Annual Report 2010 - Falck

Annual Report 2010 - Falck

Annual Report 2010 - Falck

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

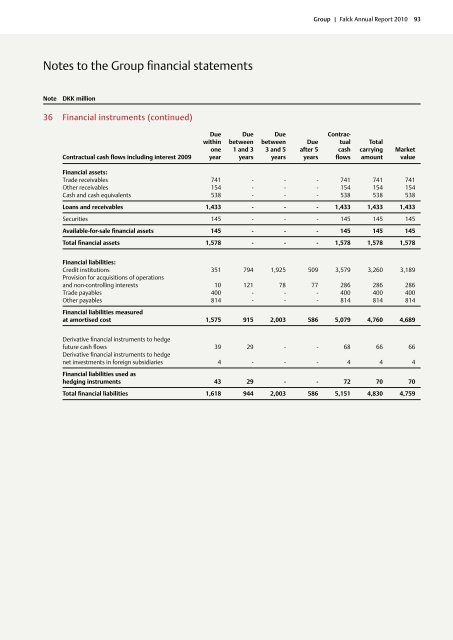

Notes to the Group financial statements<br />

Note DKK million<br />

36 Financial instruments (continued)<br />

Group | <strong>Falck</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 93<br />

Due Due Due Contrac-<br />

within between between Due tual Total<br />

one 1 and 3 3 and 5 after 5 cash carrying market<br />

Contractual cash flows including interest 2009 year years years years flows amount value<br />

Financial assets:<br />

Trade receivables 741 - - - 741 741 741<br />

Other receivables 154 - - - 154 154 154<br />

Cash and cash equivalents 538 - - - 538 538 538<br />

Loans and receivables 1,433 - - - 1,433 1,433 1,433<br />

Securities 145 - - - 145 145 145<br />

Available-for-sale financial assets 145 - - - 145 145 145<br />

Total financial assets 1,578 - - - 1,578 1,578 1,578<br />

Financial liabilities:<br />

Credit institutions 351 794 1,925 509 3,579 3,260 3,189<br />

Provision for acquisitions of operations<br />

and non-controlling interests 10 121 78 77 286 286 286<br />

Trade payables 400 - - - 400 400 400<br />

Other payables 814 - - - 814 814 814<br />

Financial liabilities measured<br />

at amortised cost 1,575 915 2,003 586 5,079 4,760 4,689<br />

Derivative financial instruments to hedge<br />

future cash flows 39 29 - - 68 66 66<br />

Derivative financial instruments to hedge<br />

net investments in foreign subsidiaries 4 - - - 4 4 4<br />

Financial liabilities used as<br />

hedging instruments 43 29 - - 72 70 70<br />

Total financial liabilities 1,618 944 2,003 586 5,151 4,830 4,759