Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Finance</strong> <strong>for</strong> <strong>Small</strong> <strong>and</strong> <strong>Medium</strong>-<strong>Sized</strong> <strong>Enterprises</strong>: A Report on the 2004 UK Survey of SME <strong>Finance</strong>s<br />

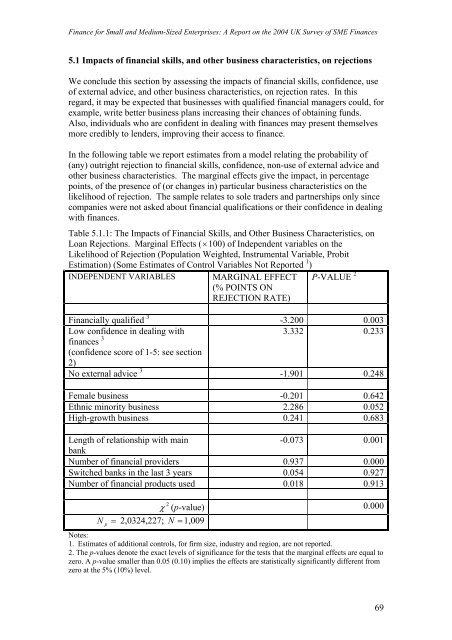

5.1 Impacts of financial skills, <strong>and</strong> other business characteristics, on rejections<br />

We conclude this section by assessing the impacts of financial skills, confidence, use<br />

of external advice, <strong>and</strong> other business characteristics, on rejection rates. In this<br />

regard, it may be expected that businesses with qualified financial managers could, <strong>for</strong><br />

example, write better business plans increasing their chances of obtaining funds.<br />

Also, individuals who are confident in dealing with finances may present themselves<br />

more credibly to lenders, improving their access to finance.<br />

In the following table we report estimates from a model relating the probability of<br />

(any) outright rejection to financial skills, confidence, non-use of external advice <strong>and</strong><br />

other business characteristics. The marginal effects give the impact, in percentage<br />

points, of the presence of (or changes in) particular business characteristics on the<br />

likelihood of rejection. The sample relates to sole traders <strong>and</strong> partnerships only since<br />

companies were not asked about financial qualifications or their confidence in dealing<br />

with finances.<br />

Table 5.1.1: The Impacts of Financial Skills, <strong>and</strong> Other Business Characteristics, on<br />

Loan Rejections. Marginal Effects (× 100) of Independent variables on the<br />

Likelihood of Rejection (Population Weighted, Instrumental Variable, Probit<br />

Estimation) (Some Estimates of Control Variables Not Reported 1 )<br />

FFECT<br />

(% POINTS ON<br />

REJECTION RATE)<br />

P-VALUE 2<br />

INDEPENDENT VARIABLES MARGINAL E<br />

Financially qualified 0.003<br />

3<br />

-3.200<br />

Low confidence in dealing<br />

with<br />

3<br />

finances<br />

( confidence score of 1-5: see section<br />

2)<br />

3.332 0.233<br />

No external advice 0.248<br />

3<br />

-1.901<br />

Female business -0.201 0.642<br />

Ethnic minority business 2.286 0.052<br />

High-growth business<br />

0.241 0.683<br />

Length of relationship with main<br />

bank<br />

-0.073 0.001<br />

Number of financial providers 0.937 0.000<br />

Switched banks in the last 3 years 0.054 0.927<br />

Number of financial products used 0.018 0.913<br />

2<br />

χ (p-value)<br />

N = 2,0324,227; N = 1,009<br />

p<br />

0.000<br />

Notes:<br />

1.<br />

Estimates of additional controls, <strong>for</strong> firm size, industry <strong>and</strong> region, are not reported.<br />

2.<br />

The p-values denote the exact levels of significance <strong>for</strong> the tests that the marginal effects are equal to<br />

zero. A p-value smaller than 0.05 (0.10) implies the effects are statistically significantly different<br />

from<br />

zero at the 5% (10%) level.<br />

69

![Joint Report on Social Protection and Social Inclusion [2005]](https://img.yumpu.com/19580638/1/190x132/joint-report-on-social-protection-and-social-inclusion-2005.jpg?quality=85)