The Group KD Group and KD Group dd

The Group KD Group and KD Group dd

The Group KD Group and KD Group dd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>Group</strong> <strong>KD</strong> <strong>Group</strong> Annual Report 2009<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2009<br />

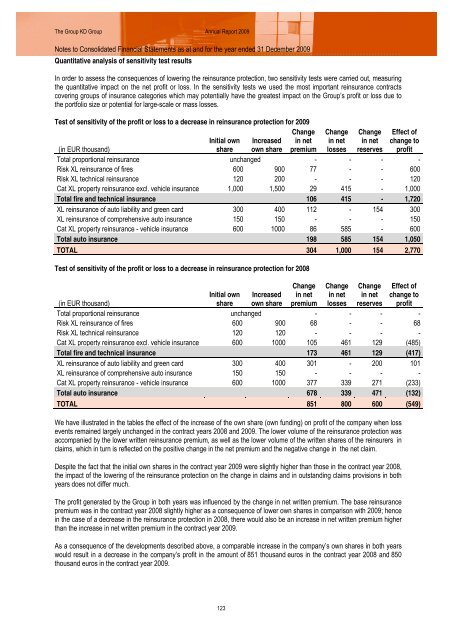

Quantitative analysis of sensitivity test results<br />

In order to assess the consequences of lowering the reinsurance protection, two sensitivity tests were carried out, measuring<br />

the quantitative impact on the net profit or loss. In the sensitivity tests we used the most important reinsurance contracts<br />

covering groups of insurance categories which may potentially have the greatest impact on the <strong>Group</strong>’s profit or loss due to<br />

the portfolio size or potential for large-scale or mass losses.<br />

Test of sensitivity of the profit or loss to a decrease in reinsurance protection for 2009<br />

Change Change Change Effect of<br />

(in EUR thous<strong>and</strong>)<br />

Initial own<br />

share<br />

Increased<br />

own share<br />

in net<br />

premium<br />

in net<br />

losses<br />

in net<br />

reserves<br />

change to<br />

profit<br />

Total proportional reinsurance unchanged - - - -<br />

Risk XL reinsurance of fires 600 900 77 - - 600<br />

Risk XL technical reinsurance 120 200 - - - 120<br />

Cat XL property reinsurance excl. vehicle insurance 1,000 1,500 29 415 - 1,000<br />

Total fire <strong>and</strong> technical insurance 106 415 - 1,720<br />

XL reinsurance of auto liability <strong>and</strong> green card 300 400 112 - 154 300<br />

XL reinsurance of comprehensive auto insurance 150 150 - - - 150<br />

Cat XL property reinsurance - vehicle insurance 600 1000 86 585 - 600<br />

Total auto insurance 198 585 154 1,050<br />

TOTAL 304 1,000 154 2,770<br />

Test of sensitivity of the profit or loss to a decrease in reinsurance protection for 2008<br />

Change<br />

in net<br />

premium<br />

Change<br />

in net<br />

losses<br />

Change<br />

in net<br />

reserves<br />

Effect of<br />

change to<br />

profit<br />

(in EUR thous<strong>and</strong>)<br />

Initial own<br />

share<br />

Increased<br />

own share<br />

Total proportional reinsurance unchanged - - - -<br />

Risk XL reinsurance of fires 600 900 68 - - 68<br />

Risk XL technical reinsurance 120 120 - - - -<br />

Cat XL property reinsurance excl. vehicle insurance 600 1000 105 461 129 (485)<br />

Total fire <strong>and</strong> technical insurance 173 461 129 (417)<br />

XL reinsurance of auto liability <strong>and</strong> green card 300 400 301 - 200 101<br />

XL reinsurance of comprehensive auto insurance 150 150 - - - -<br />

Cat XL property reinsurance - vehicle insurance 600 1000 377 339 271 (233)<br />

Total auto insurance 678 339 471 (132)<br />

TOTAL 851 800 600 (549)<br />

We have illustrated in the tables the effect of the increase of the own share (own funding) on profit of the company when loss<br />

events remained largely unchanged in the contract years 2008 <strong>and</strong> 2009. <strong>The</strong> lower volume of the reinsurance protection was<br />

accompanied by the lower written reinsurance premium, as well as the lower volume of the written shares of the reinsurers in<br />

claims, which in turn is reflected on the positive change in the net premium <strong>and</strong> the negative change in the net claim.<br />

Despite the fact that the initial own shares in the contract year 2009 were slightly higher than those in the contract year 2008,<br />

the impact of the lowering of the reinsurance protection on the change in claims <strong>and</strong> in outst<strong>and</strong>ing claims provisions in both<br />

years does not differ much.<br />

<strong>The</strong> profit generated by the <strong>Group</strong> in both years was influenced by the change in net written premium. <strong>The</strong> base reinsurance<br />

premium was in the contract year 2008 slightly higher as a consequence of lower own shares in comparison with 2009; hence<br />

in the case of a decrease in the reinsurance protection in 2008, there would also be an increase in net written premium higher<br />

than the increase in net written premium in the contract year 2009.<br />

As a consequence of the developments described above, a comparable increase in the company’s own shares in both years<br />

would result in a decrease in the company’s profit in the amount of 851 thous<strong>and</strong> euros in the contract year 2008 <strong>and</strong> 850<br />

thous<strong>and</strong> euros in the contract year 2009.<br />

123