annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

annual Report 2009 - STRATEC Biomedical AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VII.<br />

Financial instruments / risk management<br />

Financial instruments are contractually-based financial transactions involving a claim to payment. A distinction is made<br />

in this respect between:<br />

• Primary financial instruments, such as trade receivables and payables or financial receivables and financial liabilities,<br />

• derivative financial instruments not involving a hedging relationship with a hedged item,<br />

• derivative financial instruments, such as hedges deployed to cover risks resulting from changes in exchange rates and<br />

interest rates.<br />

The volume of primary financial instruments can be seen in the balance sheet. Financial assets have been subdivided<br />

into the categories defined in IAS 39 and recognized at (amortized) cost or at fair value in line with their respective classification.<br />

The current nature of receivables and cash and cash equivalents means that there are no significant variances<br />

between the respective carrying amounts and fair values of these items.<br />

Changes in the fair value of financial instruments available for sale are recognized directly in equity up to the realization<br />

of the respective financial instrument. However, any significant or permanent impairment arising in the value of such<br />

instruments is recognized through profit or loss. Changes in the fair value of financial instruments held for trading are<br />

recognized through profit or loss.<br />

Financial instruments which constitute financial liabilities have been recognized at amortized cost.<br />

The fair value of a financial instrument is the price at which the instrument can be freely traded between third parties. In<br />

the case of securities, the fair value is generally based on stock market prices. The fair value of loan liabilities is calculated<br />

by discounting future payments of interest and principal with market conditions for loans with congruent terms and<br />

risk profiles as of the balance sheet date. Due to project-related fund allocation requirements and the resultant interest<br />

benefit, the fair value calculated in this way is not directly comparable with loans unless these company-specific factors<br />

are accounted for.<br />

The financial instruments recognized in the accounts have been presented below broken down into their IAS 39 classifications<br />

and aggregated in terms of comparable measurement uncertainty and risk profiles. Holdings of cash and cash<br />

equivalents have been presented as a separate category pursuant to IFRS 7.<br />

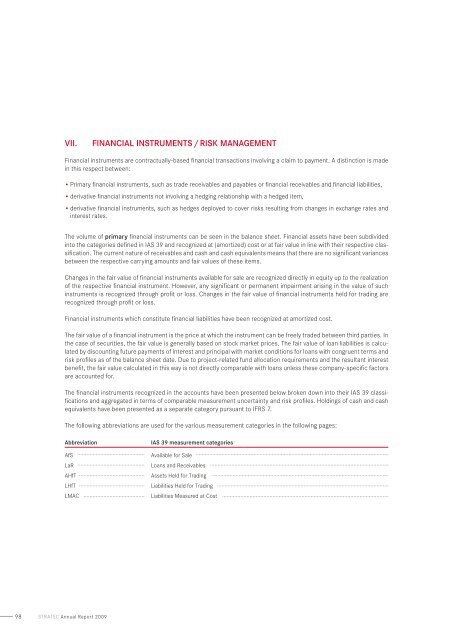

The following abbreviations are used for the various measurement categories in the following pages:<br />

Abbreviation<br />

AfS<br />

LaR<br />

AHfT<br />

LHfT<br />

LMAC<br />

IAS 39 measurement categories<br />

Available for Sale<br />

Loans and Receivables<br />

Assets Held for Trading<br />

Liabilities Held for Trading<br />

Liabilities Measured at Cost<br />

98 stratec Annual <strong>Report</strong> <strong>2009</strong>