Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

Finance for Small and Medium-Sized Enterprises - DTI Home Page

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Finance</strong> <strong>for</strong> <strong>Small</strong> <strong>and</strong> <strong>Medium</strong>-<strong>Sized</strong> <strong>Enterprises</strong>: A Report on the 2004 UK Survey of SME <strong>Finance</strong>s<br />

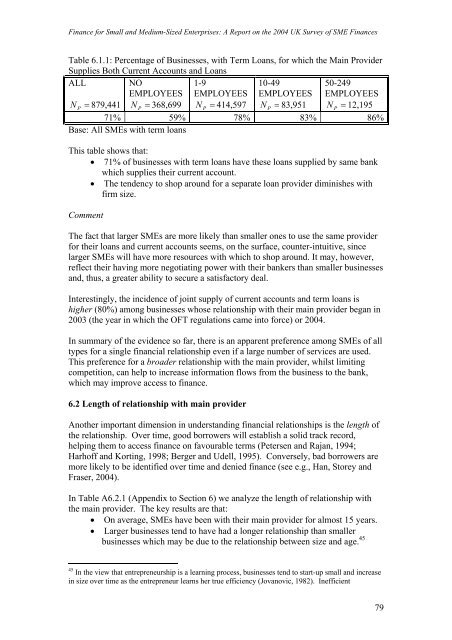

Table 6.1.1: Percentage of Businesses, with Term Loans, <strong>for</strong> which the Main Provider<br />

Supplies Both Current Accounts <strong>and</strong> Loans<br />

ALL NO<br />

1-9<br />

10-49 50-249<br />

EMPLOYEES EMPLOYEES EMPLOYEES EMPLOYEES<br />

N P = 879,441 N P = 368,699 N P = 414,597 N P = 83,951 N P = 12,195<br />

71% 59% 78% 83% 86%<br />

Base: All SMEs with term loans<br />

This<br />

table shows that:<br />

• 71% of businesses with term loans have these loans supplied by same bank<br />

which supplies their current account.<br />

• The tendency to shop around <strong>for</strong> a separate loan provider diminishes with<br />

firm size.<br />

Comment<br />

The fact that larger SMEs are more likely than smaller ones to use the same provider<br />

<strong>for</strong> their loans <strong>and</strong> current accounts seems, on the surface, counter-intuitive, since<br />

larger SMEs will have more resources with which to shop around. It may, however,<br />

reflect<br />

their having more negotiating power with their bankers than smaller businesses<br />

<strong>and</strong>, thus, a greater ability to secure a satisfactory deal.<br />

Interestingly,<br />

the incidence of joint supply of current accounts <strong>and</strong> term loans is<br />

higher (80%) among businesses whose relationship with their main provider began in<br />

2003 (the year in which the OFT regulations came into <strong>for</strong>ce) or 2004.<br />

In summary of the evidence so far, there is an apparent preference among SMEs of all<br />

types <strong>for</strong> a single financial relationship even if a large number of services are used.<br />

This preference <strong>for</strong> a broader relationship with the main provider, whilst limiting<br />

competition, can help to increase in<strong>for</strong>mation flows from the business to the bank,<br />

which may improve access to finance.<br />

6.2 Length of relationship with main provider<br />

Another important<br />

dimension in underst<strong>and</strong>ing financial relationships is the length of<br />

the relationship. Over time, good borrowers will establish a solid track record,<br />

helping them to access finance on favourable terms (Petersen <strong>and</strong> Rajan, 1994;<br />

Harhof f <strong>and</strong> Korting, 1998; Berger <strong>and</strong> Udell, 1995). Conversely, bad borrowers are<br />

more likely<br />

to be identified over time <strong>and</strong> denied finance (see e.g., Han, Storey <strong>and</strong><br />

Fraser, 2004). In Table<br />

A6.2.1 (Appendix to Section 6) we analyze the length of relationship with<br />

the main<br />

provider. The key results are that:<br />

• On average, SMEs have been with their main provider <strong>for</strong> almost 15 years.<br />

• Larger businesses tend to have had a longer relationship than smaller<br />

businesses which may be due to the relationship between size <strong>and</strong> age. 45<br />

45 In the view that entrepreneurship is a learning process, businesses tend to start-up small <strong>and</strong> increase<br />

in size over time as the entrepreneur learns her true efficiency (Jovanovic, 1982). Inefficient<br />

79

![Joint Report on Social Protection and Social Inclusion [2005]](https://img.yumpu.com/19580638/1/190x132/joint-report-on-social-protection-and-social-inclusion-2005.jpg?quality=85)