REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

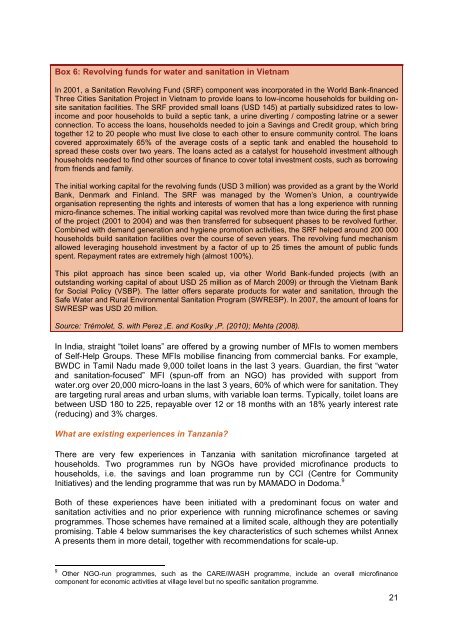

Box 6: Revolv<strong>in</strong>g funds <strong>for</strong> water and <strong>sanitation</strong> <strong>in</strong> Vietnam<br />

In 2001, a Sanitation Revolv<strong>in</strong>g Fund (SRF) component was <strong>in</strong>corporated <strong>in</strong> <strong>the</strong> World Bank-f<strong>in</strong>anced<br />

Three Cities Sanitation Project <strong>in</strong> Vietnam to provide loans to low-<strong>in</strong>come households <strong>for</strong> build<strong>in</strong>g onsite<br />

<strong>sanitation</strong> facilities. The SRF provided small loans (USD 145) at partially subsidized rates to low<strong>in</strong>come<br />

and poor households to build a septic tank, a ur<strong>in</strong>e divert<strong>in</strong>g / compost<strong>in</strong>g latr<strong>in</strong>e or a sewer<br />

connection. To access <strong>the</strong> loans, households needed to jo<strong>in</strong> a Sav<strong>in</strong>gs and Credit group, which br<strong>in</strong>g<br />

toge<strong>the</strong>r 12 to 20 people who must live close to each o<strong>the</strong>r to ensure community control. The loans<br />

covered approximately 65% <strong>of</strong> <strong>the</strong> average costs <strong>of</strong> a septic tank and enabled <strong>the</strong> household to<br />

spread <strong>the</strong>se costs over two years. The loans acted as a catalyst <strong>for</strong> household <strong>in</strong>vestment although<br />

households needed to f<strong>in</strong>d o<strong>the</strong>r sources <strong>of</strong> f<strong>in</strong>ance to cover total <strong>in</strong>vestment costs, such as borrow<strong>in</strong>g<br />

from friends and family.<br />

The <strong>in</strong>itial work<strong>in</strong>g capital <strong>for</strong> <strong>the</strong> revolv<strong>in</strong>g funds (USD 3 million) was provided as a grant by <strong>the</strong> World<br />

Bank, Denmark and F<strong>in</strong>land. The SRF was managed by <strong>the</strong> Women’s Union, a countrywide<br />

organisation represent<strong>in</strong>g <strong>the</strong> rights and <strong>in</strong>terests <strong>of</strong> women that has a long experience with runn<strong>in</strong>g<br />

micro-f<strong>in</strong>ance schemes. The <strong>in</strong>itial work<strong>in</strong>g capital was revolved more than twice dur<strong>in</strong>g <strong>the</strong> first phase<br />

<strong>of</strong> <strong>the</strong> project (2001 to 2004) and was <strong>the</strong>n transferred <strong>for</strong> subsequent phases to be revolved fur<strong>the</strong>r.<br />

Comb<strong>in</strong>ed with demand generation and hygiene promotion activities, <strong>the</strong> SRF helped around 200 000<br />

households build <strong>sanitation</strong> facilities over <strong>the</strong> course <strong>of</strong> seven years. The revolv<strong>in</strong>g fund mechanism<br />

allowed leverag<strong>in</strong>g household <strong>in</strong>vestment by a factor <strong>of</strong> up to 25 times <strong>the</strong> amount <strong>of</strong> public funds<br />

spent. Repayment rates are extremely high (almost 100%).<br />

This pilot approach has s<strong>in</strong>ce been scaled up, via o<strong>the</strong>r World Bank-funded projects (with an<br />

outstand<strong>in</strong>g work<strong>in</strong>g capital <strong>of</strong> about USD 25 million as <strong>of</strong> March 2009) or through <strong>the</strong> Vietnam Bank<br />

<strong>for</strong> Social Policy (VSBP). The latter <strong>of</strong>fers separate products <strong>for</strong> water and <strong>sanitation</strong>, through <strong>the</strong><br />

Safe Water and Rural Environmental Sanitation Program (SWRESP). In 2007, <strong>the</strong> amount <strong>of</strong> loans <strong>for</strong><br />

SWRESP was USD 20 million.<br />

Source: Trémolet, S. with Perez ,E. and Koslky ,P. (2010); Mehta (2008).<br />

In India, straight “toilet loans” are <strong>of</strong>fered by a grow<strong>in</strong>g number <strong>of</strong> MFIs to women members<br />

<strong>of</strong> Self-Help Groups. These MFIs mobilise f<strong>in</strong>anc<strong>in</strong>g from commercial banks. For example,<br />

BWDC <strong>in</strong> Tamil Nadu made 9,000 toilet loans <strong>in</strong> <strong>the</strong> last 3 years. Guardian, <strong>the</strong> first “water<br />

and <strong>sanitation</strong>-focused” MFI (spun-<strong>of</strong>f from an NGO) has provided with support from<br />

water.org over 20,000 micro-loans <strong>in</strong> <strong>the</strong> last 3 years, 60% <strong>of</strong> which were <strong>for</strong> <strong>sanitation</strong>. They<br />

are target<strong>in</strong>g rural areas and urban slums, with variable loan terms. Typically, toilet loans are<br />

between USD 180 to 225, repayable over 12 or 18 months with an 18% yearly <strong>in</strong>terest rate<br />

(reduc<strong>in</strong>g) and 3% charges.<br />

What are exist<strong>in</strong>g experiences <strong>in</strong> <strong>Tanzania</strong>?<br />

There are very few experiences <strong>in</strong> <strong>Tanzania</strong> with <strong>sanitation</strong> micr<strong>of</strong><strong>in</strong>ance targeted at<br />

households. Two programmes run by NGOs have provided micr<strong>of</strong><strong>in</strong>ance products to<br />

households, i.e. <strong>the</strong> sav<strong>in</strong>gs and loan programme run by CCI (Centre <strong>for</strong> Community<br />

Initiatives) and <strong>the</strong> lend<strong>in</strong>g programme that was run by MAMADO <strong>in</strong> Dodoma. 9<br />

Both <strong>of</strong> <strong>the</strong>se experiences have been <strong>in</strong>itiated with a predom<strong>in</strong>ant focus on water and<br />

<strong>sanitation</strong> activities and no prior experience with runn<strong>in</strong>g micr<strong>of</strong><strong>in</strong>ance schemes or sav<strong>in</strong>g<br />

programmes. Those schemes have rema<strong>in</strong>ed at a limited scale, although <strong>the</strong>y are <strong>potential</strong>ly<br />

promis<strong>in</strong>g. Table 4 below summarises <strong>the</strong> key characteristics <strong>of</strong> such schemes whilst Annex<br />

A presents <strong>the</strong>m <strong>in</strong> more detail, toge<strong>the</strong>r with recommendations <strong>for</strong> scale-up.<br />

9 O<strong>the</strong>r NGO-run programmes, such as <strong>the</strong> CARE/iWASH programme, <strong>in</strong>clude an overall micr<strong>of</strong><strong>in</strong>ance<br />

component <strong>for</strong> economic activities at village level but no specific <strong>sanitation</strong> programme.<br />

21