Beyond Borders: Global biotechnology report 2010

Beyond Borders: Global biotechnology report 2010

Beyond Borders: Global biotechnology report 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

US$31 million, down from US$38 million<br />

in 2008. We count 21 transactions in 2009<br />

with up-front payments of US$50 million<br />

or more, which in aggregate represents<br />

approximately two-thirds of the total<br />

up-front payment amount — also relatively<br />

unchanged compared to 2008.<br />

Europe<br />

M&As<br />

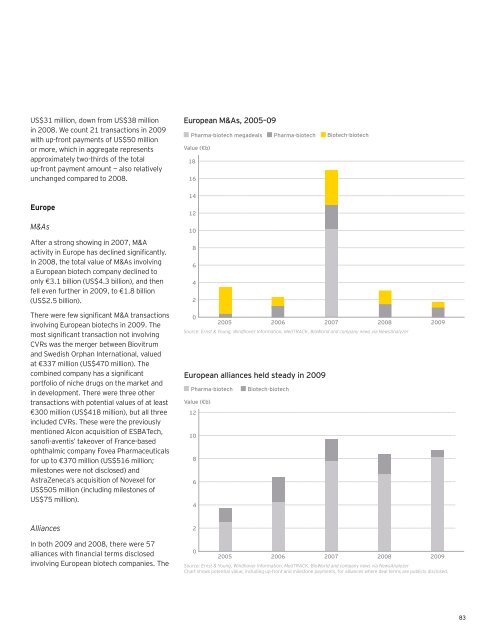

After a strong showing in 2007, M&A<br />

activity in Europe has declined significantly.<br />

In 2008, the total value of M&As involving<br />

a European biotech company declined to<br />

only €3.1 billion (US$4.3 billion), and then<br />

fell even further in 2009, to €1.8 billion<br />

(US$2.5 billion).<br />

There were few significant M&A transactions<br />

involving European biotechs in 2009. The<br />

most significant transaction not involving<br />

CVRs was the merger between Biovitrum<br />

and Swedish Orphan International, valued<br />

at €337 million (US$470 million). The<br />

combined company has a significant<br />

portfolio of niche drugs on the market and<br />

in development. There were three other<br />

transactions with potential values of at least<br />

€300 million (US$418 million), but all three<br />

included CVRs. These were the previously<br />

mentioned Alcon acquisition of ESBATech,<br />

sanofi-aventis’ takeover of France-based<br />

ophthalmic company Fovea Pharmaceuticals<br />

for up to €370 million (US$516 million;<br />

milestones were not disclosed) and<br />

AstraZeneca’s acquisition of Novexel for<br />

US$505 million (including milestones of<br />

US$75 million).<br />

Alliances<br />

In both 2009 and 2008, there were 57<br />

alliances with financial terms disclosed<br />

involving European biotech companies. The<br />

European M&As, 2005–09<br />

Pharma-biotech megadeals Pharma-biotech Biotech-biotech<br />

Value (€b)<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Source: Ernst & Young, Windhover Information, MedTRACK, BioWorld and company news via NewsAnalyzer<br />

European alliances held steady in 2009<br />

Pharma-biotech Biotech-biotech<br />

Value (€b)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

2005 2006 2007 2008 2009<br />

0<br />

2005 2006 2007 2008 2009<br />

Source: Ernst & Young, Windhover Information, MedTRACK, BioWorld and company news via NewsAnalyzer<br />

Chart shows potential value, including up-front and milestone payments, for alliances where deal terms are publicly disclosed.<br />

83