2009-10 Annual Report - Australia Post

2009-10 Annual Report - Australia Post

2009-10 Annual Report - Australia Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

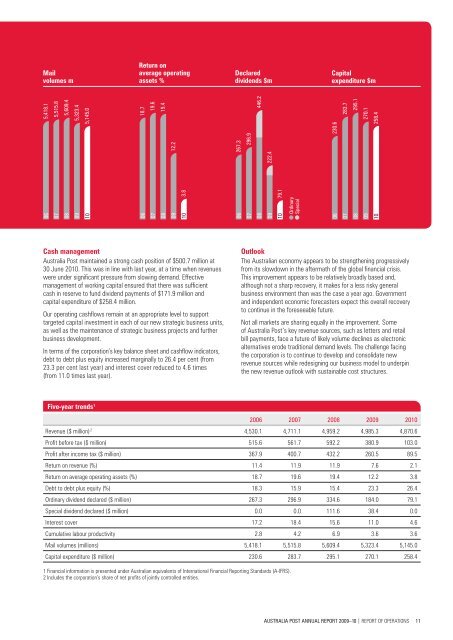

Mail<br />

volumes m<br />

5,418.1<br />

06<br />

5,515.8<br />

07<br />

5,609.4<br />

08<br />

5,323.4<br />

09<br />

5,145.0<br />

<strong>10</strong><br />

Cash management<br />

<strong>Australia</strong> <strong>Post</strong> maintained a strong cash position of $500.7 million at<br />

30 June 20<strong>10</strong>. This was in line with last year, at a time when revenues<br />

were under signifi cant pressure from slowing demand. Effective<br />

management of working capital ensured that there was suffi cient<br />

cash in reserve to fund dividend payments of $171.9 million and<br />

capital expenditure of $258.4 million.<br />

Our operating cashfl ows remain at an appropriate level to support<br />

targeted capital investment in each of our new strategic business units,<br />

as well as the maintenance of strategic business projects and further<br />

business development.<br />

In terms of the corporation’s key balance sheet and cashfl ow indicators,<br />

debt to debt plus equity increased marginally to 26.4 per cent (from<br />

23.3 per cent last year) and interest cover reduced to 4.6 times<br />

(from 11.0 times last year).<br />

Five-year trends 1<br />

Return on<br />

average operating<br />

assets %<br />

18.7<br />

19.6<br />

19.4<br />

06<br />

07<br />

08<br />

12.2<br />

09<br />

3.8<br />

<strong>10</strong><br />

Declared<br />

dividends $m<br />

267.3<br />

296.9<br />

446.2<br />

222.4<br />

06<br />

07<br />

08<br />

09<br />

<strong>10</strong> 79.1<br />

Ordinary<br />

Special<br />

Capital<br />

expenditure $m<br />

Outlook<br />

The <strong>Australia</strong>n economy appears to be strengthening progressively<br />

from its slowdown in the aftermath of the global fi nancial crisis.<br />

This improvement appears to be relatively broadly based and,<br />

although not a sharp recovery, it makes for a less risky general<br />

business environment than was the case a year ago. Government<br />

and independent economic forecasters expect this overall recovery<br />

to continue in the foreseeable future.<br />

Not all markets are sharing equally in the improvement. Some<br />

of <strong>Australia</strong> <strong>Post</strong>’s key revenue sources, such as letters and retail<br />

bill payments, face a future of likely volume declines as electronic<br />

alternatives erode traditional demand levels. The challenge facing<br />

the corporation is to continue to develop and consolidate new<br />

revenue sources while redesigning our business model to underpin<br />

the new revenue outlook with sustainable cost structures.<br />

2006 2007 2008 <strong>2009</strong> 20<strong>10</strong><br />

Revenue ($ million) 2 4,530.1 4,711.1 4,959.2 4,985.3 4,870.6<br />

Profi t before tax ($ million) 515.6 561.7 592.2 380.9 <strong>10</strong>3.0<br />

Profi t after income tax ($ million) 367.9 400.7 432.2 260.5 89.5<br />

Return on revenue (%) 11.4 11.9 11.9 7.6 2.1<br />

Return on average operating assets (%) 18.7 19.6 19.4 12.2 3.8<br />

Debt to debt plus equity (%) 18.3 15.9 15.4 23.3 26.4<br />

Ordinary dividend declared ($ million) 267.3 296.9 334.6 184.0 79.1<br />

Special dividend declared ($ million) 0.0 0.0 111.6 38.4 0.0<br />

Interest cover 17.2 18.4 15.6 11.0 4.6<br />

Cumulative labour productivity 2.8 4.2 6.9 3.6 3.6<br />

Mail volumes (millions) 5,418.1 5,515.8 5,609.4 5,323.4 5,145.0<br />

Capital expenditure ($ million) 230.6 283.7 295.1 270.1 258.4<br />

1 Financial information is presented under <strong>Australia</strong>n equivalents of International Financial <strong>Report</strong>ing Standards (A-IFRS).<br />

2 Includes the corporation’s share of net profi ts of jointly controlled entities.<br />

230.6<br />

06<br />

283.7<br />

07<br />

295.1<br />

08<br />

270.1<br />

09<br />

258.4<br />

<strong>10</strong><br />

AUSTRALIA POST ANNUAL REPORT <strong>2009</strong>–<strong>10</strong> | REPORT OF OPERATIONS 11