You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

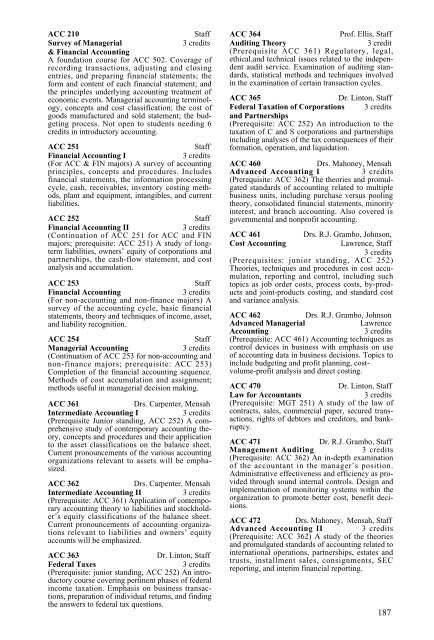

ACC 210 Staff<br />

Survey <strong>of</strong> Managerial 3 credits<br />

& Financial Accounting<br />

A foundation course for ACC 502. Coverage <strong>of</strong><br />

recording transactions, adjusting and closing<br />

entries, and preparing financial statements; the<br />

form and content <strong>of</strong> each financial statement; and<br />

the principles underlying accounting treatment <strong>of</strong><br />

economic events. Managerial accounting terminology,<br />

concepts and cost classification; the cost <strong>of</strong><br />

goods manufactured and sold statement; the budgeting<br />

process. Not open to students needing 6<br />

credits in introductory accounting.<br />

ACC 251 Staff<br />

Financial Accounting I 3 credits<br />

(For ACC & FIN majors) A survey <strong>of</strong> accounting<br />

principles, concepts and procedures. Includes<br />

financial statements, the information processing<br />

cycle, cash, receivables, inventory costing methods,<br />

plant and equipment, intangibles, and current<br />

liabilities.<br />

ACC 252 Staff<br />

Financial Accounting II 3 credits<br />

(Continuation <strong>of</strong> ACC 251 for ACC and FIN<br />

majors; prerequisite: ACC 251) A study <strong>of</strong> longterm<br />

liabilities, owners’ equity <strong>of</strong> corporations and<br />

partnerships, the cash-flow statement, and cost<br />

analysis and accumulation.<br />

ACC 253 Staff<br />

Financial Accounting 3 credits<br />

(For non-accounting and non-finance majors) A<br />

survey <strong>of</strong> the accounting cycle, basic financial<br />

statements, theory and techniques <strong>of</strong> income, asset,<br />

and liability recognition.<br />

ACC 254 Staff<br />

Managerial Accounting 3 credits<br />

(Continuation <strong>of</strong> ACC 253 for non-accounting and<br />

non-finance majors; prerequisite: ACC 253)<br />

Completion <strong>of</strong> the financial accounting sequence.<br />

Methods <strong>of</strong> cost accumulation and assignment;<br />

methods useful in managerial decision making.<br />

ACC 361 Drs. Carpenter, Mensah<br />

Intermediate Accounting I 3 credits<br />

(Prerequisite Junior standing, ACC 252) A comprehensive<br />

study <strong>of</strong> contemporary accounting theory,<br />

concepts and procedures and their application<br />

to the asset classifications on the balance sheet.<br />

Current pronouncements <strong>of</strong> the various accounting<br />

organizations relevant to assets will be emphasized.<br />

ACC 362 Drs. Carpenter, Mensah<br />

Intermediate Accounting II 3 credits<br />

(Prerequisite: ACC 361) Application <strong>of</strong> contemporary<br />

accounting theory to liabilities and stockholder’s<br />

equity classifications <strong>of</strong> the balance sheet.<br />

Current pronouncements <strong>of</strong> accounting organizations<br />

relevant to liabilities and owners’ equity<br />

accounts will be emphasized.<br />

ACC 363 Dr. Linton, Staff<br />

Federal Taxes 3 credits<br />

(Prerequisite: junior standing, ACC 252) An introductory<br />

course covering pertinent phases <strong>of</strong> federal<br />

income taxation. Emphasis on business transactions,<br />

preparation <strong>of</strong> individual returns, and finding<br />

the answers to federal tax questions.<br />

ACC 364 Pr<strong>of</strong>. Ellis, Staff<br />

Auditing <strong>The</strong>ory 3 credit<br />

(Prerequisite ACC 361) Regulatory, legal,<br />

ethical,and technical issues related to the independent<br />

audit service. Examination <strong>of</strong> auditing standards,<br />

statistical methods and techniques involved<br />

in the examination <strong>of</strong> certain transaction cycles.<br />

ACC 365 Dr. Linton, Staff<br />

Federal Taxation <strong>of</strong> Corporations 3 credits<br />

and Partnerships<br />

(Prerequisite: ACC 252) An introduction to the<br />

taxation <strong>of</strong> C and S corporations and partnerships<br />

including analyses <strong>of</strong> the tax consequences <strong>of</strong> their<br />

formation, operation, and liquidation.<br />

ACC 460 Drs. Mahoney, Mensah<br />

Advanced Accounting I 3 credits<br />

(Prerequisite: ACC 362) <strong>The</strong> theories and promulgated<br />

standards <strong>of</strong> accounting related to multiple<br />

business units, including purchase versus pooling<br />

theory, consolidated financial statements, minority<br />

interest, and branch accounting. Also covered is<br />

governmental and nonpr<strong>of</strong>it accounting.<br />

ACC 461 Drs. R.J. Grambo, Johnson,<br />

Cost Accounting Lawrence, Staff<br />

3 credits<br />

(Prerequisites: junior standing, ACC 252)<br />

<strong>The</strong>ories, techniques and procedures in cost accumulation,<br />

reporting and control, including such<br />

topics as job order costs, process costs, by-products<br />

and joint-products costing, and standard cost<br />

and variance analysis.<br />

ACC 462 Drs. R.J. Grambo, Johnson<br />

Advanced Managerial Lawrence<br />

Accounting 3 credits<br />

(Prerequisite: ACC 461) Accounting techniques as<br />

control devices in business with emphasis on use<br />

<strong>of</strong> accounting data in business decisions. Topics to<br />

include budgeting and pr<strong>of</strong>it planning, costvolume-pr<strong>of</strong>it<br />

analysis and direct costing.<br />

ACC 470 Dr. Linton, Staff<br />

Law for Accountants 3 credits<br />

(Prerequisite: MGT 251) A study <strong>of</strong> the law <strong>of</strong><br />

contracts, sales, commercial paper, secured transactions,<br />

rights <strong>of</strong> debtors and creditors, and bankruptcy.<br />

ACC 471 Dr. R.J. Grambo, Staff<br />

Management Auditing 3 credits<br />

(Prerequisite: ACC 362) An in-depth examination<br />

<strong>of</strong> the accountant in the manager’s position.<br />

Administrative effectiveness and efficiency as provided<br />

through sound internal controls. Design and<br />

implementation <strong>of</strong> monitoring systems within the<br />

organization to promote better cost, benefit decisions.<br />

ACC 472 Drs. Mahoney, Mensah, Staff<br />

Advanced Accounting II 3 credits<br />

(Prerequisite: ACC 362) A study <strong>of</strong> the theories<br />

and promulgated standards <strong>of</strong> accounting related to<br />

international operations, partnerships, estates and<br />

trusts, installment sales, consignments, SEC<br />

reporting, and interim financial reporting.<br />

187