Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Finance</strong> <strong>for</strong> <strong>Small</strong> <strong>and</strong> <strong>Medium</strong>-<strong>Sized</strong> <strong>Enterprises</strong>: A Report on the 2004 UK Survey of SME <strong>Finance</strong>s<br />

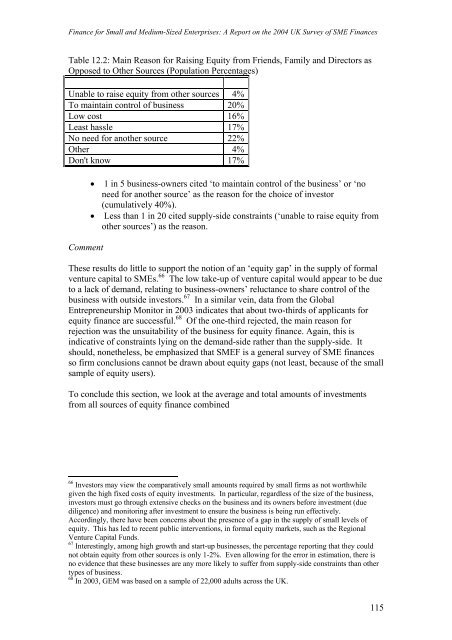

Table 12.2: Main Reason <strong>for</strong> Raising Equity from Friends, Family <strong>and</strong> Directors as<br />

Opposed to Other Sources (Population Percentages)<br />

Unable to raise equity from other sources 4%<br />

To maintain control of business 20%<br />

Low cost 16%<br />

Least hassle 17%<br />

No need <strong>for</strong> another source 22%<br />

Other 4%<br />

Don't know 17%<br />

Comment<br />

• 1 in 5 business-owners cited ‘to maintain<br />

control of the business’ or ‘no<br />

need <strong>for</strong> another source’ as the reason <strong>for</strong> the choice of investor<br />

(cumulatively 40%).<br />

• Less than 1 in 20 cited supply-side constraints (‘unable to raise equity from<br />

other sources’) as the reason.<br />

These results do little to support the notion of an ‘equity gap’ in the supply of <strong>for</strong>mal<br />

66<br />

venture capital<br />

to SMEs. The low take-up of venture capital would<br />

appear to be due<br />

to a la ck of dem<strong>and</strong>, relating to business-owners’ reluctance to share control of the<br />

business<br />

with outside investors.<br />

Entrepre<br />

equity i<br />

reject<br />

indica v <strong>and</strong>-side rather than the supply-side. It<br />

67 In a similar vein, data from the Global<br />

neurship Monitor in 2003 indicates that about two-thirds of applicants <strong>for</strong><br />

nance are successful. 68 f Of the one-third rejected, the<br />

main reason <strong>for</strong><br />

ion was the unsuitability of the business <strong>for</strong> equity finance. Again, this is<br />

ti e of constraints lying on the dem<br />

should, nonetheless, be emphasized that SMEF is a general survey of SME finances<br />

so firm conclusions cannot be drawn about equity gaps (not least, because of the small<br />

sample of equity users).<br />

To conclude this section, we look at the average <strong>and</strong> total amounts of investments<br />

from all sources of equity finance combined<br />

66<br />

Investor s may view the comparatively small amounts required by small firms as not worthwhile<br />

given the<br />

high fixed costs of equity investments. In particular, regardless of the size of the business,<br />

investors<br />

must go through extensive checks on the business <strong>and</strong> its owners be<strong>for</strong>e investment (due<br />

diligence)<br />

<strong>and</strong> monitoring after investment to ensure the business is being run effectively.<br />

Accordingly, there have<br />

been concerns about the presence of a gap in the supply of small levels of<br />

equity.<br />

This has led to recent public interventions, in <strong>for</strong>mal equity markets, such as the Regional<br />

Venture Capital Funds.<br />

67<br />

Interestingly, among high growth <strong>and</strong> start-up businesses, the percentage reporting that they could<br />

not obtain equity from other sources is only 1-2%. Even allowing <strong>for</strong> the error in estimation, there is<br />

no evidence that these businesses are any more likely to suffer from supply-side constraints than<br />

other<br />

types of business.<br />

68<br />

In 2003, GEM was based on a sample of 22,000 adults across the UK.<br />

115

![Joint Report on Social Protection and Social Inclusion [2005]](https://img.yumpu.com/19580638/1/190x132/joint-report-on-social-protection-and-social-inclusion-2005.jpg?quality=85)