Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

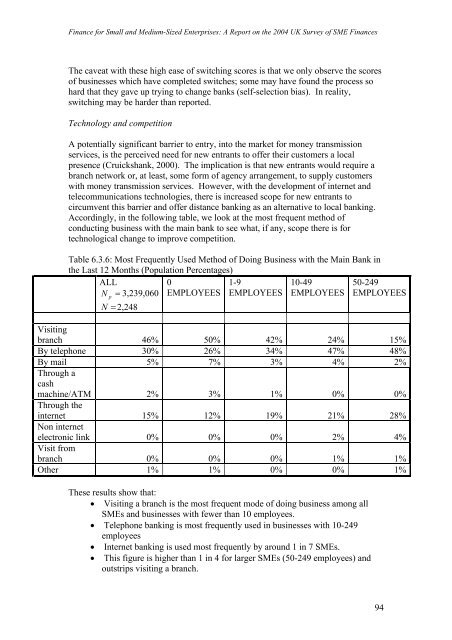

<strong>Finance</strong> <strong>for</strong> <strong>Small</strong> <strong>and</strong> <strong>Medium</strong>-<strong>Sized</strong> <strong>Enterprises</strong>: A Report on the 2004 UK Survey of SME <strong>Finance</strong>s<br />

The caveat with these high ease of switching scores is that we only observe the scores<br />

of businesses which have completed switches; some may have found the process so<br />

hard that they gave up trying to change banks (self-selection bias). In reality,<br />

switching may be harder than reported.<br />

Technology <strong>and</strong> competition<br />

A potentially significant barrier to entry, into the market <strong>for</strong> money transmission<br />

services, is the perceived need <strong>for</strong> new entrants to offer their customers a local<br />

presence (Cruickshank, 2000). The implication is that new entrants would require a<br />

branch<br />

network<br />

or, at least, some <strong>for</strong>m of agency arrangement, to supply customers<br />

with money transmission services. However, with the development of internet <strong>and</strong><br />

telecommunications technologies, there is increased scope <strong>for</strong> new entrants to<br />

circumvent this barrier <strong>and</strong> offer distance banking as an alternative to local banking.<br />

Accordingly, in the following table, we look at the most frequent method of<br />

conducting business with the main bank to see what, if any, scope there is <strong>for</strong><br />

technological change to improve competition.<br />

Table 6.3.6: Most Frequently Used Method of Doing Business with the Main Bank in<br />

the Last 12 Months (Population Percentages)<br />

ALL<br />

0<br />

1-9<br />

10-49 50-249<br />

N = 3,239,060 EMPLOYEES EMPLOYEES EMPLOYEES EMPLOYEES<br />

p<br />

N = 2,248<br />

Visiting<br />

branch 46% 50% 42% 24% 15%<br />

By telephone 30% 26% 34% 47% 48%<br />

By mail<br />

Through a<br />

cash<br />

5% 7% 3% 4% 2%<br />

machine /ATM 2% 3% 1% 0%<br />

0%<br />

Through the<br />

internet<br />

Non internet<br />

15% 12% 19% 21% 28%<br />

electronic link<br />

Visit from<br />

0% 0% 0% 2% 4%<br />

branch 0% 0% 0% 1%<br />

1%<br />

Other 1%<br />

1% 0% 0% 1%<br />

These results show that:<br />

• Visiting a branch is the most frequent mode of doing business among all<br />

SMEs <strong>and</strong><br />

businesses with fewer than 10 employees.<br />

• Telephone banking is most frequently used in businesses<br />

with 10-249<br />

employees<br />

• Internet banking is<br />

used most frequently by around 1 in 7 SMEs.<br />

• This figure is higher than 1 in 4 <strong>for</strong> larger SMEs (50-249 employees) <strong>and</strong><br />

outstrips visiting a branch.<br />

94

![Joint Report on Social Protection and Social Inclusion [2005]](https://img.yumpu.com/19580638/1/190x132/joint-report-on-social-protection-and-social-inclusion-2005.jpg?quality=85)