Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Finance</strong> <strong>for</strong> <strong>Small</strong> <strong>and</strong> <strong>Medium</strong>-<strong>Sized</strong> <strong>Enterprises</strong>: A Report on the 2004 UK Survey of SME <strong>Finance</strong>s<br />

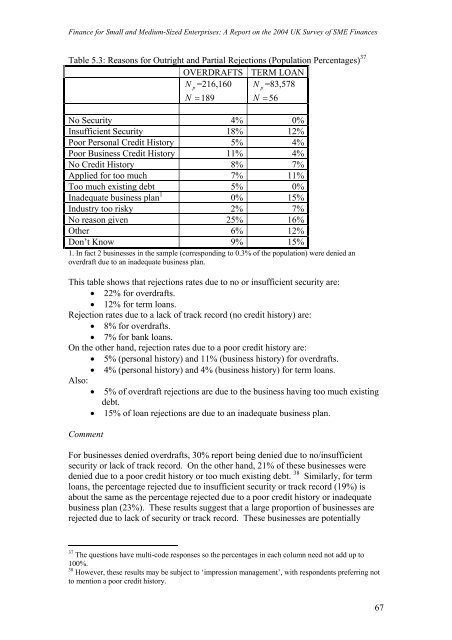

Table 5.3: Reasons <strong>for</strong> Outright <strong>and</strong> Partial Rejections (Population Percentages) 37<br />

OVERDRAFTS TERM LOAN<br />

N p =216,160 N p =83,578<br />

N = 189 N = 56<br />

No Security 4% 0%<br />

Insufficient Security 18% 12%<br />

Poor Personal Credit History 5% 4%<br />

Poor Business Credit History 11% 4%<br />

No Credit History 8% 7%<br />

Applied <strong>for</strong> too much 7% 11%<br />

Too much existing debt 5% 0%<br />

Inadequate business plan 1<br />

0% 15%<br />

Industry too risky 2% 7%<br />

No reason given 25% 16%<br />

Other 6% 12%<br />

Don’t Know 9% 15%<br />

1. In fact 2 businesses in the sample (corresponding to 0.3% of the population) were denied an<br />

overdraft due to an inadequate business plan.<br />

This<br />

table shows that rejections rates due to no or insufficient security<br />

are:<br />

• 22% <strong>for</strong> overdrafts.<br />

• 12% <strong>for</strong> term loans.<br />

Rejection rates due to a lack of track recor d (no credit history) are :<br />

• 8% <strong>for</strong> overdrafts.<br />

• 7% <strong>for</strong> bank loans.<br />

On the other h<strong>and</strong>, rejection rates due to a poor credit history are:<br />

• 5% (personal history) <strong>and</strong> 11% (business history) <strong>for</strong> overdrafts.<br />

• 4% (personal history) <strong>and</strong> 4% (business history) <strong>for</strong> term loans.<br />

Also:<br />

• 5% of overdraft rejections are due<br />

to the business having too much existing<br />

debt.<br />

• 15% of loan rejections are due to an inadequate business plan.<br />

Comment For bus inesses denied overdrafts, 30% report being denied due to no/insufficient<br />

security or lack of track record. On the<br />

other h<strong>and</strong>, 21% of these businesses were<br />

38<br />

denied due to a poor credit history or too much existing debt. Similarly, <strong>for</strong> term<br />

loans, the percentage rejected due to insufficient security or track record (19%) is<br />

about the same as the percentage rejected due to a poor credit history or inadequate<br />

business plan (23%). These results suggest that a large proportion of businesses are<br />

rejected due to lack of security or track record. These businesses<br />

are potentially<br />

37<br />

The questions have multi-code responses so the percentages in each column need not add up to<br />

100%.<br />

38<br />

Howeve r, these results may be subject to ‘impression management’, with respondents preferring not<br />

to mention a poor credit history.<br />

67

![Joint Report on Social Protection and Social Inclusion [2005]](https://img.yumpu.com/19580638/1/190x132/joint-report-on-social-protection-and-social-inclusion-2005.jpg?quality=85)