Processed Asian Foods in Australia – An update

Processed Asian Foods in Australia – An update

Processed Asian Foods in Australia – An update

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

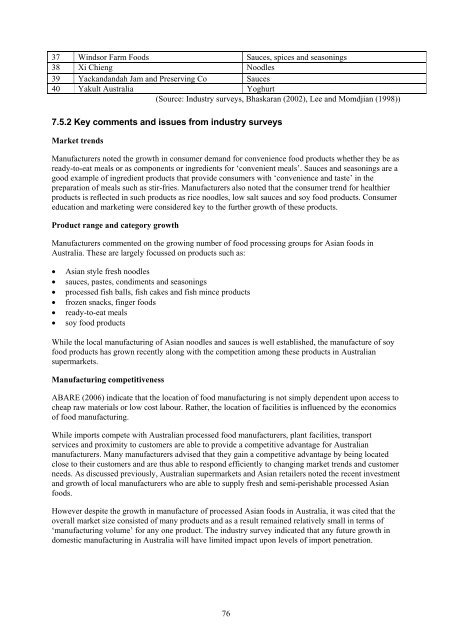

37 W<strong>in</strong>dsor Farm <strong>Foods</strong> Sauces, spices and season<strong>in</strong>gs<br />

38 Xi Chieng Noodles<br />

39 Yackandandah Jam and Preserv<strong>in</strong>g Co Sauces<br />

40 Yakult <strong>Australia</strong> Yoghurt<br />

(Source: Industry surveys, Bhaskaran (2002), Lee and Momdjian (1998))<br />

7.5.2 Key comments and issues from <strong>in</strong>dustry surveys<br />

Market trends<br />

Manufacturers noted the growth <strong>in</strong> consumer demand for convenience food products whether they be as<br />

ready-to-eat meals or as components or <strong>in</strong>gredients for ‘convenient meals’. Sauces and season<strong>in</strong>gs are a<br />

good example of <strong>in</strong>gredient products that provide consumers with ‘convenience and taste’ <strong>in</strong> the<br />

preparation of meals such as stir-fries. Manufacturers also noted that the consumer trend for healthier<br />

products is reflected <strong>in</strong> such products as rice noodles, low salt sauces and soy food products. Consumer<br />

education and market<strong>in</strong>g were considered key to the further growth of these products.<br />

Product range and category growth<br />

Manufacturers commented on the grow<strong>in</strong>g number of food process<strong>in</strong>g groups for <strong>Asian</strong> foods <strong>in</strong><br />

<strong>Australia</strong>. These are largely focussed on products such as:<br />

• <strong>Asian</strong> style fresh noodles<br />

• sauces, pastes, condiments and season<strong>in</strong>gs<br />

• processed fish balls, fish cakes and fish m<strong>in</strong>ce products<br />

• frozen snacks, f<strong>in</strong>ger foods<br />

• ready-to-eat meals<br />

• soy food products<br />

While the local manufactur<strong>in</strong>g of <strong>Asian</strong> noodles and sauces is well established, the manufacture of soy<br />

food products has grown recently along with the competition among these products <strong>in</strong> <strong>Australia</strong>n<br />

supermarkets.<br />

Manufactur<strong>in</strong>g competitiveness<br />

ABARE (2006) <strong>in</strong>dicate that the location of food manufactur<strong>in</strong>g is not simply dependent upon access to<br />

cheap raw materials or low cost labour. Rather, the location of facilities is <strong>in</strong>fluenced by the economics<br />

of food manufactur<strong>in</strong>g.<br />

While imports compete with <strong>Australia</strong>n processed food manufacturers, plant facilities, transport<br />

services and proximity to customers are able to provide a competitive advantage for <strong>Australia</strong>n<br />

manufacturers. Many manufacturers advised that they ga<strong>in</strong> a competitive advantage by be<strong>in</strong>g located<br />

close to their customers and are thus able to respond efficiently to chang<strong>in</strong>g market trends and customer<br />

needs. As discussed previously, <strong>Australia</strong>n supermarkets and <strong>Asian</strong> retailers noted the recent <strong>in</strong>vestment<br />

and growth of local manufacturers who are able to supply fresh and semi-perishable processed <strong>Asian</strong><br />

foods.<br />

However despite the growth <strong>in</strong> manufacture of processed <strong>Asian</strong> foods <strong>in</strong> <strong>Australia</strong>, it was cited that the<br />

overall market size consisted of many products and as a result rema<strong>in</strong>ed relatively small <strong>in</strong> terms of<br />

‘manufactur<strong>in</strong>g volume’ for any one product. The <strong>in</strong>dustry survey <strong>in</strong>dicated that any future growth <strong>in</strong><br />

domestic manufactur<strong>in</strong>g <strong>in</strong> <strong>Australia</strong> will have limited impact upon levels of import penetration.<br />

76