FINAL REPORT - San Bernardino Superior Court

FINAL REPORT - San Bernardino Superior Court

FINAL REPORT - San Bernardino Superior Court

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

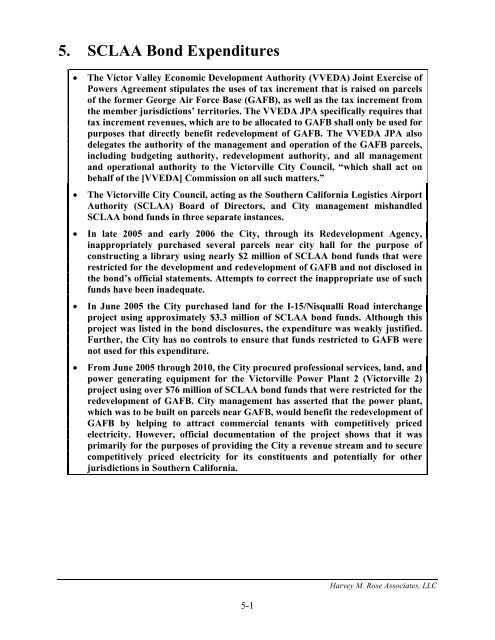

5. SCLAA Bond Expenditures<br />

<br />

<br />

<br />

<br />

<br />

The Victor Valley Economic Development Authority (VVEDA) Joint Exercise of<br />

Powers Agreement stipulates the uses of tax increment that is raised on parcels<br />

of the former George Air Force Base (GAFB), as well as the tax increment from<br />

the member jurisdictions’ territories. The VVEDA JPA specifically requires that<br />

tax increment revenues, which are to be allocated to GAFB shall only be used for<br />

purposes that directly benefit redevelopment of GAFB. The VVEDA JPA also<br />

delegates the authority of the management and operation of the GAFB parcels,<br />

including budgeting authority, redevelopment authority, and all management<br />

and operational authority to the Victorville City Council, “which shall act on<br />

behalf of the [VVEDA] Commission on all such matters.”<br />

The Victorville City Council, acting as the Southern California Logistics Airport<br />

Authority (SCLAA) Board of Directors, and City management mishandled<br />

SCLAA bond funds in three separate instances.<br />

In late 2005 and early 2006 the City, through its Redevelopment Agency,<br />

inappropriately purchased several parcels near city hall for the purpose of<br />

constructing a library using nearly $2 million of SCLAA bond funds that were<br />

restricted for the development and redevelopment of GAFB and not disclosed in<br />

the bond’s official statements. Attempts to correct the inappropriate use of such<br />

funds have been inadequate.<br />

In June 2005 the City purchased land for the I-15/Nisqualli Road interchange<br />

project using approximately $3.3 million of SCLAA bond funds. Although this<br />

project was listed in the bond disclosures, the expenditure was weakly justified.<br />

Further, the City has no controls to ensure that funds restricted to GAFB were<br />

not used for this expenditure.<br />

From June 2005 through 2010, the City procured professional services, land, and<br />

power generating equipment for the Victorville Power Plant 2 (Victorville 2)<br />

project using over $76 million of SCLAA bond funds that were restricted for the<br />

redevelopment of GAFB. City management has asserted that the power plant,<br />

which was to be built on parcels near GAFB, would benefit the redevelopment of<br />

GAFB by helping to attract commercial tenants with competitively priced<br />

electricity. However, official documentation of the project shows that it was<br />

primarily for the purposes of providing the City a revenue stream and to secure<br />

competitively priced electricity for its constituents and potentially for other<br />

jurisdictions in Southern California.<br />

Harvey M. Rose Associates, LLC<br />

5-1