Asset Pricing John H. Cochrane June 12, 2000

Asset Pricing John H. Cochrane June 12, 2000

Asset Pricing John H. Cochrane June 12, 2000

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SECTION 2.3 CONSUMPTION-BASED MODEL IN PRACTICE<br />

production technology. Having a taste of the extra assumptions required for a general equilibrium<br />

model, you can now appreciate why people stop short of full solutions when they can<br />

address an application using only the first order conditions, using knowledge of E(mx) to<br />

make a prediction about p.<br />

It is enormously tempting to slide into an interpretation that E(mx) determines p. Weroutinely<br />

think of betas and factor risk prices – components of E(mx) –asdetermining expected<br />

returns. For example, we routinely say things like “the expected return of a stock increased<br />

because the firm took on riskier projects, thereby increasing its β.” But the whole consumption<br />

process, discount factor, and factor risk premia change when the production technology<br />

changes. Similarly, we are on thin ice if we say anything about the effects of policy interventions,<br />

new markets and so on. The equilibrium consumption or asset return process one has<br />

modeled statistically may change in response to such changes in structure. For such questions<br />

one really needs to start thinking in general equilibrium terms. It may help to remember<br />

that there is an army of permanent-income macroeconomists who make precisely the opposite<br />

assumption, taking our asset return processes as exogenous and studying (endogenous)<br />

consumption and savings decisions.<br />

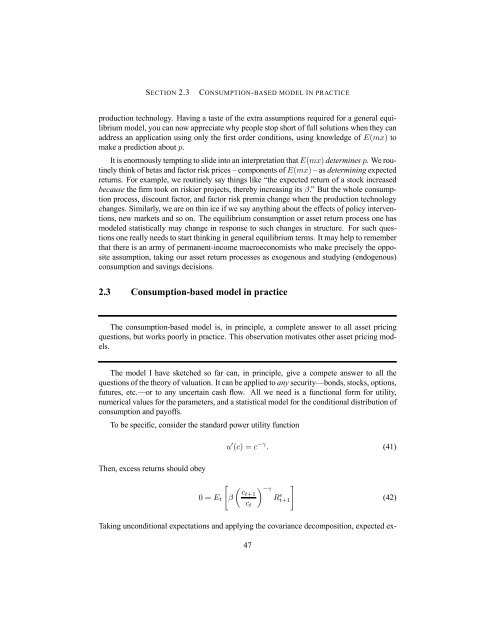

2.3 Consumption-based model in practice<br />

The consumption-based model is, in principle, a complete answer to all asset pricing<br />

questions, but works poorly in practice. This observation motivates other asset pricing models.<br />

The model I have sketched so far can, in principle, give a compete answer to all the<br />

questions of the theory of valuation. It can be applied to any security—bonds, stocks, options,<br />

futures, etc.—or to any uncertain cash flow. All we need is a functional form for utility,<br />

numerical values for the parameters, and a statistical model for the conditional distribution of<br />

consumption and payoffs.<br />

To be specific, consider the standard power utility function<br />

Then, excess returns should obey<br />

"<br />

0=Et β<br />

u 0 (c) =c −γ . (41)<br />

µ −γ<br />

ct+1<br />

R<br />

ct<br />

e t+1<br />

Taking unconditional expectations and applying the covariance decomposition, expected ex-<br />

47<br />

#<br />

(42)