulsory sav<strong>in</strong>gs. A few members <strong>of</strong> <strong>the</strong><br />

group <strong>the</strong>n access <strong>in</strong>itial loans co-guaranteed by <strong>the</strong> fellow group members and <strong>the</strong> cash<br />

collateral deposited with <strong>the</strong> MFI. Group members may access part or all <strong>of</strong> <strong>the</strong> deposits<br />

upon exit<strong>in</strong>g. Some <strong>of</strong> <strong>the</strong> MFIs may <strong>of</strong>fer <strong>in</strong>terest on <strong>the</strong> deposits referred to as bonus.<br />

Unlike commercial banks, MFIs have a limited range <strong>of</strong> f<strong>in</strong>ancial products. MFIs <strong>in</strong> particular<br />

provide enterprise work<strong>in</strong>g capital loans with short maturity periods, usually 6 to 12 months.<br />

The jo<strong>in</strong>t liability model also h<strong>in</strong>ders <strong>the</strong> development <strong>of</strong> diversified loan products s<strong>in</strong>ce<br />

fellow group members need to be guaranteed that <strong>the</strong> borrower will make <strong>the</strong> repayments<br />

from <strong>the</strong> proceeds <strong>of</strong> <strong>the</strong> <strong>in</strong>come generat<strong>in</strong>g activity. As such, consumption loans are<br />

implicitly discouraged especially, <strong>for</strong> <strong>the</strong> first loans.<br />

5 The Micr<strong>of</strong><strong>in</strong>ance In<strong>for</strong>mation Exchange (MIX) is a non-pr<strong>of</strong>it organisation that provides data and analysis on<br />

micr<strong>of</strong><strong>in</strong>ance providers and manages <strong>the</strong> Mix Market website (www.mixmarket.org), which ga<strong>the</strong>rs self-reported<br />

<strong>in</strong><strong>for</strong>mation on f<strong>in</strong>ancial and social per<strong>for</strong>mance <strong>in</strong><strong>for</strong>mation.<br />

16