Beyond Borders: Global biotechnology report 2010

Beyond Borders: Global biotechnology report 2010

Beyond Borders: Global biotechnology report 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

for biotech’s sustainability — that the<br />

business model the industry has long<br />

thrived on would be starved of its key input<br />

(funding) and companies’ efforts to cull<br />

their pipelines would lower the model’s<br />

key output (innovation). We wondered<br />

whether recovery, when it came, might<br />

bring not a return to normal, but rather the<br />

emergence of a “new normal,” requiring<br />

new models for sustainability. And we<br />

described four paradigm-shifting trends<br />

that could potentially create a path to more<br />

sustainable business models in the future.<br />

A year later, the dust has settled and the<br />

outlines of a new normal are indeed starting<br />

to emerge. In both the general economy<br />

and the biotech industry, the worst is<br />

clearly over, but things are not reverting to<br />

business as usual. And in many ways, the<br />

experience of the global biotech industry so<br />

far has mirrored that of the global economy.<br />

For one, while the downturn is commonly<br />

referred to as the global financial crisis<br />

or global recession, it has, in reality, had<br />

divergent impacts on different parts of<br />

the globe. While most industrialized nations<br />

and many developing countries suffered<br />

through recessions in 2009, some emerging<br />

economies — most notably China and<br />

India — continued to see unabated<br />

economic growth.<br />

While several economies have started<br />

to emerge from recession in late 2009<br />

and early <strong>2010</strong> (based on the official<br />

yardstick of GDP growth) and global stock<br />

markets are approaching pre-crisis levels,<br />

unemployment has remained stubbornly<br />

high, particularly in the US. The worst of the<br />

credit crisis has successfully been abated,<br />

but bank lending standards remain tight.<br />

This, coupled with an uncertain market<br />

environment, has lowered hiring at small<br />

businesses — traditionally a key engine<br />

of job creation. Amid talk of a prolonged<br />

“jobless recovery,” most economists now<br />

expect that high unemployment levels will<br />

remain part of the new normal for some<br />

time to come, with potential implications for<br />

economic and social stability.<br />

The situation for biotech is similarly<br />

mixed. On the surface, it would appear<br />

that the worst is indeed over. Aggregate<br />

funding levels rebounded nicely in 2009<br />

and strategic alliance activity remains<br />

robust. Financial performance has<br />

been fairly strong — particularly under<br />

the circumstances — with remarkable<br />

improvement on the bottom line as<br />

companies have engaged in belt tightening.<br />

The market cap of smaller companies,<br />

which had taken a beating, has rebounded<br />

impressively, making up much of the ground<br />

that was ceded in late 2008 and early<br />

2009. (For more on these trends, refer to<br />

the Industry performance section.)<br />

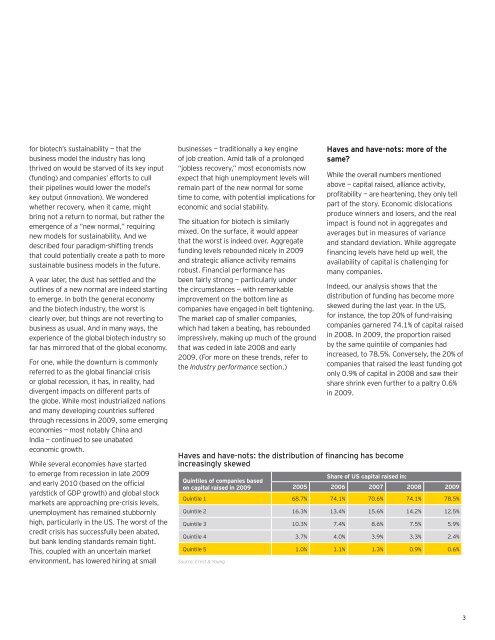

Haves and have-nots: the distribution of financing has become<br />

increasingly skewed<br />

Quintiles of companies based<br />

on capital raised in 2009<br />

2005<br />

Share of US capital raised in:<br />

2006 2007 2008 2009<br />

Quintile 1 68.7% 74.1% 70.6% 74.1% 78.5%<br />

Quintile 2 16.3% 13.4% 15.6% 14.2% 12.5%<br />

Quintile 3 10.3% 7.4% 8.6% 7.5% 5.9%<br />

Quintile 4 3.7% 4.0% 3.9% 3.3% 2.4%<br />

Quintile 5 1.0% 1.1% 1.3% 0.9% 0.6%<br />

Source: Ernst & Young<br />

Haves and have-nots: more of the<br />

same?<br />

While the overall numbers mentioned<br />

above — capital raised, alliance activity,<br />

profitability — are heartening, they only tell<br />

part of the story. Economic dislocations<br />

produce winners and losers, and the real<br />

impact is found not in aggregates and<br />

averages but in measures of variance<br />

and standard deviation. While aggregate<br />

financing levels have held up well, the<br />

availability of capital is challenging for<br />

many companies.<br />

Indeed, our analysis shows that the<br />

distribution of funding has become more<br />

skewed during the last year. In the US,<br />

for instance, the top 20% of fund-raising<br />

companies garnered 74.1% of capital raised<br />

in 2008. In 2009, the proportion raised<br />

by the same quintile of companies had<br />

increased, to 78.5%. Conversely, the 20% of<br />

companies that raised the least funding got<br />

only 0.9% of capital in 2008 and saw their<br />

share shrink even further to a paltry 0.6%<br />

in 2009.<br />

3