Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Finance</strong> <strong>for</strong> <strong>Small</strong> <strong>and</strong> <strong>Medium</strong>-<strong>Sized</strong> <strong>Enterprises</strong>: A Report on the 2004 UK Survey of SME <strong>Finance</strong>s<br />

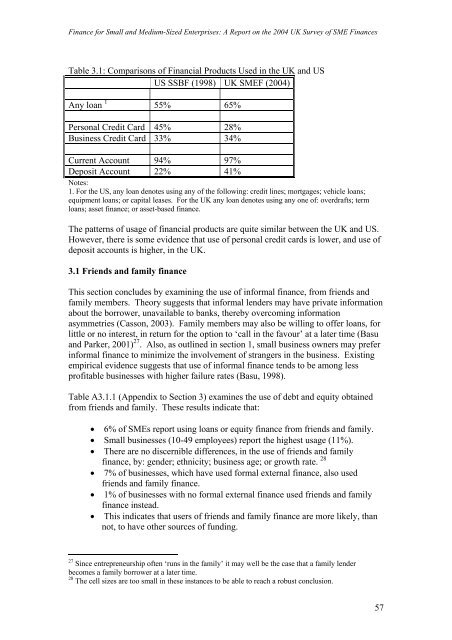

Table 3.1: Comparisons of Financial Products Used in the UK <strong>and</strong> US<br />

US SSBF (1998) UK SMEF (2004)<br />

Any loan 1<br />

55% 65%<br />

Personal Credit Card 45% 28%<br />

Business Credit Card 33% 34%<br />

Current Account 94% 97%<br />

Deposit Account 22% 41%<br />

Notes:<br />

1. For the US, any loan denotes using any of the following: credit lines; mortgages; vehicle loans;<br />

equipment loans; or capital leases. For the UK any loan denotes using any one of: overdrafts; term<br />

loans; asset finance; or asset-based finance.<br />

The patterns of usage of financial products are quite similar between the UK <strong>and</strong> US.<br />

However, there is some evidence that use of personal credit<br />

cards is lower, <strong>and</strong> use of<br />

deposit<br />

accounts is higher, in the UK.<br />

3.1 Friends <strong>and</strong> family finance<br />

This section concludes by examining the use of in<strong>for</strong>mal finance, from friends <strong>and</strong><br />

family members. Theory suggests that in<strong>for</strong>mal lenders may have private in<strong>for</strong>mation<br />

about the borrower, unavailable to banks, thereby overcoming in<strong>for</strong>mation<br />

asymmetries (Casson, 2003). Family members may<br />

also be willing to offer loans, <strong>for</strong><br />

little<br />

or no interest, in return <strong>for</strong> the option to ‘call in the favour’ at a later time (Basu<br />

<strong>and</strong> Parker, 2001) er<br />

27 . Also, as outlined in section 1, small business owners may pref<br />

in<strong>for</strong>mal finance to minimize the involvement of strangers in the business. Existing<br />

empirical evidence suggests that use of in<strong>for</strong>mal finance tends to be among less<br />

profitable businesses with higher failure rates (Basu, 1998).<br />

Table<br />

A3.1.1 (Appendix to Section 3) examines the use of debt <strong>and</strong> equity obtained<br />

from friends <strong>and</strong> family. These results indicate that:<br />

nds <strong>and</strong> family.<br />

sage (11%).<br />

• There are no discernible differences, in the use of friends <strong>and</strong> family<br />

finance, by: gender; ethnicity; business age; or growth rate. 28<br />

• 6% of SMEs report using loans or equity finance from frie<br />

• <strong>Small</strong> businesses (10-49 employees) report the highest u<br />

• 7% of businesses, which have used <strong>for</strong>mal external finance, also used<br />

friends <strong>and</strong> family finance.<br />

• 1% of businesses with no <strong>for</strong>mal<br />

external finance used friends <strong>and</strong> family<br />

finance instead.<br />

• This indicates that users of friends <strong>and</strong> family finance are more likely, than<br />

not, to have other sources of funding.<br />

27 Since entrepreneurship often ‘runs in the family’ it may well be the case that a family lender<br />

becomes a family borrower at a later time.<br />

28 The cell sizes are too small in these instances to be able to reach a robust conclusion.<br />

57

![Joint Report on Social Protection and Social Inclusion [2005]](https://img.yumpu.com/19580638/1/190x132/joint-report-on-social-protection-and-social-inclusion-2005.jpg?quality=85)