Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Finance</strong> <strong>for</strong> <strong>Small</strong> <strong>and</strong> <strong>Medium</strong>-<strong>Sized</strong> <strong>Enterprises</strong>: A Report on the 2004 UK Survey of SME <strong>Finance</strong>s<br />

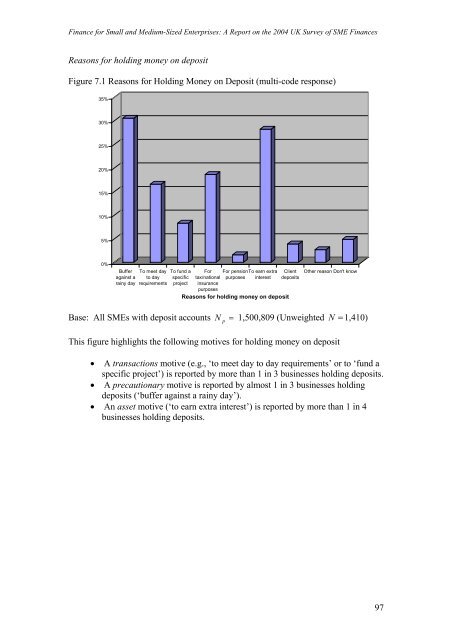

Reasons <strong>for</strong> holding money on deposit<br />

Figure 7.1 Reasons <strong>for</strong> Holding Money on Deposit (multi-code response)<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Buffer To meet<br />

day To fund a For For pensionTo<br />

earn extra Client Other<br />

reason Don't know<br />

against a to day<br />

specific<br />

tax/national<br />

purposes interest<br />

deposits<br />

rainy day requirements<br />

project<br />

insurance<br />

purposes<br />

Reaso ns <strong>for</strong> holding money on deposit<br />

Base: All SMEs with d eposit accou nts N = 1,500,809 (Unweighted N = 1,410)<br />

This figure highlights the following motives <strong>for</strong> holding money on deposit<br />

p<br />

• A transactions motive (e.g., ‘to meet day to day requirements’ or to ‘fund a<br />

specific project’) is reported by more than 1 in 3 businesses holding deposits.<br />

• A precautionary motive is reported<br />

by almost 1 in 3 businesses holding<br />

deposits (‘buffer against a rainy day’).<br />

• An asset motive (‘to earn extra interest’) is reported by more than 1 in 4<br />

businesses holding deposits.<br />

97

![Joint Report on Social Protection and Social Inclusion [2005]](https://img.yumpu.com/19580638/1/190x132/joint-report-on-social-protection-and-social-inclusion-2005.jpg?quality=85)