Annual Report 2010 - Falck

Annual Report 2010 - Falck

Annual Report 2010 - Falck

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Group financial statements<br />

Note DKK million<br />

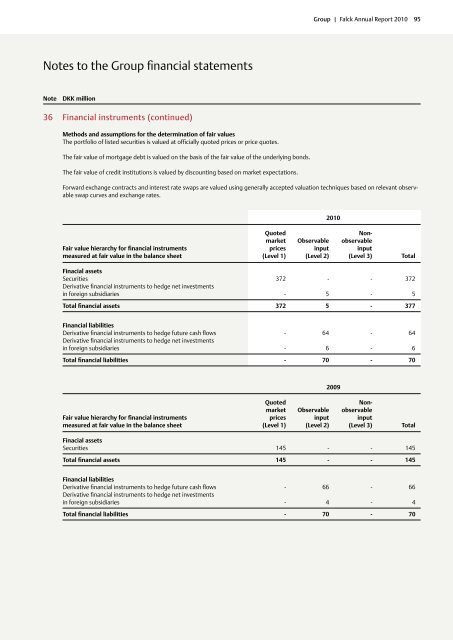

36 Financial instruments (continued)<br />

methods and assumptions for the determination of fair values<br />

The portfolio of listed securities is valued at officially quoted prices or price quotes.<br />

The fair value of mortgage debt is valued on the basis of the fair value of the underlying bonds.<br />

The fair value of credit institutions is valued by discounting based on market expectations.<br />

Group | <strong>Falck</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 95<br />

Forward exchange contracts and interest rate swaps are valued using generally accepted valuation techniques based on relevant observable<br />

swap curves and exchange rates.<br />

Quoted Non-<br />

market Observable observable<br />

Fair value hierarchy for financial instruments prices input input<br />

measured at fair value in the balance sheet (Level 1) (Level 2) (Level 3) Total<br />

Finacial assets<br />

Securities 372 - - 372<br />

Derivative financial instruments to hedge net investments<br />

in foreign subsidiaries - 5 - 5<br />

Total financial assets 372 5 - 377<br />

Financial liabilities<br />

Derivative financial instruments to hedge future cash flows - 64 - 64<br />

Derivative financial instruments to hedge net investments<br />

in foreign subsidiaries - 6 - 6<br />

Total financial liabilities - 70 - 70<br />

Quoted Non-<br />

market Observable observable<br />

Fair value hierarchy for financial instruments prices input input<br />

measured at fair value in the balance sheet (Level 1) (Level 2) (Level 3) Total<br />

Finacial assets<br />

Securities 145 - - 145<br />

Total financial assets 145 - - 145<br />

Financial liabilities<br />

Derivative financial instruments to hedge future cash flows - 66 - 66<br />

Derivative financial instruments to hedge net investments<br />

in foreign subsidiaries - 4 - 4<br />

Total financial liabilities - 70 - 70<br />

<strong>2010</strong><br />

2009