is Coming to Korea - Korea IT Times

is Coming to Korea - Korea IT Times

is Coming to Korea - Korea IT Times

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

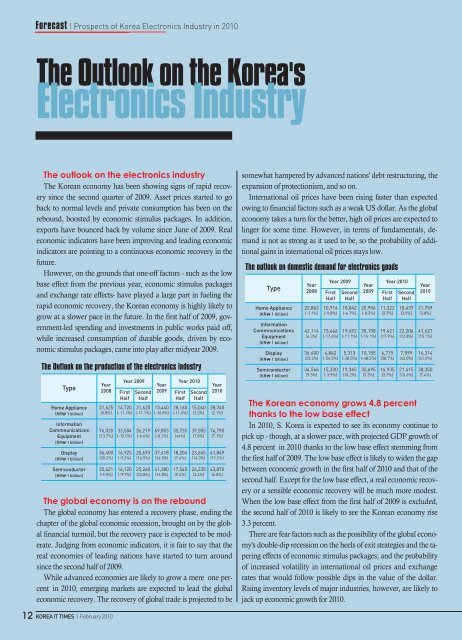

Forecast | Prospects of <strong>Korea</strong> Electronics Industry in 2010<br />

The Outlook on the <strong>Korea</strong>'s<br />

Electronics Industry<br />

The outlook on the electronics industry<br />

The <strong>Korea</strong>n economy has been showing signs of rapid recovery<br />

since the second quarter of 2009. Asset prices started <strong>to</strong> go<br />

back <strong>to</strong> normal levels and private consumption has been on the<br />

rebound, boosted by economic stimulus packages. In addition,<br />

exports have bounced back by volume since June of 2009. Real<br />

economic indica<strong>to</strong>rs have been improving and leading economic<br />

indica<strong>to</strong>rs are pointing <strong>to</strong> a continuous economic recovery in the<br />

future.<br />

However, on the grounds that one-off fac<strong>to</strong>rs - such as the low<br />

base effect from the previous year, economic stimulus packages<br />

and exchange rate effects- have played a large part in fueling the<br />

rapid economic recovery, the <strong>Korea</strong>n economy <strong>is</strong> highly likely <strong>to</strong><br />

grow at a slower pace in the future. In the first half of 2009, government-led<br />

spending and investments in public works paid off,<br />

while increased consumption of durable goods, driven by economic<br />

stimulus packages, came in<strong>to</strong> play after midyear 2009.<br />

somewhat hampered by advanced nations' debt restructuring, the<br />

expansion of protection<strong>is</strong>m, and so on.<br />

International oil prices have been r<strong>is</strong>ing faster than expected<br />

owing <strong>to</strong> financial fac<strong>to</strong>rs such as a weak US dollar. As the global<br />

economy takes a turn for the better, high oil prices are expected <strong>to</strong><br />

linger for some time. However, in terms of fundamentals, demand<br />

<strong>is</strong> not as strong as it used <strong>to</strong> be, so the probability of additional<br />

gains in international oil prices stays low.<br />

The global economy <strong>is</strong> on the rebound<br />

The global economy has entered a recovery phase, ending the<br />

chapter of the global economic recession, brought on by the global<br />

financial turmoil, but the recovery pace <strong>is</strong> expected <strong>to</strong> be moderate.<br />

Judging from economic indica<strong>to</strong>rs, it <strong>is</strong> fair <strong>to</strong> say that the<br />

real economies of leading nations have started <strong>to</strong> turn around<br />

since the second half of 2009.<br />

While advanced economies are likely <strong>to</strong> grow a mere one percent<br />

in 2010, emerging markets are expected <strong>to</strong> lead the global<br />

economic recovery. The recovery of global trade <strong>is</strong> projected <strong>to</strong> be<br />

The <strong>Korea</strong>n economy grows 4.8 percent<br />

thanks <strong>to</strong> the low base effect<br />

In 2010, S. <strong>Korea</strong> <strong>is</strong> expected <strong>to</strong> see its economy continue <strong>to</strong><br />

pick up - though, at a slower pace, with projected GDP growth of<br />

4.8 percent in 2010 thanks <strong>to</strong> the low base effect stemming from<br />

the first half of 2009. The low base effect <strong>is</strong> likely <strong>to</strong> widen the gap<br />

between economic growth in the first half of 2010 and that of the<br />

second half. Except for the low base effect, a real economic recovery<br />

or a sensible economic recovery will be much more modest.<br />

When the low base effect from the first half of 2009 <strong>is</strong> excluded,<br />

the second half of 2010 <strong>is</strong> likely <strong>to</strong> see the <strong>Korea</strong>n economy r<strong>is</strong>e<br />

3.3 percent.<br />

There are fear fac<strong>to</strong>rs such as the possibility of the global economy's<br />

double-dip recession on the heels of exit strategies and the tapering<br />

effects of economic stimulus packages; and the probability<br />

of increased volatility in international oil prices and exchange<br />

rates that would follow possible dips in the value of the dollar.<br />

R<strong>is</strong>ing inven<strong>to</strong>ry levels of major industries, however, are likely <strong>to</strong><br />

jack up economic growth for 2010.<br />

12 KOREA <strong>IT</strong> TIMES | February 2010