2009-10 Annual Report - Australia Post

2009-10 Annual Report - Australia Post

2009-10 Annual Report - Australia Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

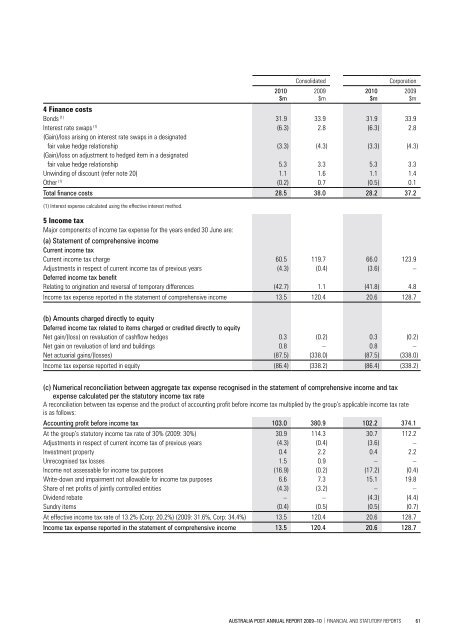

4 Finance costs<br />

Bonds (1)<br />

interest rate swaps (1)<br />

(Gain)/loss arising on interest rate swaps in a designated<br />

fair value hedge relationship<br />

(Gain)/loss on adjustment to hedged item in a designated<br />

fair value hedge relationship<br />

unwinding of discount (refer note 20)<br />

other (1)<br />

20<strong>10</strong><br />

$m<br />

31.9<br />

(6.3)<br />

(3.3)<br />

5.3<br />

1.1<br />

(0.2)<br />

consolidated corporation<br />

total finance costs 28.5 38.0 28.2 37.2<br />

(1) interest expense calculated using the effective interest method.<br />

5 Income tax<br />

Major components of income tax expense for the years ended 30 June are:<br />

(a) statement of comprehensive income<br />

Current income tax<br />

current income tax charge<br />

adjustments in respect of current income tax of previous years<br />

deferred income tax benefit<br />

relating to origination and reversal of temporary differences<br />

(42.7) 1.1<br />

(41.8) 4.8<br />

income tax expense reported in the statement of comprehensive income 13.5 120.4 20.6 128.7<br />

(b) Amounts charged directly to equity<br />

deferred income tax related to items charged or credited directly to equity<br />

net gain/(loss) on revaluation of cashflow hedges<br />

net gain on revaluation of land and buildings<br />

net actuarial gains/(losses)<br />

60.5<br />

(4.3)<br />

0.3<br />

0.8<br />

(87.5)<br />

<strong>2009</strong><br />

$m<br />

33.9<br />

2.8<br />

(4.3)<br />

3.3<br />

1.6<br />

0.7<br />

119.7<br />

(0.4)<br />

(0.2)<br />

–<br />

(338.0)<br />

20<strong>10</strong><br />

$m<br />

31.9<br />

(6.3)<br />

(3.3)<br />

5.3<br />

1.1<br />

(0.5)<br />

66.0<br />

(3.6)<br />

0.3<br />

0.8<br />

(87.5)<br />

<strong>2009</strong><br />

$m<br />

33.9<br />

2.8<br />

(4.3)<br />

3.3<br />

1.4<br />

0.1<br />

123.9<br />

–<br />

(0.2)<br />

–<br />

(338.0)<br />

income tax expense reported in equity (86.4) (338.2) (86.4) (338.2)<br />

(c) numerical reconciliation between aggregate tax expense recognised in the statement of comprehensive income and tax<br />

expense calculated per the statutory income tax rate<br />

a reconciliation between tax expense and the product of accounting profit before income tax multiplied by the group’s applicable income tax rate<br />

is as follows:<br />

Accounting profit before income tax <strong>10</strong>3.0 380.9 <strong>10</strong>2.2 374.1<br />

at the group’s statutory income tax rate of 30% (<strong>2009</strong>: 30%)<br />

adjustments in respect of current income tax of previous years<br />

investment property<br />

unrecognised tax losses<br />

income not assessable for income tax purposes<br />

Write-down and impairment not allowable for income tax purposes<br />

share of net profits of jointly controlled entities<br />

dividend rebate<br />

sundry items<br />

at effective income tax rate of 13.2% (corp: 20.2%) (<strong>2009</strong>: 31.6%, corp: 34.4%) 13.5 120.4 20.6 128.7<br />

income tax expense reported in the statement of comprehensive income 13.5 120.4 20.6 128.7<br />

30.9<br />

(4.3)<br />

0.4<br />

1.5<br />

(16.9)<br />

6.6<br />

(4.3)<br />

–<br />

(0.4)<br />

114.3<br />

(0.4)<br />

2.2<br />

0.9<br />

(0.2)<br />

7.3<br />

(3.2)<br />

–<br />

(0.5)<br />

30.7<br />

(3.6)<br />

0.4<br />

–<br />

(17.2)<br />

15.1<br />

–<br />

(4.3)<br />

(0.5)<br />

112.2<br />

–<br />

2.2<br />

–<br />

(0.4)<br />

19.8<br />

–<br />

(4.4)<br />

(0.7)<br />

AustrAliA <strong>Post</strong> AnnuAl rePort <strong>2009</strong>–<strong>10</strong> | Financial and statutory reports 61