REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>of</strong> products e.g. at some po<strong>in</strong>t FINCA Uganda had a solar loan product.<br />

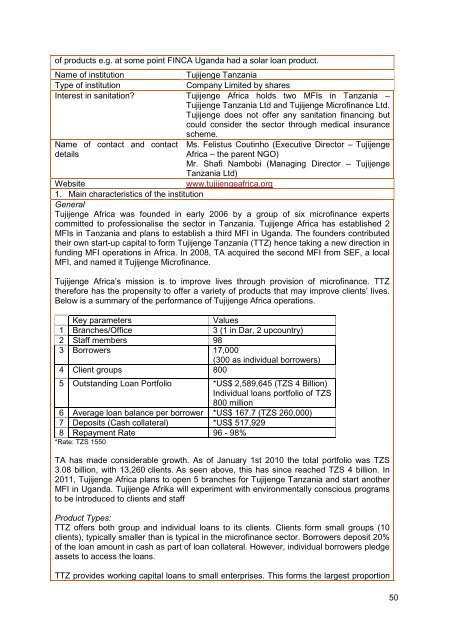

Name <strong>of</strong> <strong>in</strong>stitution Tujijenge <strong>Tanzania</strong><br />

Type <strong>of</strong> <strong>in</strong>stitution Company Limited by shares<br />

Interest <strong>in</strong> <strong>sanitation</strong>? Tujijenge Africa holds two MFIs <strong>in</strong> <strong>Tanzania</strong> –<br />

Tujijenge <strong>Tanzania</strong> Ltd and Tujijenge Micr<strong>of</strong><strong>in</strong>ance Ltd.<br />

Tujijenge does not <strong>of</strong>fer any <strong>sanitation</strong> f<strong>in</strong>anc<strong>in</strong>g but<br />

could consider <strong>the</strong> sector through medical <strong>in</strong>surance<br />

Name <strong>of</strong> contact and contact<br />

details<br />

scheme.<br />

Ms. Felistus Cout<strong>in</strong>ho (Executive Director – Tujijenge<br />

Africa – <strong>the</strong> parent NGO)<br />

Mr. Shafi Nambobi (Manag<strong>in</strong>g Director – Tujijenge<br />

<strong>Tanzania</strong> Ltd)<br />

Website www.tujijengeafrica.org<br />

1. Ma<strong>in</strong> characteristics <strong>of</strong> <strong>the</strong> <strong>in</strong>stitution<br />

General<br />

Tujijenge Africa was founded <strong>in</strong> early 2006 by a group <strong>of</strong> six micr<strong>of</strong><strong>in</strong>ance experts<br />

committed to pr<strong>of</strong>essionalise <strong>the</strong> sector <strong>in</strong> <strong>Tanzania</strong>. Tujijenge Africa has established 2<br />

MFIs <strong>in</strong> <strong>Tanzania</strong> and plans to establish a third MFI <strong>in</strong> Uganda. The founders contributed<br />

<strong>the</strong>ir own start-up capital to <strong>for</strong>m Tujijenge <strong>Tanzania</strong> (TTZ) hence tak<strong>in</strong>g a new direction <strong>in</strong><br />

fund<strong>in</strong>g MFI operations <strong>in</strong> Africa. In 2008, TA acquired <strong>the</strong> second MFI from SEF, a local<br />

MFI, and named it Tujijenge Micr<strong>of</strong><strong>in</strong>ance.<br />

Tujijenge Africa’s mission is to improve lives through provision <strong>of</strong> micr<strong>of</strong><strong>in</strong>ance. TTZ<br />

<strong>the</strong>re<strong>for</strong>e has <strong>the</strong> propensity to <strong>of</strong>fer a variety <strong>of</strong> products that may improve clients’ lives.<br />

Below is a summary <strong>of</strong> <strong>the</strong> per<strong>for</strong>mance <strong>of</strong> Tujijenge Africa operations.<br />

Key parameters Values<br />

1 Branches/Office 3 (1 <strong>in</strong> Dar, 2 upcountry)<br />

2 Staff members 98<br />

3 Borrowers 17,000<br />

(300 as <strong>in</strong>dividual borrowers)<br />

4 Client groups 800<br />

5 Outstand<strong>in</strong>g Loan Portfolio *US$ 2,589,645 (TZS 4 Billion)<br />

Individual loans portfolio <strong>of</strong> TZS<br />

800 million<br />

6 Average loan balance per borrower *US$ 167.7 (TZS 260,000)<br />

7 Deposits (Cash collateral) *US$ 517,929<br />

8 Repayment Rate 96 - 98%<br />

*Rate: TZS 1550<br />

TA has made considerable growth. As <strong>of</strong> January 1st 2010 <strong>the</strong> total portfolio was TZS<br />

3.08 billion, with 13,260 clients. As seen above, this has s<strong>in</strong>ce reached TZS 4 billion. In<br />

2011, Tujijenge Africa plans to open 5 branches <strong>for</strong> Tujijenge <strong>Tanzania</strong> and start ano<strong>the</strong>r<br />

MFI <strong>in</strong> Uganda. Tujijenge Afrika will experiment with environmentally conscious programs<br />

to be <strong>in</strong>troduced to clients and staff<br />

Product Types:<br />

TTZ <strong>of</strong>fers both group and <strong>in</strong>dividual loans to its clients. Clients <strong>for</strong>m small groups (10<br />

clients), typically smaller than is typical <strong>in</strong> <strong>the</strong> micr<strong>of</strong><strong>in</strong>ance sector. Borrowers deposit 20%<br />

<strong>of</strong> <strong>the</strong> loan amount <strong>in</strong> cash as part <strong>of</strong> loan collateral. However, <strong>in</strong>dividual borrowers pledge<br />

assets to access <strong>the</strong> loans.<br />

TTZ provides work<strong>in</strong>g capital loans to small enterprises. This <strong>for</strong>ms <strong>the</strong> largest proportion<br />

50