Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Finance</strong> <strong>for</strong> <strong>Small</strong> <strong>and</strong> <strong>Medium</strong>-<strong>Sized</strong> <strong>Enterprises</strong>: A Report on the 2004 UK Survey of SME <strong>Finance</strong>s<br />

6. PROVIDERS OF FINANCE<br />

In this section w e look at the main providers of financial services to SMEs <strong>and</strong> the<br />

characteristics of the relationship with this provider. In<strong>for</strong>mation on the main<br />

provider<br />

was collected by asking businesses which bank or financial institution they<br />

considered to be their main<br />

provider of finance.<br />

Firstly,<br />

we look at the types of services <strong>and</strong> finances supplied by this main provider.<br />

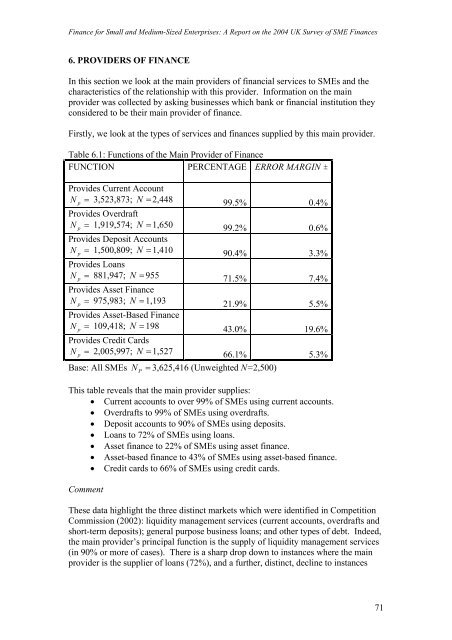

Table 6. 1:<br />

Functions of the Main Provider of <strong>Finance</strong><br />

FUNCTION<br />

PERCENTAGE ERROR MARGIN ±<br />

Provides Current Account<br />

N p = 3,523,873; N = 2,448 99.5% 0.4%<br />

Provides Overdraft<br />

N p = 1,919,574; N = 1,650 99.2% 0.6%<br />

Provides Deposit Accounts<br />

N p = 1,500,809; N = 1,410 90.4% 3.3%<br />

Provides Loans<br />

N p = 881,947; N = 955 71.5% 7.4%<br />

Provides Asset <strong>Finance</strong><br />

N p = 975,983; N = 1,193<br />

Provides Asset-Based <strong>Finance</strong><br />

21.9% 5.5%<br />

N p = 109,418; N = 198 43.0% 19.6%<br />

Provides Credit Cards<br />

N p = 2,005,997; N = 1,527 66.1% 5.3%<br />

Base: All SMEs N P = 3,625,416 (Unweighted N=2,500)<br />

This table reveals that the main provider supplies:<br />

• Current accounts to over 99% of SMEs using current accounts.<br />

• Overdrafts to 99% of SMEs using overdrafts.<br />

• Deposit accounts to 90% of SMEs using deposits.<br />

• Loans to 72% of SMEs using loans.<br />

• Asset finance<br />

to 22% of SMEs using asset finance.<br />

• Asset-based finance to 43% of SMEs using asset-based finance.<br />

• Credit cards to 66% of SMEs using credit cards.<br />

Commen t<br />

These data highlight the three distinct markets which were identified in Competition<br />

Commission<br />

(2002): liquidity management services (current accounts, overdrafts <strong>and</strong><br />

short-term deposits); general purpose business loans; <strong>and</strong> other<br />

types of debt. Indeed,<br />

the main provider’s principal function is the supply of liquidity management services<br />

(in 90% or more of cases). There is a sharp drop down to instances where the main<br />

provider is the supplier of loans (72%), <strong>and</strong> a further, distinct, decline to instances<br />

71

![Joint Report on Social Protection and Social Inclusion [2005]](https://img.yumpu.com/19580638/1/190x132/joint-report-on-social-protection-and-social-inclusion-2005.jpg?quality=85)