Beyond Borders: Global biotechnology report 2010

Beyond Borders: Global biotechnology report 2010

Beyond Borders: Global biotechnology report 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

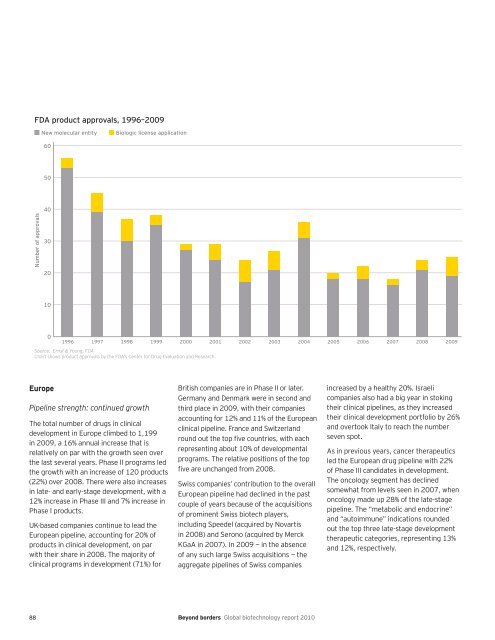

FDA product approvals, 1996–2009<br />

Number of approvals<br />

New molecular entity Biologic license application<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

Source: Ernst & Young, FDA<br />

Chart shows product approvals by the FDA’s Center for Drug Evaluation and Research.<br />

Europe<br />

Pipeline strength: continued growth<br />

The total number of drugs in clinical<br />

development in Europe climbed to 1,199<br />

in 2009, a 16% annual increase that is<br />

relatively on par with the growth seen over<br />

the last several years. Phase II programs led<br />

the growth with an increase of 120 products<br />

(22%) over 2008. There were also increases<br />

in late- and early-stage development, with a<br />

12% increase in Phase III and 7% increase in<br />

Phase I products.<br />

UK-based companies continue to lead the<br />

European pipeline, accounting for 20% of<br />

products in clinical development, on par<br />

with their share in 2008. The majority of<br />

clinical programs in development (71%) for<br />

British companies are in Phase II or later.<br />

Germany and Denmark were in second and<br />

third place in 2009, with their companies<br />

accounting for 12% and 11% of the European<br />

clinical pipeline. France and Switzerland<br />

round out the top five countries, with each<br />

representing about 10% of developmental<br />

programs. The relative positions of the top<br />

five are unchanged from 2008.<br />

Swiss companies’ contribution to the overall<br />

European pipeline had declined in the past<br />

couple of years because of the acquisitions<br />

of prominent Swiss biotech players,<br />

including Speedel (acquired by Novartis<br />

in 2008) and Serono (acquired by Merck<br />

KGaA in 2007). In 2009 — in the absence<br />

of any such large Swiss acquisitions — the<br />

aggregate pipelines of Swiss companies<br />

88 <strong>Beyond</strong> borders <strong>Global</strong> <strong>biotechnology</strong> <strong>report</strong> <strong>2010</strong><br />

increased by a healthy 20%. Israeli<br />

companies also had a big year in stoking<br />

their clinical pipelines, as they increased<br />

their clinical development portfolio by 26%<br />

and overtook Italy to reach the number<br />

seven spot.<br />

As in previous years, cancer therapeutics<br />

led the European drug pipeline with 22%<br />

of Phase III candidates in development.<br />

The oncology segment has declined<br />

somewhat from levels seen in 2007, when<br />

oncology made up 28% of the late-stage<br />

pipeline. The “metabolic and endocrine”<br />

and “autoimmune” indications rounded<br />

out the top three late-stage development<br />

therapeutic categories, representing 13%<br />

and 12%, respectively.