Asset Pricing John H. Cochrane June 12, 2000

Asset Pricing John H. Cochrane June 12, 2000

Asset Pricing John H. Cochrane June 12, 2000

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

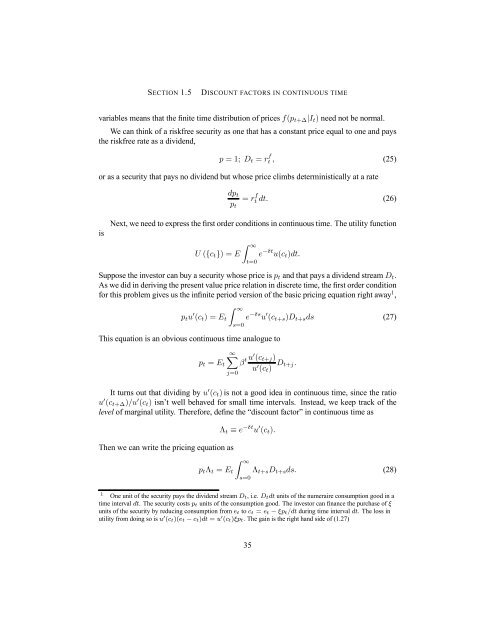

SECTION 1.5 DISCOUNT FACTORS IN CONTINUOUS TIME<br />

variables means that the finite time distribution of prices f(pt+∆|It) need not be normal.<br />

We can think of a riskfree security as one that has a constant price equal to one and pays<br />

the riskfree rate as a dividend,<br />

p =1; Dt = r f<br />

t , (25)<br />

or as a security that pays no dividend but whose price climbs deterministically at a rate<br />

dpt<br />

pt<br />

= r f<br />

t dt. (26)<br />

Next, we need to express the first order conditions in continuous time. The utility function<br />

is<br />

Z ∞<br />

U ({ct}) =E e<br />

t=0<br />

−δt u(ct)dt.<br />

Suppose the investor can buy a security whose price is pt and that pays a dividend stream Dt.<br />

As we did in deriving the present value price relation in discrete time, the first order condition<br />

for this problem gives us the infinite period version of the basic pricing equation right away1 ,<br />

ptu 0 (ct) =Et<br />

This equation is an obvious continuous time analogue to<br />

Z ∞<br />

e<br />

s=0<br />

−δs u 0 (ct+s)Dt+sds (27)<br />

∞X<br />

pt = Et β<br />

j=0<br />

t u0 (ct+j)<br />

u0 (ct) Dt+j.<br />

It turns out that dividing by u 0 (ct) is not a good idea in continuous time, since the ratio<br />

u 0 (ct+∆)/u 0 (ct) isn’t well behaved for small time intervals. Instead, we keep track of the<br />

level of marginal utility. Therefore, define the “discount factor” in continuous time as<br />

Then we can write the pricing equation as<br />

Λt ≡ e −δt u 0 (ct).<br />

Z ∞<br />

ptΛt = Et<br />

s=0<br />

Λt+sDt+sds. (28)<br />

1 One unit of the security pays the dividend stream Dt, i.e.Dtdt units of the numeraire consumption good in a<br />

time interval dt. The security costs pt units of the consumption good. The investor can finance the purchase of ξ<br />

units of the security by reducing consumption from et to ct = et − ξpt/dt during time interval dt. Thelossin<br />

utility from doing so is u 0 (ct)(et − ct)dt = u 0 (ct)ξpt. The gain is the right hand side of (1.27)<br />

35