ANNUAL REPORT 2007-2008 CITY OF GREATER GEELONG

ANNUAL REPORT 2007-2008 CITY OF GREATER GEELONG

ANNUAL REPORT 2007-2008 CITY OF GREATER GEELONG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CITY</strong> <strong>OF</strong> <strong>GREATER</strong> <strong>GEELONG</strong><br />

NOTES TO THE FINANCIAL <strong>REPORT</strong> FOR THE YEAR ENDED 30 JUNE <strong>2008</strong><br />

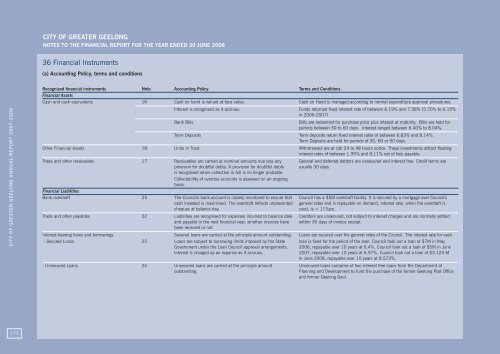

36 Financial Instruments<br />

(a) Accounting Policy, terms and conditions<br />

<strong>CITY</strong> <strong>OF</strong> <strong>GREATER</strong> <strong>GEELONG</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2007</strong>-<strong>2008</strong><br />

Recognised financial instruments Note Accounting Policy Terms and Conditions<br />

Financial Assets<br />

Cash and cash equivalents 16 Cash on hand is valued at face value. Cash on Hand is managed according to normal expenditure approval procedures.<br />

Interest is recognised as it accrues. Funds returned fixed interest rate of between 6.19% and 7.38% (5.70% to 6.15%<br />

in 2006-<strong>2007</strong>)<br />

Bank Bills<br />

Bills are redeemed for purchase price plus interest at maturity. Bills are held for<br />

periods between 30 to 60 days. Interest ranged between 6.40% to 8.04%.<br />

Term Deposits Term deposits return fixed interest rates of between 6.83% and 8.14%.<br />

Term Deposits are held for periods of 30, 60 or 90 days.<br />

Other Financial Assets 18 Units in Trust Withdrawals are at call 24 to 48 hours notice. These investments attract floating<br />

interest rates of between 1.95% and 8.11% net of fees payable.<br />

Trade and other receivables 17 Receivables are carried at nominal amounts due less any General and deferred debtors are unsecured and interest free. Credit terms are<br />

provision for doubtful debts. A provision for doubtful debts usually 30 days.<br />

is recognised when collection in full is no longer probable.<br />

Collectability of overdue accounts is assessed on an ongoing<br />

basis.<br />

Financial Liabilities<br />

Bank overdraft 25 The Council's bank account is closely monitored to ensure that Council has a $5M overdraft facility. It is secured by a mortgage over Council's<br />

cash invested is maximised. The overdraft reflects unpresented general rates and is repayable on demand, interest rate, when the overdraft is<br />

cheques at balance day.<br />

used, is < 11%pa.<br />

Trade and other payables 22 Liabilities are recognised for expenses incurred to balance date Creditors are unsecured, not subject to interest charges and are normally settled<br />

and payable in the next financial year, whether invoices have within 30 days of invoice receipt.<br />

been received or not.<br />

Interest-bearing loans and borrowings Secured loans are carried at the principle amount outstanding. Loans are secured over the general rates of the Council. The interest rate for each<br />

- Secured Loans 25 Loans are subject to borrowing limits imposed by the State loan is fixed for the period of the loan. Council took out a loan of $7M in May<br />

Government under the Loan Council approval arrangements. 2006, repayable over 10 years at 6.4%. Council took out a loan of $5M in June<br />

Interest is charged as an expense as it accrues.<br />

<strong>2007</strong>, repayable over 10 years at 6.97%. Council took out a loan of $3.125 M<br />

in June <strong>2008</strong>, repayable over 10 years at 8.573%.<br />

- Unsecured Loans 25 Unsecured loans are carried at the principle amount Unsecured loans comprise of two interest free loans from the Department of<br />

outstanding.<br />

Planning and Development to fund the purchase of the former Geelong Post Office<br />

and former Geelong Gaol.<br />

175