is Coming to Korea - Korea IT Times

is Coming to Korea - Korea IT Times

is Coming to Korea - Korea IT Times

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

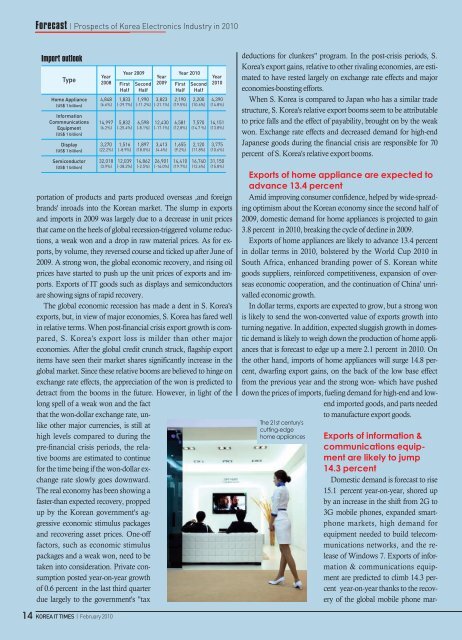

Forecast | Prospects of <strong>Korea</strong> Electronics Industry in 2010<br />

deductions for clunkers" program. In the post-cr<strong>is</strong><strong>is</strong> periods, S.<br />

<strong>Korea</strong>'s export gains, relative <strong>to</strong> other rivaling economies, are estimated<br />

<strong>to</strong> have rested largely on exchange rate effects and major<br />

economies-boosting efforts.<br />

When S. <strong>Korea</strong> <strong>is</strong> compared <strong>to</strong> Japan who has a similar trade<br />

structure, S. <strong>Korea</strong>'s relative export booms seem <strong>to</strong> be attributable<br />

<strong>to</strong> price falls and the effect of payability, brought on by the weak<br />

won. Exchange rate effects and decreased demand for high-end<br />

Japanese goods during the financial cr<strong>is</strong><strong>is</strong> are responsible for 70<br />

percent of S. <strong>Korea</strong>'s relative export booms.<br />

portation of products and parts produced overseas ,and foreign<br />

brands' inroads in<strong>to</strong> the <strong>Korea</strong>n market. The slump in exports<br />

and imports in 2009 was largely due <strong>to</strong> a decrease in unit prices<br />

that came on the heels of global recession-triggered volume reductions,<br />

a weak won and a drop in raw material prices. As for exports,<br />

by volume, they reversed course and ticked up after June of<br />

2009. A strong won, the global economic recovery, and r<strong>is</strong>ing oil<br />

prices have started <strong>to</strong> push up the unit prices of exports and imports.<br />

Exports of <strong>IT</strong> goods such as d<strong>is</strong>plays and semiconduc<strong>to</strong>rs<br />

are showing signs of rapid recovery.<br />

The global economic recession has made a dent in S. <strong>Korea</strong>'s<br />

exports, but, in view of major economies, S. <strong>Korea</strong> has fared well<br />

in relative terms. When post-financial cr<strong>is</strong><strong>is</strong> export growth <strong>is</strong> compared,<br />

S. <strong>Korea</strong>'s export loss <strong>is</strong> milder than other major<br />

economies. After the global credit crunch struck, flagship export<br />

items have seen their market shares significantly increase in the<br />

global market. Since these relative booms are believed <strong>to</strong> hinge on<br />

exchange rate effects, the appreciation of the won <strong>is</strong> predicted <strong>to</strong><br />

detract from the booms in the future. However, in light of the<br />

long spell of a weak won and the fact<br />

that the won-dollar exchange rate, unlike<br />

other major currencies, <strong>is</strong> still at<br />

high levels compared <strong>to</strong> during the<br />

pre-financial cr<strong>is</strong><strong>is</strong> periods, the relative<br />

booms are estimated <strong>to</strong> continue<br />

for the time being if the won-dollar exchange<br />

rate slowly goes downward.<br />

The real economy has been showing a<br />

faster-than expected recovery, propped<br />

up by the <strong>Korea</strong>n government's aggressive<br />

economic stimulus packages<br />

and recovering asset prices. One-off<br />

fac<strong>to</strong>rs, such as economic stimulus<br />

packages and a weak won, need <strong>to</strong> be<br />

taken in<strong>to</strong> consideration. Private consumption<br />

posted year-on-year growth<br />

of 0.6 percent in the last third quarter<br />

due largely <strong>to</strong> the government's "tax<br />

Exports of home appliance are expected <strong>to</strong><br />

advance 13.4 percent<br />

Amid improving consumer confidence, helped by wide-spreading<br />

optim<strong>is</strong>m about the <strong>Korea</strong>n economy since the second half of<br />

2009, domestic demand for home appliances <strong>is</strong> projected <strong>to</strong> gain<br />

3.8 percent in 2010, breaking the cycle of decline in 2009.<br />

Exports of home appliances are likely <strong>to</strong> advance 13.4 percent<br />

in dollar terms in 2010, bolstered by the World Cup 2010 in<br />

South Africa, enhanced branding power of S. <strong>Korea</strong>n white<br />

goods suppliers, reinforced competitiveness, expansion of overseas<br />

economic cooperation, and the continuation of China' unrivalled<br />

economic growth.<br />

In dollar terms, exports are expected <strong>to</strong> grow, but a strong won<br />

<strong>is</strong> likely <strong>to</strong> send the won-converted value of exports growth in<strong>to</strong><br />

turning negative. In addition, expected slugg<strong>is</strong>h growth in domestic<br />

demand <strong>is</strong> likely <strong>to</strong> weigh down the production of home appliances<br />

that <strong>is</strong> forecast <strong>to</strong> edge up a mere 2.1 percent in 2010. On<br />

the other hand, imports of home appliances will surge 14.8 percent,<br />

dwarfing export gains, on the back of the low base effect<br />

from the previous year and the strong won- which have pushed<br />

down the prices of imports, fueling demand for high-end and lowend<br />

imported goods, and parts needed<br />

<strong>to</strong> manufacture export goods.<br />

The 21st century's<br />

cutting-edge<br />

home appliances<br />

Exports of information &<br />

communications equipment<br />

are likely <strong>to</strong> jump<br />

14.3 percent<br />

Domestic demand <strong>is</strong> forecast <strong>to</strong> r<strong>is</strong>e<br />

15.1 percent year-on-year, shored up<br />

by an increase in the shift from 2G <strong>to</strong><br />

3G mobile phones, expanded smartphone<br />

markets, high demand for<br />

equipment needed <strong>to</strong> build telecommunications<br />

networks, and the release<br />

of Windows 7. Exports of information<br />

& communications equipment<br />

are predicted <strong>to</strong> climb 14.3 percent<br />

year-on-year thanks <strong>to</strong> the recovery<br />

of the global mobile phone mar-<br />

14 KOREA <strong>IT</strong> TIMES | February 2010