Appendices - GSA

Appendices - GSA

Appendices - GSA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

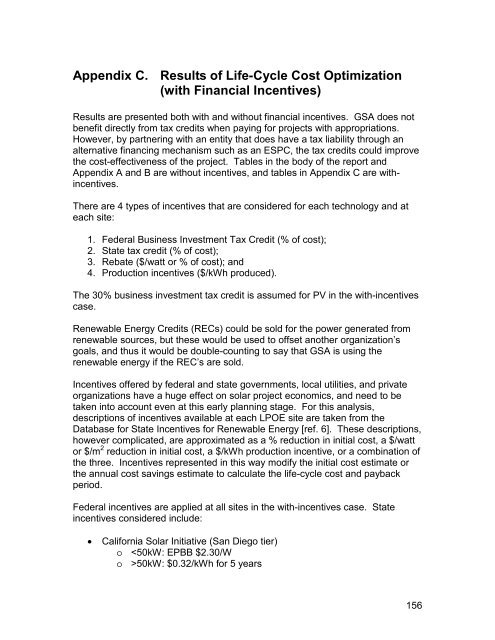

Appendix C. Results of Life-Cycle Cost Optimization<br />

(with Financial Incentives)<br />

Results are presented both with and without financial incentives. <strong>GSA</strong> does not<br />

benefit directly from tax credits when paying for projects with appropriations.<br />

However, by partnering with an entity that does have a tax liability through an<br />

alternative financing mechanism such as an ESPC, the tax credits could improve<br />

the cost-effectiveness of the project. Tables in the body of the report and<br />

Appendix A and B are without incentives, and tables in Appendix C are withincentives.<br />

There are 4 types of incentives that are considered for each technology and at<br />

each site:<br />

1. Federal Business Investment Tax Credit (% of cost);<br />

2. State tax credit (% of cost);<br />

3. Rebate ($/watt or % of cost); and<br />

4. Production incentives ($/kWh produced).<br />

The 30% business investment tax credit is assumed for PV in the with-incentives<br />

case.<br />

Renewable Energy Credits (RECs) could be sold for the power generated from<br />

renewable sources, but these would be used to offset another organization’s<br />

goals, and thus it would be double-counting to say that <strong>GSA</strong> is using the<br />

renewable energy if the REC’s are sold.<br />

Incentives offered by federal and state governments, local utilities, and private<br />

organizations have a huge effect on solar project economics, and need to be<br />

taken into account even at this early planning stage. For this analysis,<br />

descriptions of incentives available at each LPOE site are taken from the<br />

Database for State Incentives for Renewable Energy [ref. 6]. These descriptions,<br />

however complicated, are approximated as a % reduction in initial cost, a $/watt<br />

or $/m 2 reduction in initial cost, a $/kWh production incentive, or a combination of<br />

the three. Incentives represented in this way modify the initial cost estimate or<br />

the annual cost savings estimate to calculate the life-cycle cost and payback<br />

period.<br />

Federal incentives are applied at all sites in the with-incentives case. State<br />

incentives considered include:<br />

• California Solar Initiative (San Diego tier)<br />

o 50kW: $0.32/kWh for 5 years<br />

156