Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Finance</strong> <strong>for</strong> <strong>Small</strong> <strong>and</strong> <strong>Medium</strong>-<strong>Sized</strong> <strong>Enterprises</strong>: A Report on the 2004 UK Survey of SME <strong>Finance</strong>s<br />

where it supplies<br />

other <strong>for</strong>ms of debt. Analysis of the number of different financial<br />

products,<br />

supplied by the main provider, is given later in this section.<br />

Market shares<br />

Now we turn to an analysis of market shares based<br />

on data provided by businesses<br />

about their main provider of finance.<br />

of marke<br />

dicates that the market we are looking at here is, principally, <strong>for</strong> liquidity<br />

nt services.<br />

42 In the following charts we report the degree<br />

t concentration among the largest four providers. The previous analysis<br />

in<br />

manageme<br />

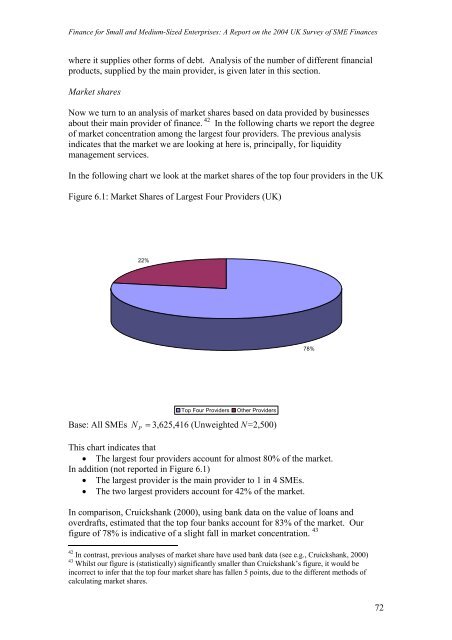

In the following chart we look at the market shares of the top four providers in the UK<br />

Figure 6.1: Market Shares of Largest Four Providers (UK)<br />

22%<br />

Top Four Providers Other Providers<br />

Base: All SMEs N P = 3,625,416 (Unweighted N=2,500)<br />

This chart indicates that<br />

• The largest four providers account <strong>for</strong> almost 80% of the market.<br />

In addition (not reported in Figure 6.1)<br />

• The largest provider is the main provider to 1 in 4 SMEs.<br />

• The two largest providers account <strong>for</strong> 42% of the market.<br />

In comparison, Cruickshank (2000), using bank data on the value of loans <strong>and</strong><br />

overdrafts,<br />

estimated that the top four banks account <strong>for</strong> 83% of the market. Our<br />

figure of 78% is indicative of a slight fall in market concentration. 43<br />

42<br />

In contra st, previous analyses of market share have used bank data (see e.g., Cruickshank, 2000)<br />

43<br />

Whilst our figure is (statistically) significantly smaller than Cruickshank’s figure, it would be<br />

incorrect to infer that the top four market share has fallen 5 points, due to the different methods of<br />

calculating market shares.<br />

78%<br />

72

![Joint Report on Social Protection and Social Inclusion [2005]](https://img.yumpu.com/19580638/1/190x132/joint-report-on-social-protection-and-social-inclusion-2005.jpg?quality=85)