The Group KD Group and KD Group dd

The Group KD Group and KD Group dd

The Group KD Group and KD Group dd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>The</strong> <strong>Group</strong> <strong>KD</strong> <strong>Group</strong> Annual Report 2009<br />

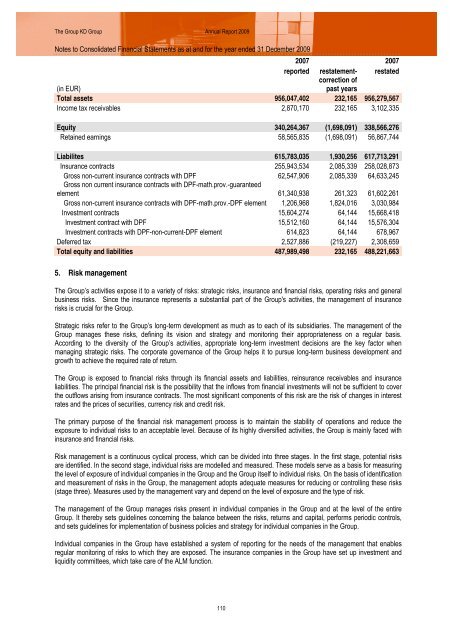

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2009<br />

2007 2007<br />

reported restatement- restated<br />

correction of<br />

(in EUR)<br />

past years<br />

Total assets 956,047,402 232,165 956,279,567<br />

Income tax receivables 2,870,170 232,165 3,102,335<br />

Equity 340,264,367 (1,698,091) 338,566,276<br />

Retained earnings 58,565,835 (1,698,091) 56,867,744<br />

Liabilites 615,783,035 1,930,256 617,713,291<br />

Insurance contracts 255,943,534 2,085,339 258,028,873<br />

Gross non-current insurance contracts with DPF 62,547,906 2,085,339 64,633,245<br />

Gross non current insurance contracts with DPF-math.prov.-guaranteed<br />

element 61,340,938 261,323 61,602,261<br />

Gross non-current insurance contracts with DPF-math.prov.-DPF element 1,206,968 1,824,016 3,030,984<br />

Investment contracts 15,604,274 64,144 15,668,418<br />

Investment contract with DPF 15,512,160 64,144 15,576,304<br />

Investment contracts with DPF-non-current-DPF element 614,823 64,144 678,967<br />

Deferred tax 2,527,886 (219,227) 2,308,659<br />

Total equity <strong>and</strong> liabilities 487,989,498 232,165 488,221,663<br />

5. Risk management<br />

<strong>The</strong> <strong>Group</strong>’s activities expose it to a variety of risks: strategic risks, insurance <strong>and</strong> financial risks, operating risks <strong>and</strong> general<br />

business risks. Since the insurance represents a substantial part of the <strong>Group</strong>'s activities, the management of insurance<br />

risks is crucial for the <strong>Group</strong>.<br />

Strategic risks refer to the <strong>Group</strong>’s long-term development as much as to each of its subsidiaries. <strong>The</strong> management of the<br />

<strong>Group</strong> manages these risks, defining its vision <strong>and</strong> strategy <strong>and</strong> monitoring their appropriateness on a regular basis.<br />

According to the diversity of the <strong>Group</strong>’s activities, appropriate long-term investment decisions are the key factor when<br />

managing strategic risks. <strong>The</strong> corporate governance of the <strong>Group</strong> helps it to pursue long-term business development <strong>and</strong><br />

growth to achieve the required rate of return.<br />

<strong>The</strong> <strong>Group</strong> is exposed to financial risks through its financial assets <strong>and</strong> liabilities, reinsurance receivables <strong>and</strong> insurance<br />

liabilities. <strong>The</strong> principal financial risk is the possibility that the inflows from financial investments will not be sufficient to cover<br />

the outflows arising from insurance contracts. <strong>The</strong> most significant components of this risk are the risk of changes in interest<br />

rates <strong>and</strong> the prices of securities, currency risk <strong>and</strong> credit risk.<br />

<strong>The</strong> primary purpose of the financial risk management process is to maintain the stability of operations <strong>and</strong> reduce the<br />

exposure to individual risks to an acceptable level. Because of its highly diversified activities, the <strong>Group</strong> is mainly faced with<br />

insurance <strong>and</strong> financial risks.<br />

Risk management is a continuous cyclical process, which can be divided into three stages. In the first stage, potential risks<br />

are identified. In the second stage, individual risks are modelled <strong>and</strong> measured. <strong>The</strong>se models serve as a basis for measuring<br />

the level of exposure of individual companies in the <strong>Group</strong> <strong>and</strong> the <strong>Group</strong> itself to individual risks. On the basis of identification<br />

<strong>and</strong> measurement of risks in the <strong>Group</strong>, the management adopts adequate measures for reducing or controlling these risks<br />

(stage three). Measures used by the management vary <strong>and</strong> depend on the level of exposure <strong>and</strong> the type of risk.<br />

<strong>The</strong> management of the <strong>Group</strong> manages risks present in individual companies in the <strong>Group</strong> <strong>and</strong> at the level of the entire<br />

<strong>Group</strong>. It thereby sets guidelines concerning the balance between the risks, returns <strong>and</strong> capital, performs periodic controls,<br />

<strong>and</strong> sets guidelines for implementation of business policies <strong>and</strong> strategy for individual companies in the <strong>Group</strong>.<br />

Individual companies in the <strong>Group</strong> have established a system of reporting for the needs of the management that enables<br />

regular monitoring of risks to which they are exposed. <strong>The</strong> insurance companies in the <strong>Group</strong> have set up investment <strong>and</strong><br />

liquidity committees, which take care of the ALM function.<br />

110