REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

REPORT__Evaluating_the_potential_of_microfinance_for_sanitation_in_Tanzania_May_2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

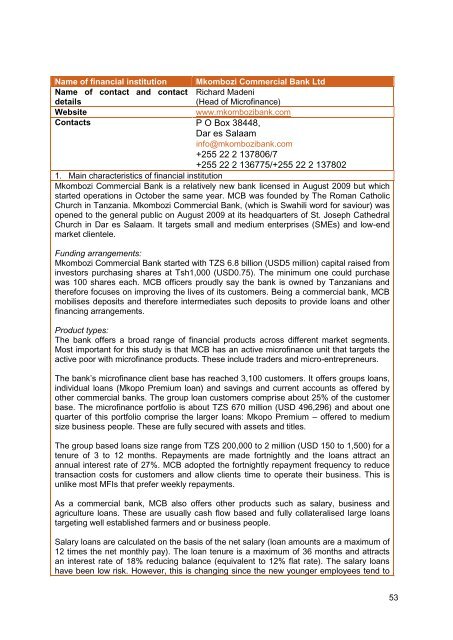

Name <strong>of</strong> f<strong>in</strong>ancial <strong>in</strong>stitution Mkombozi Commercial Bank Ltd<br />

Name <strong>of</strong> contact and contact Richard Madeni<br />

details<br />

(Head <strong>of</strong> Micr<strong>of</strong><strong>in</strong>ance)<br />

Website www.mkombozibank.com<br />

Contacts P O Box 38448,<br />

Dar es Salaam<br />

<strong>in</strong>fo@mkombozibank.com<br />

+255 22 2 137806/7<br />

+255 22 2 136775/+255 22 2 137802<br />

1. Ma<strong>in</strong> characteristics <strong>of</strong> f<strong>in</strong>ancial <strong>in</strong>stitution<br />

Mkombozi Commercial Bank is a relatively new bank licensed <strong>in</strong> August 2009 but which<br />

started operations <strong>in</strong> October <strong>the</strong> same year. MCB was founded by The Roman Catholic<br />

Church <strong>in</strong> <strong>Tanzania</strong>. Mkombozi Commercial Bank, (which is Swahili word <strong>for</strong> saviour) was<br />

opened to <strong>the</strong> general public on August 2009 at its headquarters <strong>of</strong> St. Joseph Ca<strong>the</strong>dral<br />

Church <strong>in</strong> Dar es Salaam. It targets small and medium enterprises (SMEs) and low-end<br />

market clientele.<br />

Fund<strong>in</strong>g arrangements:<br />

Mkombozi Commercial Bank started with TZS 6.8 billion (USD5 million) capital raised from<br />

<strong>in</strong>vestors purchas<strong>in</strong>g shares at Tsh1,000 (USD0.75). The m<strong>in</strong>imum one could purchase<br />

was 100 shares each. MCB <strong>of</strong>ficers proudly say <strong>the</strong> bank is owned by <strong>Tanzania</strong>ns and<br />

<strong>the</strong>re<strong>for</strong>e focuses on improv<strong>in</strong>g <strong>the</strong> lives <strong>of</strong> its customers. Be<strong>in</strong>g a commercial bank, MCB<br />

mobilises deposits and <strong>the</strong>re<strong>for</strong>e <strong>in</strong>termediates such deposits to provide loans and o<strong>the</strong>r<br />

f<strong>in</strong>anc<strong>in</strong>g arrangements.<br />

Product types:<br />

The bank <strong>of</strong>fers a broad range <strong>of</strong> f<strong>in</strong>ancial products across different market segments.<br />

Most important <strong>for</strong> this study is that MCB has an active micr<strong>of</strong><strong>in</strong>ance unit that targets <strong>the</strong><br />

active poor with micr<strong>of</strong><strong>in</strong>ance products. These <strong>in</strong>clude traders and micro-entrepreneurs.<br />

The bank’s micr<strong>of</strong><strong>in</strong>ance client base has reached 3,100 customers. It <strong>of</strong>fers groups loans,<br />

<strong>in</strong>dividual loans (Mkopo Premium loan) and sav<strong>in</strong>gs and current accounts as <strong>of</strong>fered by<br />

o<strong>the</strong>r commercial banks. The group loan customers comprise about 25% <strong>of</strong> <strong>the</strong> customer<br />

base. The micr<strong>of</strong><strong>in</strong>ance portfolio is about TZS 670 million (USD 496,296) and about one<br />

quarter <strong>of</strong> this portfolio comprise <strong>the</strong> larger loans: Mkopo Premium – <strong>of</strong>fered to medium<br />

size bus<strong>in</strong>ess people. These are fully secured with assets and titles.<br />

The group based loans size range from TZS 200,000 to 2 million (USD 150 to 1,500) <strong>for</strong> a<br />

tenure <strong>of</strong> 3 to 12 months. Repayments are made <strong>for</strong>tnightly and <strong>the</strong> loans attract an<br />

annual <strong>in</strong>terest rate <strong>of</strong> 27%. MCB adopted <strong>the</strong> <strong>for</strong>tnightly repayment frequency to reduce<br />

transaction costs <strong>for</strong> customers and allow clients time to operate <strong>the</strong>ir bus<strong>in</strong>ess. This is<br />

unlike most MFIs that prefer weekly repayments.<br />

As a commercial bank, MCB also <strong>of</strong>fers o<strong>the</strong>r products such as salary, bus<strong>in</strong>ess and<br />

agriculture loans. These are usually cash flow based and fully collateralised large loans<br />

target<strong>in</strong>g well established farmers and or bus<strong>in</strong>ess people.<br />

Salary loans are calculated on <strong>the</strong> basis <strong>of</strong> <strong>the</strong> net salary (loan amounts are a maximum <strong>of</strong><br />

12 times <strong>the</strong> net monthly pay). The loan tenure is a maximum <strong>of</strong> 36 months and attracts<br />

an <strong>in</strong>terest rate <strong>of</strong> 18% reduc<strong>in</strong>g balance (equivalent to 12% flat rate). The salary loans<br />

have been low risk. However, this is chang<strong>in</strong>g s<strong>in</strong>ce <strong>the</strong> new younger employees tend to<br />

53