REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

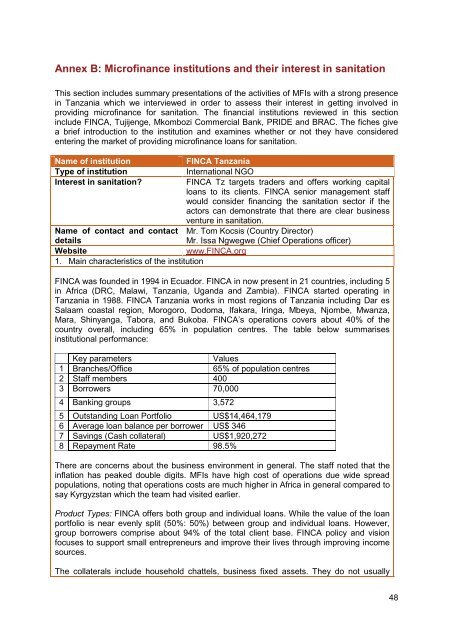

Annex B: Micr<strong>of</strong><strong>in</strong>ance <strong>in</strong>stitutions and <strong>the</strong>ir <strong>in</strong>terest <strong>in</strong> <strong>sanitation</strong><br />

This section <strong>in</strong>cludes summary presentations <strong>of</strong> <strong>the</strong> activities <strong>of</strong> MFIs with a strong presence<br />

<strong>in</strong> <strong>Tanzania</strong> which we <strong>in</strong>terviewed <strong>in</strong> order to assess <strong>the</strong>ir <strong>in</strong>terest <strong>in</strong> gett<strong>in</strong>g <strong>in</strong>volved <strong>in</strong><br />

provid<strong>in</strong>g micr<strong>of</strong><strong>in</strong>ance <strong>for</strong> <strong>sanitation</strong>. The f<strong>in</strong>ancial <strong>in</strong>stitutions reviewed <strong>in</strong> this section<br />

<strong>in</strong>clude FINCA, Tujijenge, Mkombozi Commercial Bank, PRIDE and BRAC. The fiches give<br />

a brief <strong>in</strong>troduction to <strong>the</strong> <strong>in</strong>stitution and exam<strong>in</strong>es whe<strong>the</strong>r or not <strong>the</strong>y have considered<br />

enter<strong>in</strong>g <strong>the</strong> market <strong>of</strong> provid<strong>in</strong>g micr<strong>of</strong><strong>in</strong>ance loans <strong>for</strong> <strong>sanitation</strong>.<br />

Name <strong>of</strong> <strong>in</strong>stitution FINCA <strong>Tanzania</strong><br />

Type <strong>of</strong> <strong>in</strong>stitution International NGO<br />

Interest <strong>in</strong> <strong>sanitation</strong>? FINCA Tz targets traders and <strong>of</strong>fers work<strong>in</strong>g capital<br />

loans to its clients. FINCA senior management staff<br />

would consider f<strong>in</strong>anc<strong>in</strong>g <strong>the</strong> <strong>sanitation</strong> sector if <strong>the</strong><br />

actors can demonstrate that <strong>the</strong>re are clear bus<strong>in</strong>ess<br />

venture <strong>in</strong> <strong>sanitation</strong>.<br />

Name <strong>of</strong> contact and contact Mr. Tom Kocsis (Country Director)<br />

details<br />

Mr. Issa Ngwegwe (Chief Operations <strong>of</strong>ficer)<br />

Website www.FINCA.org<br />

1. Ma<strong>in</strong> characteristics <strong>of</strong> <strong>the</strong> <strong>in</strong>stitution<br />

FINCA was founded <strong>in</strong> 1994 <strong>in</strong> Ecuador. FINCA <strong>in</strong> now present <strong>in</strong> 21 countries, <strong>in</strong>clud<strong>in</strong>g 5<br />

<strong>in</strong> Africa (DRC, Malawi, <strong>Tanzania</strong>, Uganda and Zambia). FINCA started operat<strong>in</strong>g <strong>in</strong><br />

<strong>Tanzania</strong> <strong>in</strong> 1988. FINCA <strong>Tanzania</strong> works <strong>in</strong> most regions <strong>of</strong> <strong>Tanzania</strong> <strong>in</strong>clud<strong>in</strong>g Dar es<br />

Salaam coastal region, Morogoro, Dodoma, Ifakara, Ir<strong>in</strong>ga, Mbeya, Njombe, Mwanza,<br />

Mara, Sh<strong>in</strong>yanga, Tabora, and Bukoba. FINCA’s operations covers about 40% <strong>of</strong> <strong>the</strong><br />

country overall, <strong>in</strong>clud<strong>in</strong>g 65% <strong>in</strong> population centres. The table below summarises<br />

<strong>in</strong>stitutional per<strong>for</strong>mance:<br />

Key parameters Values<br />

1 Branches/Office 65% <strong>of</strong> population centres<br />

2 Staff members 400<br />

3 Borrowers 70,000<br />

4 Bank<strong>in</strong>g groups 3,572<br />

5 Outstand<strong>in</strong>g Loan Portfolio US$14,464,179<br />

6 Average loan balance per borrower US$ 346<br />

7 Sav<strong>in</strong>gs (Cash collateral) US$1,920,272<br />

8 Repayment Rate 98.5%<br />

There are concerns about <strong>the</strong> bus<strong>in</strong>ess environment <strong>in</strong> general. The staff noted that <strong>the</strong><br />

<strong>in</strong>flation has peaked double digits. MFIs have high cost <strong>of</strong> operations due wide spread<br />

populations, not<strong>in</strong>g that operations costs are much higher <strong>in</strong> Africa <strong>in</strong> general compared to<br />

say Kyrgyzstan which <strong>the</strong> team had visited earlier.<br />

Product Types: FINCA <strong>of</strong>fers both group and <strong>in</strong>dividual loans. While <strong>the</strong> value <strong>of</strong> <strong>the</strong> loan<br />

portfolio is near evenly split (50%: 50%) between group and <strong>in</strong>dividual loans. However,<br />

group borrowers comprise about 94% <strong>of</strong> <strong>the</strong> total client base. FINCA policy and vision<br />

focuses to support small entrepreneurs and improve <strong>the</strong>ir lives through improv<strong>in</strong>g <strong>in</strong>come<br />

sources.<br />

The collaterals <strong>in</strong>clude household chattels, bus<strong>in</strong>ess fixed assets. They do not usually<br />

48